With a market cap of $17.3 billion, McCormick & Company, Incorporated (MKC) is a global leader in manufacturing, marketing, and distributing spices, seasonings, condiments, and flavor products. The company operates through two segments: Consumer and Flavor Solutions, serving both retail and foodservice customers worldwide under well-known brands like McCormick, French’s, Frank’s RedHot, Lawry’s, OLD BAY, Cholula, and Ducros.

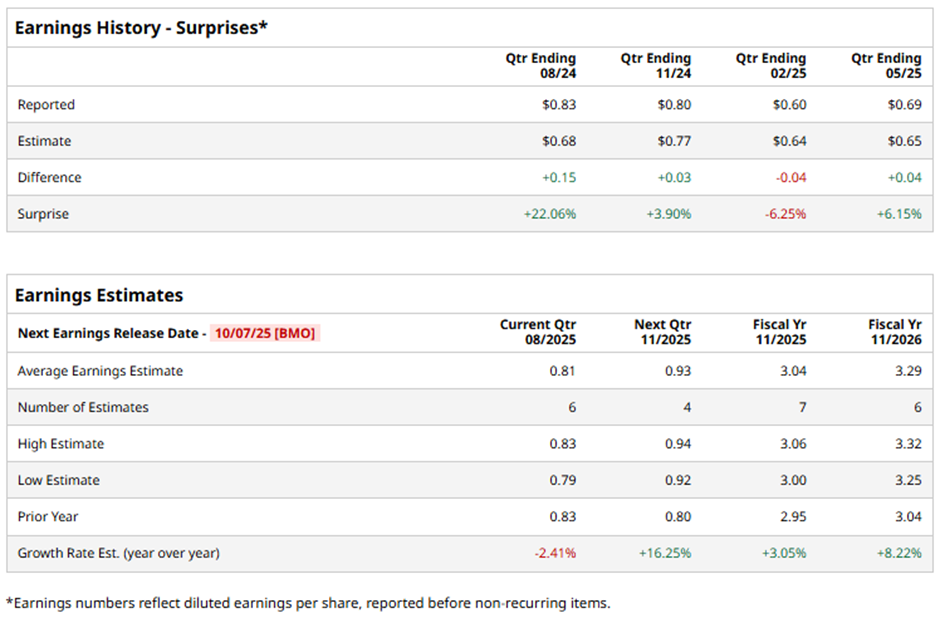

The Hunt Valley, Maryland-based company is expected to announce its fiscal Q3 2025 results before the market opens on Tuesday, Oct. 7. Ahead of this event, analysts forecast McCormick to report an adjusted EPS of $0.81, down 2.4% from $0.83 in the year-ago quarter. It has exceeded Wall Street's earnings estimates in three of the last four quarters while missing on another occasion.

For fiscal 2025, analysts project the spice maker to report an adjusted EPS of $3.04, up 3.1% from $2.95 in fiscal 2024. Moreover, adjusted EPS is projected to grow 8.2% year-over-year to $3.29 in fiscal 2026.

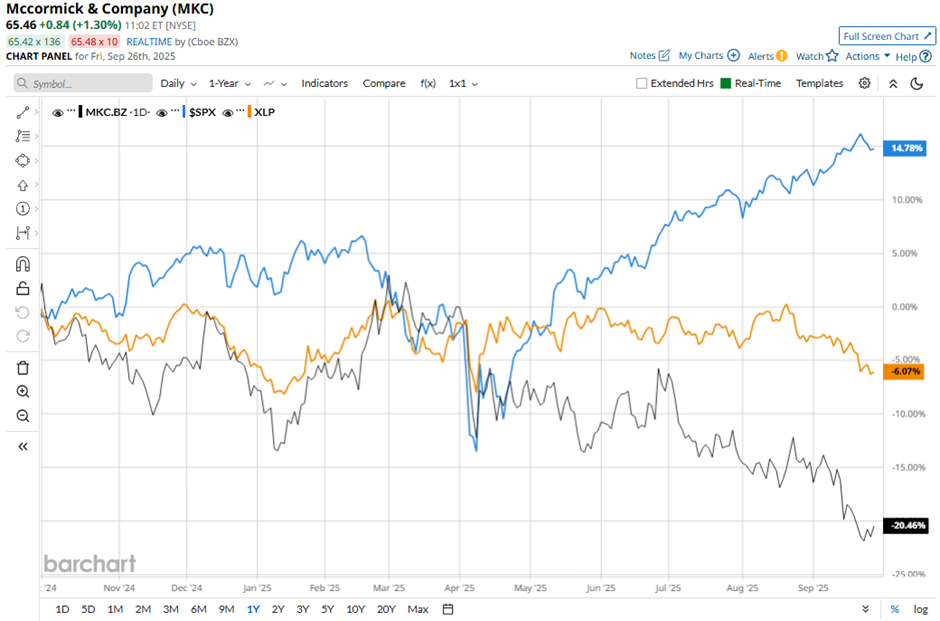

Shares of McCormick have dropped 21.3% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) over 15% return and the Consumer Staples Select Sector SPDR Fund’s (XLP) 6% dip over the same period.

Shares of McCormick soared 5.3% on Jun. 26 after the company reported stronger-than-expected Q2 2025 results, with adjusted EPS of $0.69. Net sales rose to $1.66 billion, driven by a 1.3% increase in volumes and a 0.3% rise in prices. Investor confidence was further boosted as McCormick reaffirmed its full-year forecast of flat to 2% sales growth and adjusted EPS of $3.03 to $3.08, while outlining strategies to offset tariff-related costs.

Analysts' consensus view on MKC stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 14 analysts covering the stock, seven recommend "Strong Buy," one "Moderate Buy," and six suggest "Hold." The average analyst price target for McCormick is $85.57, indicating a potential upside of 30.7% from the current levels.