Investors are still feeling very optimistic as the Australian share market has risen to its highest level since April, while a tech rebound boosted Wall Street overnight.

Elon Musk has taken the witness stand for a second day to defend against allegations that he misled Tesla investors, and Spotify is the latest company to announce sweeping job cuts, with plans to sack 6 per cent of its workforce.

See how the trading day unfolded.

Disclaimer: this blog is not intended as investment advice.

Live updates

ASX notches five-day winning streak

By David Chau

The Australian share market has risen for its fifth straight day to finish at its highest level since April 21.

The ASX 200 gained 0.4% to close at 7,490 points, with (mainly) mining stocks driving the gains.

Some of today's best performers were Breville Group (+7.5%), Block (+5.7%), Mineral Resources (+5.3%), Pilbara Minerals (+5.2%) and Evolution Mining (+4.9%).

On the flip side, shares of Telix Pharmaceuticals (-3.5%), Imugene (-3.2%), Cochlear (-2.5%), Bega Cheese (-2.5%) and Qantas (-2.3%) posted heavy losses.

By 4:35pm AEDT, the Australian dollar was slightly higher at 70.35 US cents.

Tomorrow, investors will be closely watching the ABS consumer price index , which is expected to show annual inflation rising to a three-decade high 7.5%.

A weaker-than-expected inflation result would be welcomed by stock market investors, and spur bets that inflation has peaked and the Reserve Bank will not need to lift interest rates much more.

Musk says he could have sold SpaceX shares to fund Tesla privatisation

By David Chau

Elon Musk told jurors on Monday that he was sure he had locked up financial support from Saudi investors in 2018 to take his electric car maker Tesla.

The tech billionare also said he and could even have used his stake in rocket company SpaceX to fund a buyout.

At a trial in San Francisco federal court, the Tesla chief executive, who said he was tired from a lack of sleep, spoke quietly and calmly during roughly five hours of testimony.

"With SpaceX stock alone, I felt funding was secured" for the buyout, he told a jury, referring to the aerospace company where he is also CEO.

He added later that he chose not to take Tesla private due to a lack of support from some investors and a wish to avoid a lengthy process.

Musk is defending against claims that he defrauded investors by tweeting on August 7, 2018, that he had "funding secured" to take Tesla private at $US420 per share, and that "investor support is confirmed".

The trial tests Musk's penchant for taking to Twitter to air his sometimes irreverent views, and when the world's second-richest person can be held liable for crossing a line.

Tesla's stock price surged after Musk's 2018 tweets, only to fall as it became clear the buyout would not happen.

Investors say they lost millions of dollars as a result.

Business conditions are deteriorating: NAB survey

By David Chau

The economic situation is starting to look a bit gloomier for businesses even though inflation has likely peaked, and cost pressures are easing.

Businesses conditions dropped for a third straight month in December, according to a NAB's closely-watched business survey.

The results may reduce pressure on the Reserve Bank to raise interest rates at its next policy-setting meeting, on February 7.

Business conditions fell 8 points (to +12) in December. That's well above its long-run average.

On the other hand, business confidence improved by 3 points (to -1). It remains in negative territory for the second month in a row.

So far, markets are still inclined to think the central bank will raise its 3.1% cash rate by another quarter point.

But they have also priced in a 40% chance it will pause, given that interest rates have climbed by 300 basis points since May.

“After holding up relatively well in recent months, business conditions eased significantly in December with the trading conditions, profitability and employment indexes all falling,” said NAB chief economist Alan Oster.

“The falls were significant and occurred in every sector.

"That said, conditions are still significantly above long run averages.

"As a result, the main message from the December monthly survey is that the growth momentum has slowed significantly in late 2022 while price and purchase cost pressures have probably peaked”.

ASX flat at midday

By David Chau

It's a cautious trading day on the Australian share market, ahead of tomorrow's cost of living update.

The ABS will release its December quarter inflation figures, which is expected to show annual inflation rising to a three-decade high of 7.5%, according to Reuters-polled economists.

In the meantime, the ASX 200 was up 0.1% to 7,467 points, by 12:30pm AEDT (practically flat).

Miners were among the top performers as copper prices rose on improving demand prospects in top consumer China.

