/AI%20(artificial%20intelligence)/Close-%20up%20of%20computer%20chip%20with%20AI%20sign%20by%20YAKOBCHUK%20V%20via%20Shutterstock.jpg)

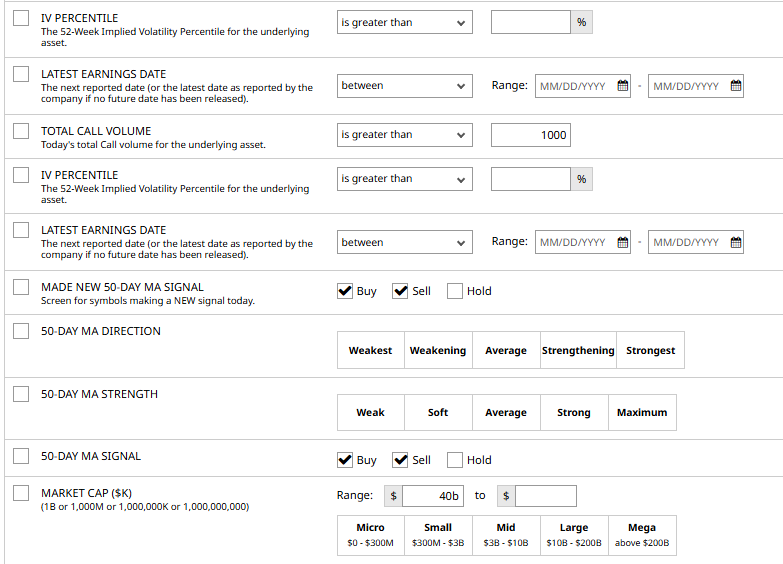

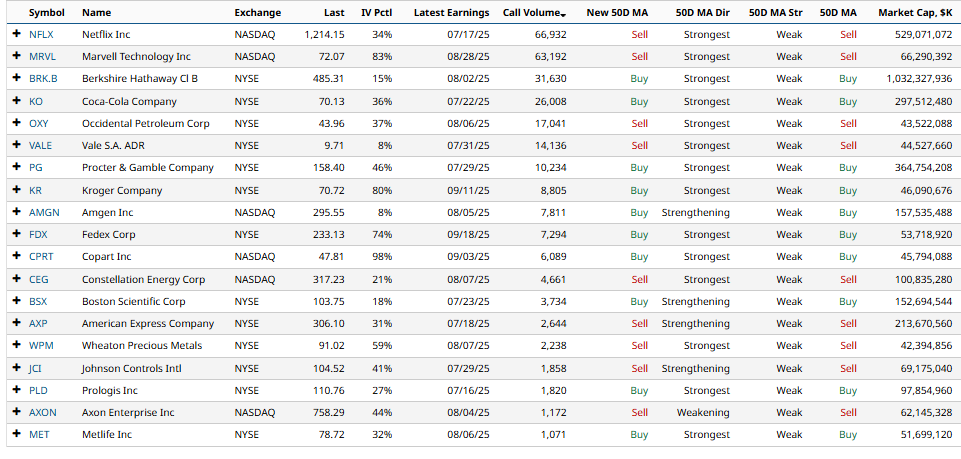

Marvell Technology (MRVL) stock was a bearish candidate that came up on one of my Barchart Stock Screeners having broken below the 50-day moving average.

Here are the full parameters for the screener and the results.

Today, we’re going to look at a Bear Put spread trade that assumes MRVL will continue to move lower since breaking through the 50-day moving average.

A Bear Put spread is a bearish trade that also benefits from a rise in implied volatility.

The maximum risk for a Bear Put spread is limited to the premium paid while the maximum potential profit is also capped.

The maximum profit is equal to the width between the strikes less the premium paid.

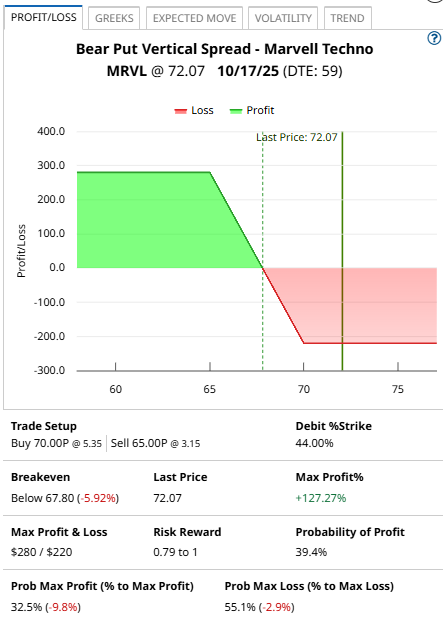

MRVL BEAR CALL SPREAD

To create a Bear Put spread, we buy an out-of-the-money put and then sell another put further out-of-the-money.

Buying the October 17 put with a strike price of $70 and selling the $65 put would create a Bear Put spread.

This spread was trading for around $2.20 yesterday. That means a trader buying this spread would pay $220 in option premium and would have a maximum profit of $280.

That represents a 127.27% return on risk between now and October 17 if MRVL stock falls below $65.

If MRVL stock closes above $70 on the expiration date the trade loses the full $220.

The breakeven point for the Bear Put spread is $67.80 which is calculated as $70 minus the $2.20 option premium per contract.

COMPANY DETAILS

The Barchart Technical Opinion rating is a 32% Sell with a Weakest short term outlook on maintaining the current direction.

Marvell Technology is a fabless designer, developer and marketer of analog, mixed-signal and digital signal processing integrated circuits. The company operates in Bermuda, China, Germany, Japan, Korea, Taiwan, the United Kingdom, and the United States.

Marvell specializes in highly integrated System-on-a-Chip (SoC) and System-in-a-Package (SiP) devices based primarily on ARM designs and sells to both enterprise and consumer customers.

It has a significant number of patents in design, software and reference platforms to its credit.

The company's product line includes application processors, controllers, switches, communications and networking processors and technologies, as well as other SoCs for printers and smart home products. These serve two broad end markets - data center and enterprise networking.

Conclusion And Risk Management

One way to set a stop loss for a Bear Put spread is based on the premium paid. In this case, we paid $220, so we could set a stop loss equal to the 50% of the premium paid, or a loss of around $110.

Another stop loss level could be if the stock broke above $80.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.