Match Group, Inc. (MTCH) is a leading provider of digital dating products and services, headquartered in Dallas, Texas. Valued at a market cap of $7.9 billion, the company owns and operates a broad portfolio of popular dating platforms, including Tinder, Hinge, OkCupid, Plenty of Fish, Match.com, and Pairs, collectively serving users in over 40 languages and 190 countries.

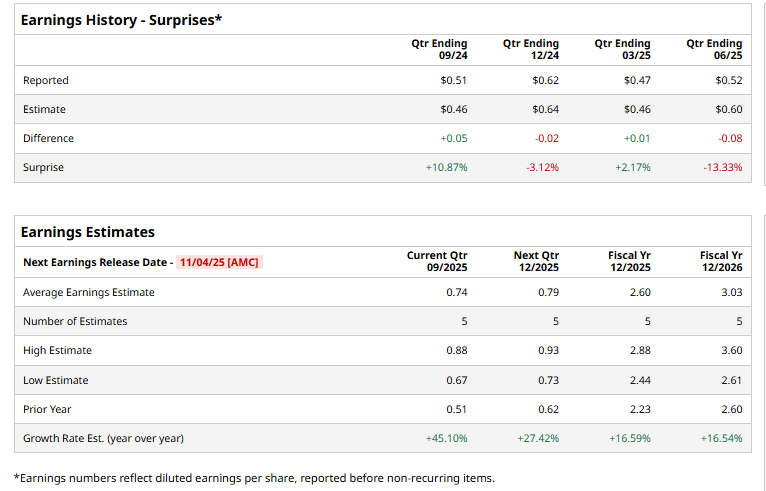

It is expected to announce its fiscal Q3 earnings for 2025 after the market closes on Tuesday, Nov. 4. Ahead of the event, analysts project this online dating service company to report a profit of $0.74 per share, up 45.1% from $0.51 per share in the year-ago quarter. The company has exceeded Wall Street's bottom-line estimates in two of the last four quarters, while missing on two other occasions.

For the current year, analysts expect MTCH to report EPS of $2.60, up 16.6% from $2.23 in fiscal 2024. Its EPS is expected to further grow 16.5% year over year to $3.03 in fiscal 2026.

MTCH has dipped 12.7% over the past 52 weeks, falling behind both the S&P 500 Index's ($SPX) 15.1% rise and the Communication Services Select Sector SPDR Fund’s (XLC) 28.4% uptick over the same time frame.

On August 5, Match Group shares surged 10.5% after the company reported Q2 2025. Its revenue of $863.7 million surpassed Wall Street estimates, fueled by robust growth at Hinge and initial gains from a new AI-powered discovery algorithm that enhanced user recommendations and engagement. Adding to investor optimism, Match Group issued an upbeat Q3 revenue forecast of $910–$920 million, well above expectations, and announced a $50 million reinvestment initiative to drive product innovation and future expansion.

Wall Street analysts are moderately optimistic about Match Group’s stock, with a "Moderate Buy" rating overall. Among 22 analysts covering the stock, seven recommend "Strong Buy," one suggests a “Moderate Buy,” and 14 advise “Hold.” The mean price target for MTCH is $38.47, which indicates a potential upside of 16.4% from the current levels.