Shares of Mineral Resources jumped 5.4% to a record high ($96.47) after UBS upgraded the lithium producer to "buy" from "neutral".

Meanwhile, Coronado Global Resources retreated 3.7% and was the top loser on the local share market after the coal miner reported weak sales volume for the December quarter.

Technology stocks rose to their highest level in more than a month, with Block, Xero and WiseTech Global up between 1.9% and 7.1%.

Zip Co jumped 6.6% after the buy-now-pay-later firm reported a record second-quarter revenue.

Some of today's worst performers were Qantas (-2.5%), Ansell (-2.5%), Telix Pharmaceuticals (-3.9%), Cochlear (-2.5%) and Perseus Mining (-2.2%).

Banks and healthcare weigh on ASX

By David Chau

Now here are today's worst-performing companies on the ASX 200, which has erased most of its gains in the past hour.

They include coal miner Coronado Global Resources, health stocks Cochlear and Ansell, along with major bank Westpac.

The financial and healthcare sectors are weighing most heavily on the local share market so far.

Australian market losing steam

By David Chau

The local share market has lost some momentum after the first trading hour.

The ASX 200 was flat at 7,460 points, by 11:10am AEDT, with six out of every 10 stocks trading higher.

Most sectors were trading higher, with industrials and consumer discretionary in the lead.

Here are the best performing stocks so far:

ASX rises 0.2% to nine-month high

By David Chau

Australian shares has begun its day with slight gains, taking the benchmark index to its highest level since April 2022.

The ASX 200 index was up 0.3% to 7,480 points, by 10:20am AEDT.

The Australian dollar was steady at 70.3 US cents.

Elon Musk 'very upset' Saudis backpedalled from Tesla privatisation

By David Chau

Elon Musk has taken the witness stand for a second day in a San Francisco federal court.

The tech billionaire is defending against claims that he defrauded investors when he tweeted on August 7, 2018, that he had "funding secured" to take Tesla private at $US420 per share, and that "investor support is confirmed."

Investors say they lost millions as a result of Musk's tweets.

Tesla's stock price surged after Musk's tweets, and later fell as it became clear the buyout would not materialize.

US Judge Edward Chen ruled last May that Musk's post was untruthful and reckless.

A jury of nine will decide whether the Tesla CEO artificially inflated the company's share price by touting the buyout's prospects, and if so by how much.

Musk did not discuss takeover price with Saudis

On Monday (US time), Musk told the court that he was sure he had backing from Saudi financiers in 2018 to privatise Tesla, but said the fund later backpedalled on its commitment.

The Tesla CEO told the shareholders' lawyer that he met with representatives of Saudi Arabia's sovereign wealth fund (the Public Investment Fund) at Tesla's Fremont, California, factory on July 31, 2018.

Musk acknowledged he did not discuss a takeover price with representatives of the Saudi fund, but said they made clear they would do what it took to make a buyout happen.

"PIF unequivocally wanted to take Tesla private," he testified.

Musk subsequently said that Yasir Al-Rumayyan, governor of the fund, later backpedalled on the commitment to take Tesla private.

"I was very upset because he had been unequivocal in his support for taking Tesla private when we met and now he appeared to be backpedaling," he said at the witness stand.

The shareholders' lawyer told the court that written evidence does not support Musk's claim (that the Saudi fund made a commitment to him).

The lawyer added that minutes of a meeting between Musk and the Saudis showed the Saudis wanted to learn more about the billionaire's plan.

Microsoft pumps more investment into OpenAI

By David Chau

Microsoft has announced a further multibillion dollar investment in OpenAI, but has not specified the amount.

Some media outlets earlier reported the investment could be around $US10 billion.

Essentially, Microsoft will deepen ties with the startup behind the chatbot sensation ChatGPT (an articifial intelligence technology that can learn how to create virtually any type of content simply from a text prompt).

Microsoft is building on a bet it made on OpenAI nearly four years ago, when it dedicated $US1 billion for the startup co-founded by Elon Musk and investor Sam Altman.

The tech giant in a blog post has now announced "the third phase" of its partnership "through a multiyear, multibillion dollar investment" including additional supercomputer development and cloud-computing support for OpenAI.

Both companies will be able to commercialise the AI tech that results, the blog post said.

Microsoft has started adding OpenAI's tech to its search engine Bing, which for the first time in years is being discussed as a potential rival to Google, the industry leader.

