With a market cap of $8.9 billion, Match Group, Inc. (MTCH) is a global leader in providing digital dating products and technologies. With a portfolio of more than 45 brands including Tinder, Hinge, Match.com, OkCupid, Plenty of Fish, and Meetic, the company connects users across over 40 languages and countries.

Companies valued less than $10 billion are generally classified as “mid-cap” stocks, and Match Group fits this criterion perfectly. Its diverse offerings, from the world’s top-grossing Tinder app to niche platforms like OurTime and BLK, are designed to help people build meaningful connections.

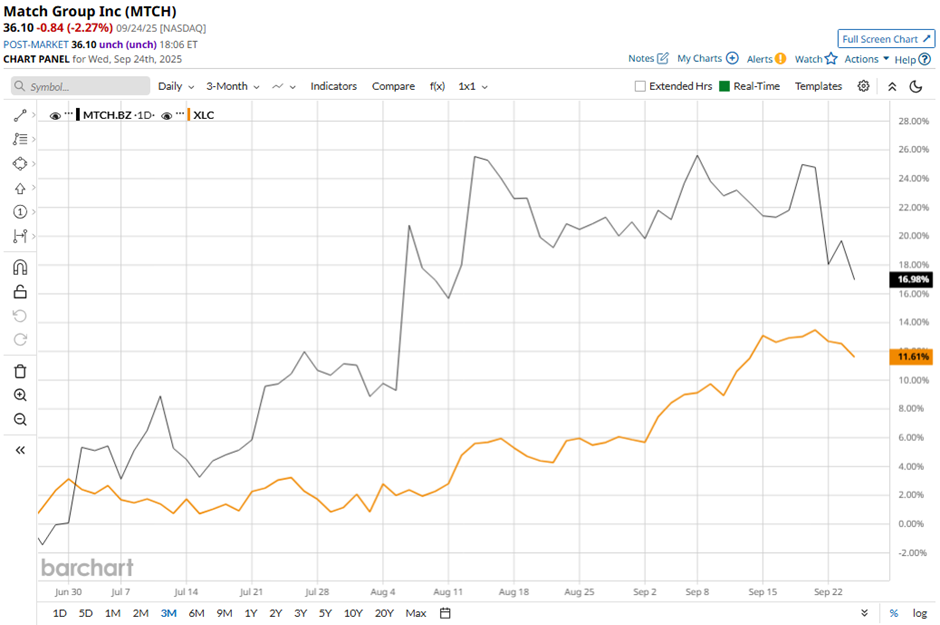

Shares of the Dallas, Texas-based company have fallen 7.9% from its 52-week high of $39.20. MTCH stock has gained 14.4% over the past three months, outperforming the Communication Services Select Sector SPDR ETF Fund's (XLC) 11.6% rise during the same period.

In the longer term, Tinder-parent's shares have increased 10.4% on a YTD basis, lagging behind XLC's 21.3% gain. Over the past 52 weeks, MTCH stock has declined 3.3%, compared to XLC's 31.6% surge over the same period.

Yet, the stock has been trading above its 50-day moving average since late May. Also, it has climbed above its 200-day moving average since mid-July.

Shares of Match Group jumped 10.5% following its reported Q2 2025 revenue of $863.7 million on Aug. 5, beating Wall Street expectations. The upside was driven by strong performance at Hinge and early benefits from its new AI-powered discovery algorithm, which improved recommendations and user interactions. Investors were further encouraged by guidance for Q3 revenue of $910 million - $920 million, well above the estimate, along with a $50 million reinvestment plan to fuel product innovation and expansion.

In comparison, rival Snap Inc. (SNAP) has lagged behind MTCH stock. SNAP stock has dropped 23.7% on a YTD basis and 22.2% over the past 52 weeks.

Due to the stock's underperformance relative to the sector over the past year, analysts are moderately optimistic on MTCH. The stock has a consensus rating of “Moderate Buy” from the 22 analysts covering it, and the mean price target of $38.47 is a premium of 6.6% to current levels.