/Merck%20%26%20Co%20Inc%20billboard-by%20monticello%20via%20Shutterstock.jpg)

Rahway, New Jersey-based Merck & Co., Inc. (MRK) provides health solutions through its prescription medicines, vaccines, biologic therapies, animal health, and consumer care products. With a market cap of $214.8 billion, Merck operates through Pharmaceutical, Animal Health, and Other segments and serves in nearly 140 countries across the globe.

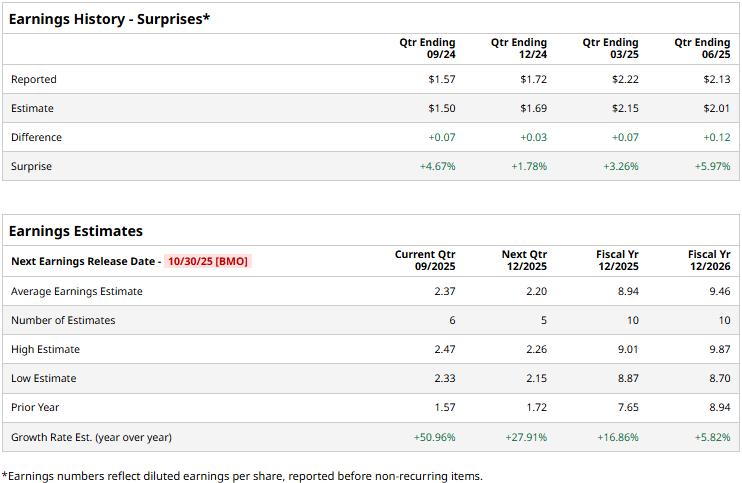

The healthcare giant is gearing up to unveil its third-quarter results before the market opens on Thursday, Oct. 30. Ahead of the event, analysts expect MRK to deliver a profit of $2.37 per share, up 51% from $1.57 per share reported in the year-ago quarter. Further, the company has a solid earnings surprise history and has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, analysts expect MRK to deliver an EPS of $8.94, up 16.9% from $7.65 reported in 2024. While in fiscal 2026, its earnings are expected to grow 5.8% year-over-year to $9.46 per share.

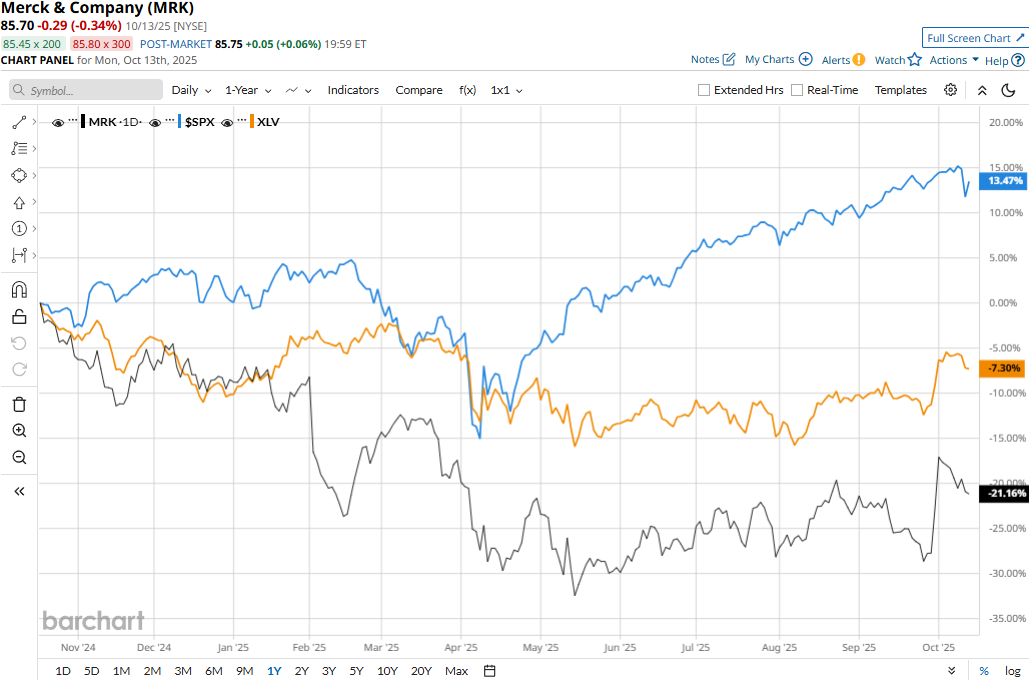

MRK stock prices have plummeted 21.9% over the past 52 weeks, notably underperforming the Health Care Select Sector SPDR Fund’s (XLV) 7.8% decline and the S&P 500 Index’s ($SPX) 14.4% gains during the same time frame.

Merck’s stock prices dipped 1.7% in the trading session following the release of its mixed Q2 results on Jul. 29. The company’s KEYTRUDA sales grew by 9% to $8 billion, while Animal Health Sales surged by 11% to $1.6 billion, but its GARDASIL sales plummeted 55% year-over-year to $1.1 billion. Overall, the company’s topline came in at $15.8 billion, down 1.9% year-over-year and missing the Street’s expectations by a small margin. Meanwhile, its adjusted EPS dropped 6.6% compared to the year-ago quarter to $2.13, but surpassed the consensus estimates by 6%.

Analysts take an optimistic view of the stock’s prospects. MRK maintains a consensus “Moderate Buy” rating overall. Of the 25 analysts covering the stock, opinions include 11 “Strong Buys,” one “Moderate Buy,” and 13 “Holds.” Its mean price target of $102.43 suggests a 19.5% upside potential from current price levels.