Singapore has ordered Meta Platforms Inc. (NASDAQ:META) to roll out stricter anti-scam measures on Facebook or risk a fine of up to S$1 million ($775,698), escalating regulatory pressure on the tech giant over its handling of online fraud.

Singapore's First Crackdown Under New Law

On Wednesday, Minister of State for Home Affairs Goh Pei Ming said authorities invoked the nation's Online Criminal Harms Act—enacted in February 2024—to compel Meta to curb scams involving fake profiles impersonating government officials, reported Reuters.

"Facebook is the top platform used by scammers for such impersonation scams," Goh said. "More decisive action is required to curb these scams."

Police data showed impersonation scams nearly tripled to 1,762 cases in the first half of 2025, with losses climbing 88% to S$126.5 million from a year earlier.

Meta's History Of Global Scam-Related Scrutiny

Singapore's order follows years of criticism over Facebook Marketplace's weak anti-fraud safeguards, despite recent measures like enhanced seller verification and in-app scam warnings.

Other countries, including Thailand and South Korea, have also threatened penalties or bans over similar fraud concerns.

In 2023, Thailand's Ministry of Digital Economy and Society warned Meta it could be blocked from the country if it failed to stop crypto scam ads using fake regulatory endorsements.

Meta has previously said it removed more than 2 million scam-related accounts and is sharing intelligence with international law enforcement to combat large-scale fraud networks.

The company has also pledged new tools to flag suspicious messages across Facebook, Instagram and WhatsApp.

Meta's Financial Outlook

The regulatory pressure comes as Meta's business remains strong. In July, it reported second-quarter revenue of $47.52 billion, beating expectations and forecasting third-quarter revenue between $47.5 billion and $50.5 billion.

Full-year expenses are projected between $114 billion and $118 billion, with capital spending as high as $72 billion.

Price Action: Meta shares climbed 0.48% in after-hours trading, offsetting a 0.49% decline during the regular session, per Benzinga Pro.

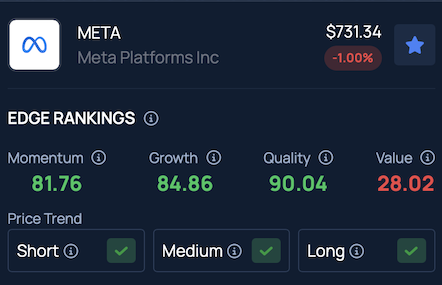

According to Benzinga's Edge Stock Rankings, META continues to show a solid upward trend across short, medium and long-term periods. More detailed performance data is available here.

Read Next:

Photo Courtesy: Skorzewiak on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.