/Mastercard%20Incorporated%20card%20logo%20-by%20jbk_photography%20via%20iStock.jpg)

Purchase, New York-based Mastercard Incorporated (MA) provides transaction processing and other payment-related products and services. Valued at $504 billion by market cap, Mastercard offers a range of integrated products and value-added services to millions of account holders, institutions, businesses, governments, and other organizations.

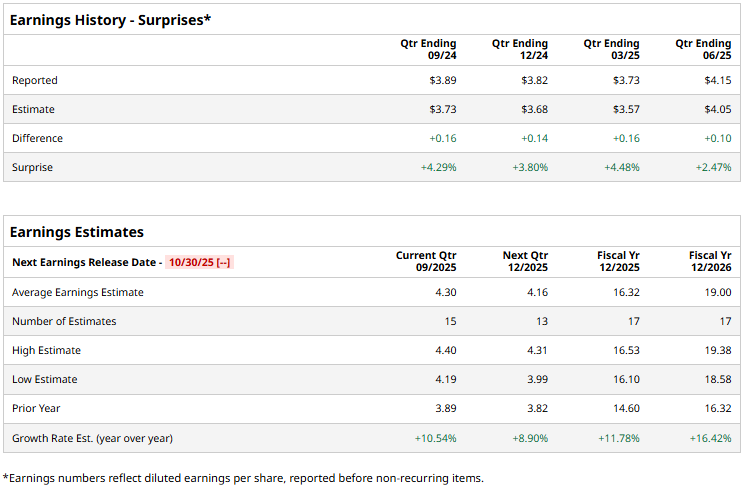

The payments giant is set to announce its third-quarter results before the market opens on Thursday, Oct. 30. Ahead of the event, analysts expect Mastercard to report an adjusted profit of $4.30 per share, up 10.5% from $3.89 per share reported in the year-ago quarter. Further, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, Mastercard is expected to deliver an adjusted EPS of $16.32, up 11.8% from $14.60 reported in 2024. While in fiscal 2026, its earnings are expected to soar 16.4% year-over-year to $19 per share.

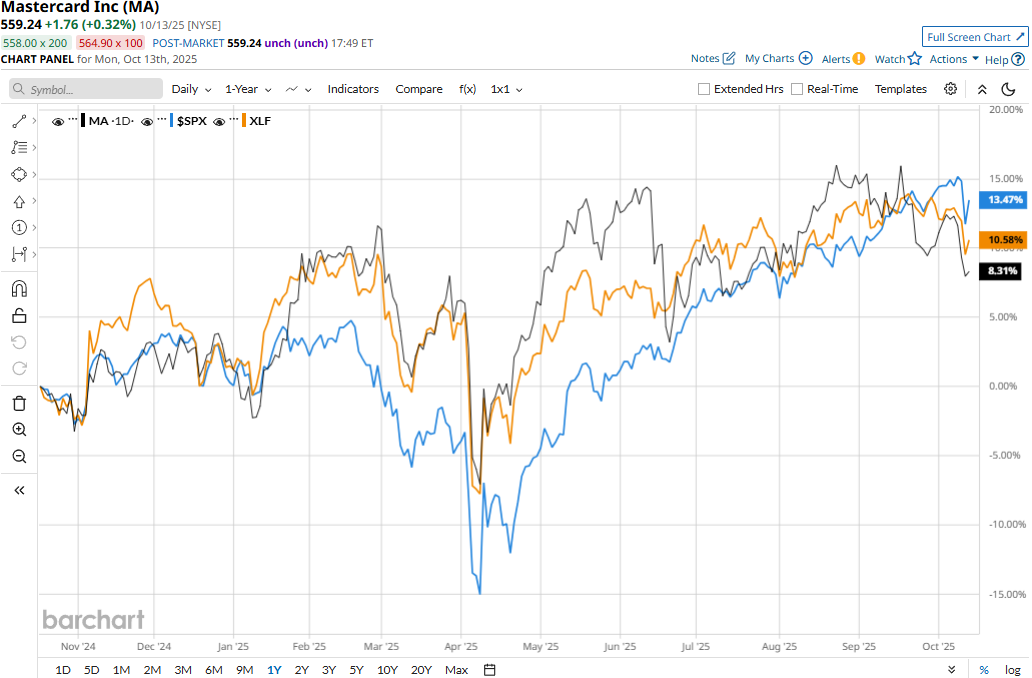

MA stock prices have gained 11.3% over the past 52 weeks, lagging behind the Financial Select Sector SPDR Fund’s (XLF) 13.2% gains and the S&P 500 Index’s ($SPX) 14.4% returns during the same time frame.

Mastercard’s stock prices gained 1.3% in the trading session following the release of its robust Q2 results on Jul. 31. The company has continued to observe a solid momentum in its business. Driven by the constant growth in its payment network and value-added services and solutions, Mastercard’s revenues for the quarter surged 16.8% year-over-year to $8.1 billion, exceeding the Street expectations by 1.9%. Meanwhile, its adjusted net income grew 13% year-over-year to $3.8 billion, and its adjusted EPS of $4.15 surpassed the consensus estimates by 2.5%.

Analysts remain optimistic about the stock’s prospects. Mastercard maintains a consensus “Strong Buy” rating overall. Of the 36 analysts covering the stock, opinions include 25 “Strong Buys,” four “Moderate Buys,” and seven “Holds.” Its mean price target of $652.33 suggests a 16.6% upside potential from current price levels.