Microsoft's bet comes days after it and Alphabet (Google) each announced layoffs of 10,000 or more workers.

Washington-based Microsoft warned of a recession and growing scrutiny of digital spend by customers in its layoff announcement.

Tech giants sacked thousands of workers

By David Chau

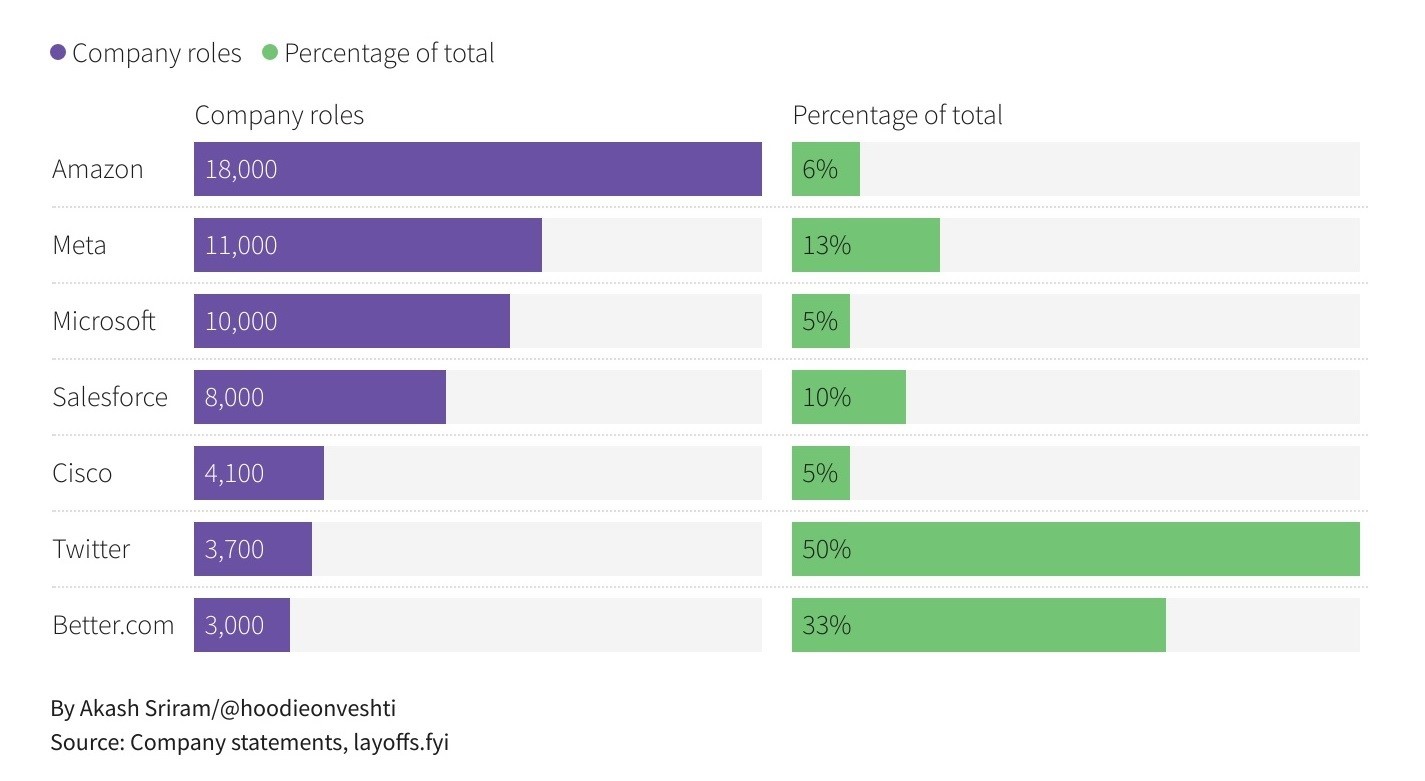

Here's a handy snapshot of which tech-related companies have announced big job cuts recently.

Leading the pack (in terms of head count) is Amazon, which sacked 18,000 employees.

But when you're measuring by percentage, Twitter's job cuts were even more severe — with new owner Elon Musk firing at least 50 per cent of his workforce.

