BlueScope Steel has rejected a $13.2 billion takeover bid involving billionaire Kerry Stokes and a US partner, saying it "dramatically undervalued" its assets.

US-based industrial metals group Steel Dynamics had teamed with the Mr Stokes-controlled SGH Limited in a bid to acquire the company's North American operations.

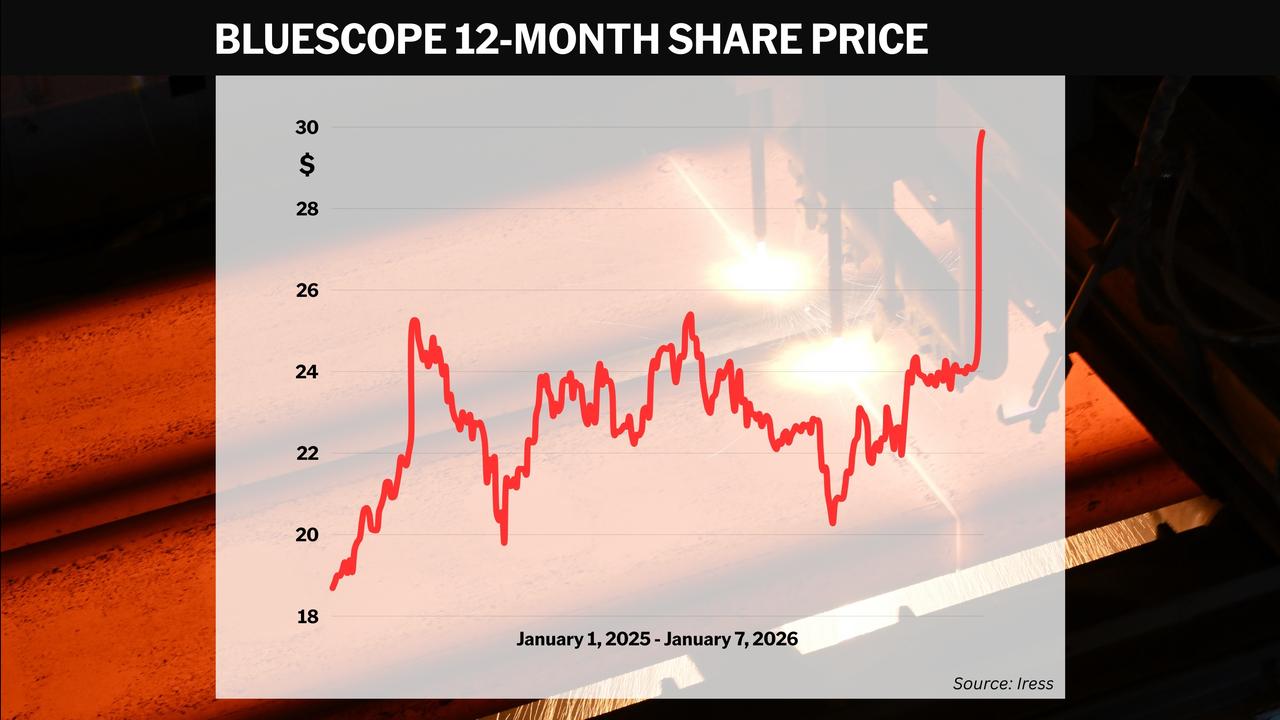

They had offered $30 a share, a 27 per cent premium to the trading price of BlueScope shares when the offer was made on December 12.

Steel Dynamics had made three unsuccessful previous approaches to take control of BlueScope.

Shares in the Port Kembla Steelworks operator on Tuesday soared 20.6 per cent to a 17-year high of $29.48 after the takeover offer was first made public on Monday night.

BlueScope chair Jane McAloon said the board had unanimously rejected the offer.

"Let me be clear - this proposal was an attempt to take BlueScope from its shareholders on the cheap," Ms McAloon said in a statement to the ASX late on Wednesday.

"It drastically undervalued our world-class assets, our growth momentum, and our future - and the board will not let that happen.

"This is the fourth time we've said no, and the answer remained the same - BlueScope is worth considerably more than what was on the table."

BlueScope had shown little public enthusiasm for the offer when it was first made public, describing it as unsolicited and highly conditional.

The offer involved breaking up BlueScope, with SGH offloading the North American operations to Steel Dynamics while retaining the Australian steel and Asia coated products and the New Zealand and Pacific islands businesses.

SGH and Steel Dynamic said they believed BlueScope's operations in the Asia Pacific and its North American business were not "strategically compatible".

"We believe BlueScope's Australian business is a strong strategic fit for SGH, and we have a proven track record of driving performance improvement in domestic industrial businesses," SGH chief executive Ryan Stokes said on Tuesday.

"We intend to leverage our disciplined operating model and capital allocation approach to deliver better outcomes for stakeholders."

Steel Dynamics chief executive Mark Millett said the North American assets, which include BlueScope's North Star flat rolled steel mill and building and coated products businesses, would fit in well with its operations.

SGH owns construction materials group Boral, equipment hire firm Coates and equipment dealer WesTrac, and has a 40.2 per cent stake in television station owner Seven West Media.

BlueScope is leading an international consortium to explore the possible acquisition of the Whyalla Steelworks, which was placed into administration by the South Australian government in early 2025.

BlueScope has previously highlighted that the Whyalla assets include iron ore mines and structural rail, as well as the steelworks.

BlueScope shares closed on Wednesday at $29.87, up 1.1 per cent from Tuesday and just under the consortium's $30-per-share offer.

SGH shares finished up 0.8 per cent to $48.97.

.png?w=600)