Mastercard Inc. (NYSE:MA) is charting a new course for the digital economy, and it’s a future where open banking and stablecoins are at the core. This includes the potential for stablecoins to act as settlement currencies, as the company states it sees them as just another form of money.

Check out the MA stock price over here.

What Happened: During its earnings call, executives underscored the company’s “Open banking” initiative as a key to future growth. This is a system that allows banks and other financial institutions to share customer financial data securely with third-party providers with the customer’s explicit consent.

CEO Michael Mihwach underscored that one of the most notable open banking developments is the launch of “Mastercard Account to Account Protect,” a new fraud prevention service. A critical part of this “Mastercard One credential” is its ability to provide consumers with flexibility in how they pay, whether through debit, credit, prepaid, or even stablecoin.

The inclusion of stablecoins as potential settlement currencies is a clear signal that Mastercard sees a future where it not only facilitates payments for traditional currency but for digital assets as well. “As to Stablecoins, we see it as another currency,” said Mihwach.

“We will bring our reach, ubiquity, and trust to Agentic Commerce and Stablecoins and will provide an environment for our partners to innovate upon. That is the Mastercard way,” he added.

Mastercard is leveraging this by enhancing fraud prevention, forging new partnerships, and creating a “global account overlay.” The company is also leveraging open banking to secure new partnerships and expand its market share globally.

The company also outlined its strategy about providing choice and partnering wherever possible. This is further evidenced by its work with Deutsche Bank AG (NYSE:DB) to grow account-to-account payments across Europe.

The vision, as described by Mihwach, is to provide a single digitally connected credential that gives consumers flexibility in how they pay, whether through debit, credit, prepaid, or even stablecoin.

Why It Matters: The company reported revenue of $8.13 billion, up 17% year-over-year and 16% YoY on a neutral currency basis, beating the analyst consensus estimate of $7.95 billion. Its adjusted EPS rose 16% YoY to $4.15, exceeding the analyst consensus estimate of $4.02.

The company now expects high-end mid-teens revenue growth (prior low teen-digit revenue growth) for fiscal 2025 versus the $31.96 billion analyst consensus estimate.

Price Action: MA stock rose 1.32% on Thursday. The stock was up 8.44% year-to-date and 22.5% over a year. It was trading 0.61% lower in premarket on Friday.

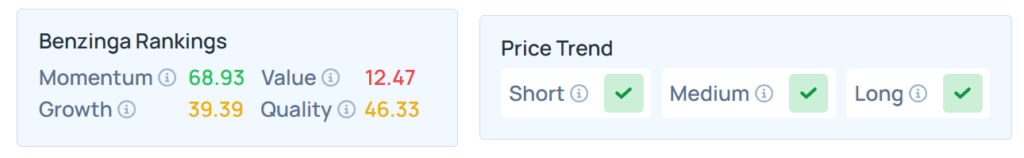

Benzinga's Edge Stock Rankings indicate that MA maintains a strong price trend across the short, medium, and long term. However, the stock scores badly on value rankings. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, dropped in premarket on Friday. The SPY was down 0.94% at $626.13, while the QQQ declined 1.09% to $558.85, according to Benzinga Pro data.

On Friday, the futures of Dow Jones, S&P 500, and Nasdaq 100 indices were trading lower.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo: rblfmr/Shutterstock