Nasdaq jumps 2% on bets of slower Fed rate hikes

By David Chau

Wall Street has now finished trading, and it was a very optimistic day. Here are the closing figures:

- Dow Jones: +0.8% to 33,630 points

- S&P 500: +1.2% to 4,020

- Nasdaq: +2% to 11,364

Investors are all but certain the US Federal Reserve will announce a small interest rate hike next week, while announcing it remains committed to bringing inflation down from a 40-year high.

"[Investors] are pretty comfortable that they’re going to see lower rate hikes from the Fed, that we are rounding the corner on inflation and interest rate hikes," said Peter Tuz, president of Chase Investment Counsel.

"Stocks can do well in that environment, especially the big growth stocks that drive the market."

Financial markets have priced in an almost 100% chance of the Fed lifting rates by 25 basis points (or 0.25 percentage points) at the end of its two-day meeting next Wednesday, according to CME's FedWatch tool.

Spotify sacks 6 per cent of its workforce

By David Chau

Spotify is the latest tech business to announce mass lay-offs, with plans to cut 6 per cent of its workforce.

This roughly equates to 600 job losses.

The tech industry is facing a sharp fall in demand for its services after two years of pandemic-powered growth (during which it had hired aggressively).

That has led firms like Meta (Facebook), Alphabet (Google), Amazon and Microsoft shedding thousands of jobs.

"Over the last few months we've made a considerable effort to rein in costs, but it simply hasn't been enough," said Spotify chief executive Daniel Elk in a blog post.

"I was too ambitious in investing ahead of our revenue growth," he added, echoing a sentiment voiced by other tech bosses in recent months.

Spotify's operating expenditure grew at twice the speed of its revenue last year as the audio-streaming company aggressively poured money into its podcast business, which is more attractive for advertisers due to higher engagement levels.

At the same time, businesses pulled back on ad spending on the platform, mirroring a trend seen at Meta and Alphabet, as rapid interest rate hikes and the fallout from the Russia-Ukraine war pressured the economy.

Spotify's share price rose 2.1% to $US99.94 on the back of these job cuts.

It had about 9,800 full-time employees as of September 30.

Tech companies surge on Wall Street

By David Chau

The local share market is likely to follow a very upbeat lead from Wall Street — which is about to close for the day.

Investor sentiment has risen on hopes the US Federal Reserve will go slow on the rate hikes.

Markets are betting the Fed will lift interest rates by just 0.25 percentage points at its next policy meeting on February 1.

Gains in chipmakers boosted the technology sector, which has been hit by recession concerns amid high interest rates (which led to Microsoft, Amazon, and Google sacking thousands of employees in recent weeks).

Qualcomm and Advanced Micro Devices (AMD) jumped about 8% each after Barclays upgraded their stocks to "overweight" (from "equal-weight").

Western Digital jumped 7.1% on a report that the memory chipmaker could merge with Japan's Kioxia Holdings.

This helped to lift Wall Street's tech index, the Nasdaq Composite, by 1.8%.

Investors are anxious to hear from corporate executives about their economic outlook in a week in which Microsoft posts results on Tuesday, Tesla and IBM on Wednesday and Intel on Thursday (local time).

"The market’s still quite buoyant at the moment," said Peter Chatwell, head of global macro strategies trading at Mizuho, who said markets were being driven by the idea that US inflation has peaked.

ASX likely to hit fresh nine-month high

By David Chau

Good morning! I'll be taking you through the latest happenings on markets, the economy and a bit of company news.

We're only into the fourth week of 2023, and there's quite a bit of optimism in the stock market.

The Australian share market has risen almost every day since the year began, and it's currently trading at its highest level since April (in other words, a nine-month high).

Here's how the market is looking at 7:30am AEDT:

- ASX futures: +0.1% (which implies the local stock market could open slightly higher)

- Australian dollar: 70.2 US cents (+0.8%)

- US markets: Dow Jones (+0.6%), S&P 500 (+1%), Nasdaq Composite (+1.7%)

- Europe: DAX (+0.5%), FTSE 100 (+0.2%), STOXX 600 (+0.5%)

- Gold: $US1,928 an ounce (+0.1%)

- Brent crude oil: $US88 a barrel (+0.5%)

- Bitcoin: $US22,851 (+2.3%)

ABC/Reuters