/Marsh%20%26%20McLennan%20Cos_%2C%20Inc_%20NY%20HQ%20-by%20JHVEPhoto%20via%20Shutterstock.jpg)

New York-based Marsh & McLennan Companies, Inc. (MMC) provides advice and solutions to clients in the areas of risk, strategy, and people worldwide. With a market cap of $98.1 billion, Marsh & McLennan operates through Risk and Insurance Services and Consulting segments.

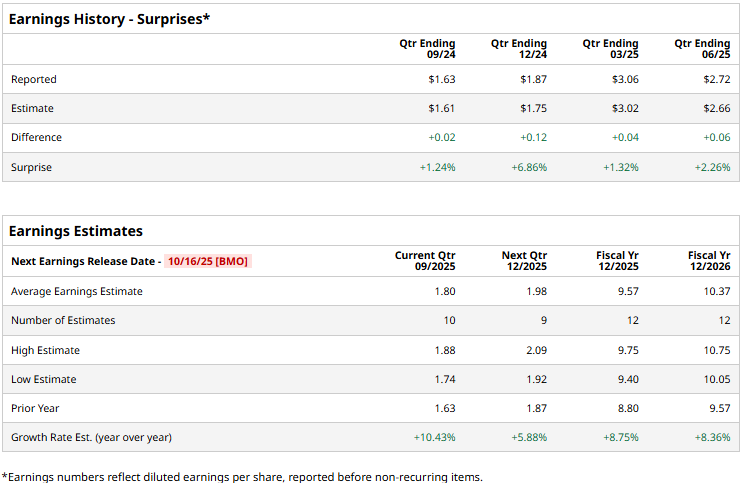

The insurance giant is gearing up to announce its third-quarter results before the market opens on Thursday, Oct. 16. Ahead of the event, analysts expect MMC to deliver an adjusted profit of $1.80 per share, up 10.4% from $1.63 per share reported in the year-ago quarter. Further, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, MMC’s adjusted EPS is expected to come in at $9.57, up 8.8% from $8.80 in 2024. Further, in 2026, its earnings are expected to grow 8.4% year-over-year to $10.37 per share.

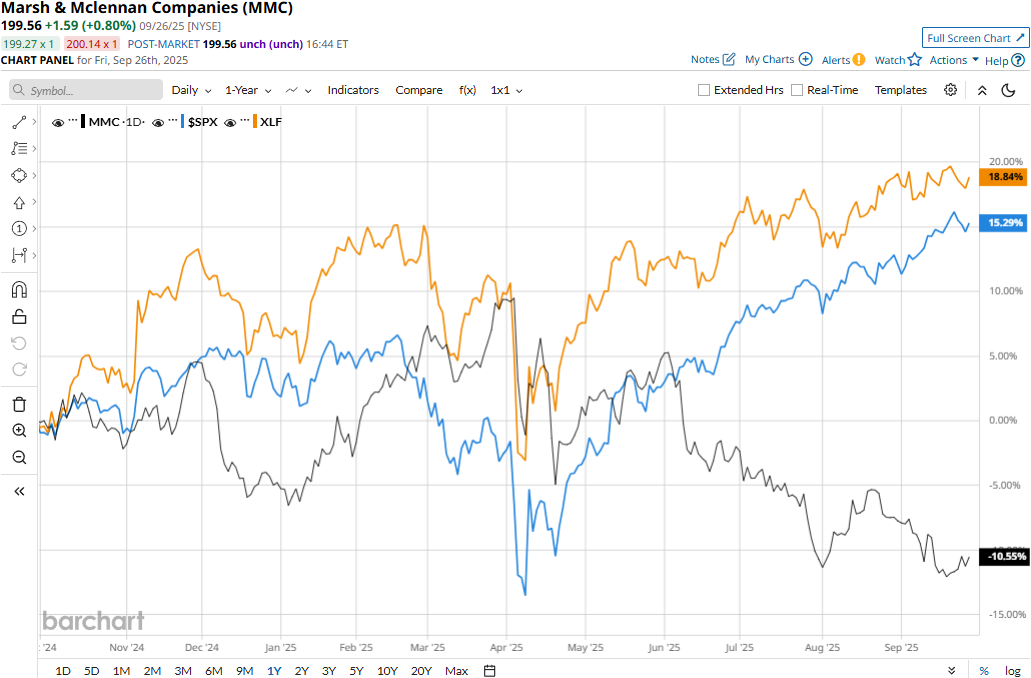

Marsh & McLennan’s stock prices have declined 10.8% over the past 52 weeks, notably underperforming the Financial Select Sector SPDR Fund’s (XLF) 19.6% surge and the S&P 500 Index’s ($SPX) 15.6% gains during the same time frame.

Despite delivering better-than-expected results, Marsh & McLennan’s stock prices observed a marginal 44 bps dip in the trading session following the release of its Q2 results on Jul. 17. Driven by notable organic growth and contribution from acquisitions, the company’s overall revenues for the quarter surged 12.1% year-over-year to $6.97 billion, surpassing the Street expectations by 75 bps. Furthermore, the company’s adjusted EPS for the quarter increased by an impressive 11.5% year-over-year to $2.72, exceeding the consensus estimates by 2.3%. Following the initial dip, MMC stock prices gained 59 bps in the subsequent trading session.

Analysts remain cautious about the stock’s prospects. MMC maintains a consensus “Hold” rating overall. Of the 23 analysts covering the MMC stock, opinions include five “Strong Buys,” one “Moderate Buy,” 15 “Holds,” one “Moderate Sell,” and one “Strong Sell.” Its mean price target of $234.58 suggests a 17.5% upside potential from current price levels.