Martin Marietta Materials, Inc. (MLM), headquartered in Raleigh, North Carolina, is a leading natural resource-based building materials supplier. With a market cap of $30 billion, the company provides aggregates and heavy-side construction materials to the building industry. In addition, it produces and markets magnesia-based products, including heat-resistant refractories for the steel sector, chemical products for industrial and environmental applications, and dolomitic lime.

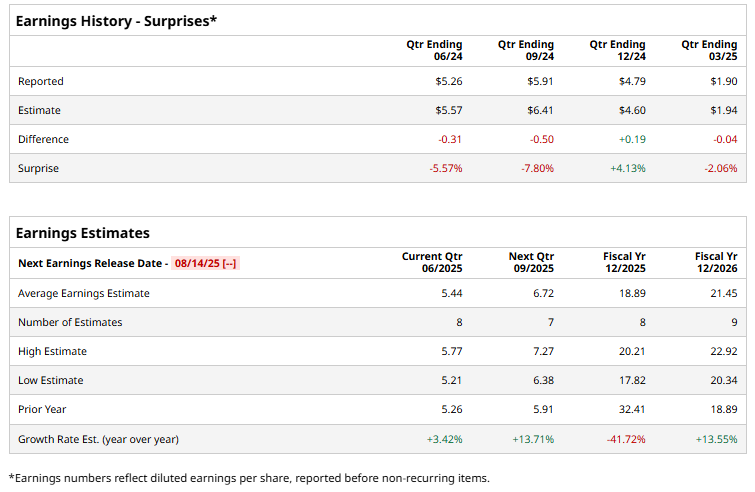

MLM is expected to announce its fiscal second-quarter earnings for 2025 on Tuesday, Aug. 14. Ahead of the event, analysts expect MLM to report a profit of $5.44 per share on a diluted basis, up 3.4% from $5.26 per share in the year-ago quarter. However, the company missed the consensus estimates in three of the last four quarters while beating the forecast on another occasion.

For the current year, analysts expect MLM to report EPS of $18.89, down 41.7% from $32.41 in fiscal 2024. However, its EPS is expected to rise 13.6% year over year to $21.45 in fiscal 2026.

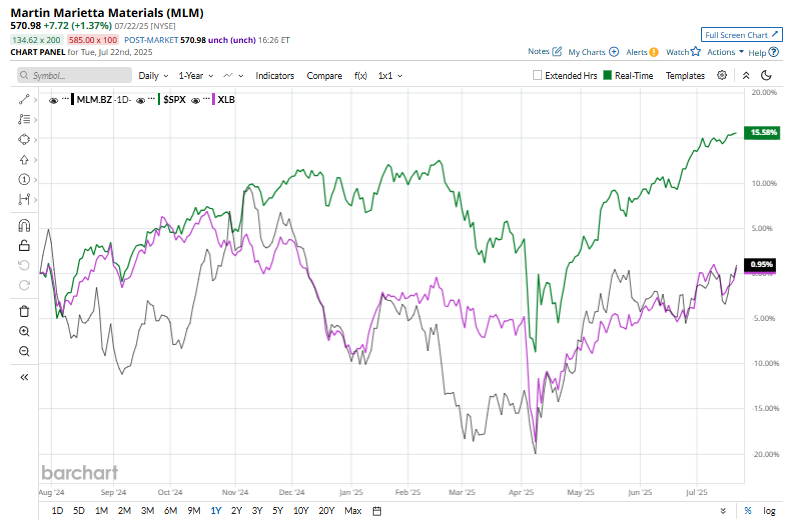

MLM shares have surged marginally over the past year, underperforming the S&P 500 Index’s ($SPX) 13.4% gain and the Materials Select Sector SPDR Fund’s (XLB) 1.7% rise.

MLM delivered its first quarter earnings on April 30, and its shares rose 3.8%. Its revenue grew 8.2% year-over-year to $1.4 billion but fell short of Wall Street expectations. Meanwhile, EPS plunged 88.7% from the year-ago period to $1.90, missing the consensus estimate of $1.94.

However, the company showcased strong operational execution, achieving first-quarter records in consolidated gross profit, gross margin, adjusted EBITDA, and adjusted EBITDA margin. A standout highlight was the 24% year-over-year increase in aggregate gross profit per ton, driven by robust pricing power and disciplined cost control, factors that likely supported the stock’s upward move.

Analysts’ consensus opinion on MLM stock is reasonably upbeat, with a “Moderate Buy” rating overall. Out of 18 analysts covering the stock, 12 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and five give a “Hold.” MLM’s average analyst price target is $602.32, indicating a potential upside of 5.5% from the current price levels.