Meta Platforms Inc. (NASDAQ:META) is nearing a $30 billion financing deal for its Hyperion data center in Richland Parish, Louisiana, which would be the largest private capital raise on record, according to a report published on Friday.

Check out the current price of META stock here.

Blue Owl, Meta To Share Ownership

Blue Owl Capital Inc. (NYSE:OWL) and Meta are sharing ownership of the Hyperion data center site, with the California-based tech giant retaining a 20% equity stake, Bloomberg reported, citing sources.

Morgan Stanley (NYSE:MS) is structuring the deal with more than $27 billion in debt and approximately $2.5 billion in equity through a special purpose vehicle, according to Bloomberg.

Pacific Investment Management Co. (Pimco) is the anchor lender, the report said.

Meta, Morgan Stanley, Pimco, and Blue Owl did not respond to Benzinga‘s request for comment.

The bonds were priced on Thursday under the Rule 144A format and are set to mature in 2049, with full amortization at approximately 225 basis points over U.S. Treasuries. S&P Ratings assigned the securities an investment-grade rating of A+.

Hyperion To Be Completed By 2029

The Hyperion data center covers 4 million square feet and can draw up to 5 gigawatts of power at full capacity, which is enough to power about 4 million U.S. homes, according to Bloomberg's analysis of government data. The facility is expected to be completed by 2029.

The special-purpose vehicle structure allows Meta to avoid carrying significant debt on its balance sheet while acting as the developer, operator, and tenant of the facility.

Meta is also building a new AI-focused data center in El Paso, Texas. The facility is designed to scale up to 1 gigawatt and will be the company's 29th data center worldwide and third in Texas.

See Also: Meta Tightens Teen AI Safety, Adds Parental Controls And Content Limits

Texas has emerged as a hub for AI infrastructure investment, including the $40 billion acquisition of Aligned Data Centers by a consortium of BlackRock Inc. (NYSE:BLK), Microsoft Corp. (NASDAQ:MSFT), NVIDIA, and xAI, as well as OpenAI's planned $11.6 billion facility in Abilene.

Price Action

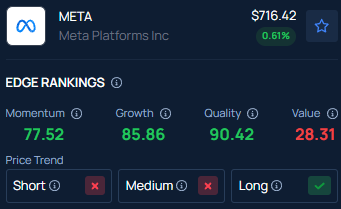

Meta has gained 22.44% over the past year and is up 47.92% in the last six months, according to data from Benzinga Pro.

Its 52-week range is $479.80 to $796.25, with a market capitalization of $1.8 trillion, an average volume of 12.18 million shares, a price-to-earnings ratio of 26, and a dividend yield of 0.29%.

Benzinga’s Edge Stock Rankings highlight that Meta’s Growth, Momentum, and Quality scores are strong. Track the performance of other players in this segment.

Read Next:

Photo: Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.