The Australian share market ended its day slightly lower, while building approvals fell to their weakest level in 11 years.

Treasury officials fronted Senate Estimates to answer questions about why action was not taken any earlier against PwC for leaking confidential information.

Meanwhile, Crown has agreed to pay a $450 million fine for money laundering breaches.

See how the trading day unfolded on our live blog.

Disclaimer: this blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Market snapshot at 4:15pm AEST

By David Chau

-

ASX 200: -0.1% at 7,209 points (live values below)

- Australian dollar: -0.4% at 65.1 US cents

- Nikkei: +0.2% at 31,306 points

- Hang Seng: -0.3% at 18,504

- Shanghai Composite: -0.6% at 3,204

- Wall Street and FTSE closed for public holiday

- STOXX Europe 600 : -0.1.% to 461 points

- Spot gold: -0.5% to $US1,933/ounce

- Brent crude: -0.8% to $US76.46/barrel

- Iron ore: +2.7% to $US103.25 / tonne

- Bitcoin: +0.3% at $US27,765

Live updates on the major ASX indices:

ASX finishes lower, Australian dollar slips on China weakness

By David Chau

With the world's biggest stock market, Wall Street, closed for the Memorial Day holiday, the local bourse was essentially flat for much of today.

The ASX 200 closed 0.1% lower at 7,209 points, with energy, property and banking stocks weighing on the market.

Best and worst performers

The worst performing stock was Paladin Energy (-19.6%), which was placed in a trading halt on worries about Namibia's plans to nationale its nautral resources.

Paladin produces uranium in Namibia.

Stocks like Sayona Mining (-11.9%), Imugene (-4.6%) and Core Lithium (-3.8%) also suffered heavy falls.

On the flip side, some of today's best performers were Nickel Industries (+4.6%), Sandfire Resources (+3.7%), Polynovo (+3%) and Qantas (+2.7%).

Shares of Qantas jumped after the airline forecast its international divisions will be twice as profitable in the post-COVID era on strong recovery in tourism, with earnings at domestic and loyalty divisions also projected to improve.

China's weaker-than-expected recovery weighs on Aussie dollar

The Australian dollar was buying 65.2 US cents, after falling by 0.3%.

"A weaker Chinese yuan and disappointing Australian economic data weighed on the Australian dollar," Commonwealth Bank currency strategist Carol Kong wrote in a note to clients.

China's currency has slipped to a six-month low against the US greenback.

"China’s lacklustre economic recovery has dampened market sentiment towards Chinese assets," Ms Kong said.

In regards to the weak Australian economic data, she noted that: "Building approvals fell by 8.1%/mth in April compared to the consensus estimate of a 2.0%/mth increase."

Crown facing one of the largest fines in Australia's corporate history

By David Chau

The Crown Resorts casino empire is bracing for a $450 million fine that's been negotiated with the financial crime agency AUSTRAC.

The proposed penalty - if signed off by the Federal Court - would be one of the biggest in Australian corporate history and ends damaging legal action over anti-money laundering breaches and evidence of links with criminal gangs.

For more, you can listen to this report from ABC senior business correspondent Peter Ryan:

Perth Mint CEO resigns after one year ... to join Perth Airport

By David Chau

The chief executive of Perth Mint, Jason Waters, will step down after one year in the role — to become the CEO of Perth Airport.

The announcement was made by the state government-owned Gold Corporation (which operates the Australian refiner).

It comes after Western Australia said it would launch a review of its ownership of The Perth Mint, as the company battles allegations it sold diluted gold to China from 2018 to 2021.

Australia's financial intelligence authority, AUSTRAC, has also launched an investigation into the Mint's level of compliance with anti-money laundering and counter-terrorism financing laws.

Perth Mint, the world's largest processor of newly mined gold and a member of the London Bullion Market Association, had rejected those allegations.

Gold Corporation chairman Sam Walsh said that Mr Waters had presided over significant and positive change across the organisation.

That included the launch of a substantial, fully-funded remediation programme to address historical shortcomings and non-compliance issues, Walsh added in the statement (which did not provide further details).

Mr Waters will continue to lead The Perth Mint while he works out his notice period, and the process to recruit a successor will commence immediately, the company said.

After that, he will take up his new role as the CEO of Perth Airport.

Building slump 'will see the affordability and rental crisis deteriorate further' warns HIA

By Michael Janda

Bad news for both for builders and those seeking a place to live, with the ABS releasing the latest building approvals data for April.

The figures show approvals for new houses as well as apartments and townhouses are at their lowest levels in more than a decade.

Housing Industry Association senior economist Tom Devitt said that leaves both the residential construction industry and those relying on it to increase housing supply facing a dire outlook.

"On a quarterly basis, this leaves detached house approvals 15.4 per cent lower than the same time the previous year, and multi-units down by 38.9 per cent," he wrote.

"This continues the long-lagged response of Australian homebuyers to the RBA's interest rate hiking cycle, with further declines expected in the coming months.

"The combination of construction cost blowouts, labour uncertainties, increased compliance costs and taxes on investors has seen approvals for multi-units fall.

"These disappointing approvals numbers are occurring as population growth surges with the return of overseas migrants, students and tourists.

"This imbalance will see the affordability and rental crisis deteriorate further."

The HIA said, over the past three months, seasonally adjusted building approvals had fallen from the levels seen a year earlier in every state and territory, with the biggest drops in the ACT (-49.8%), Victoria (-35.3%), NSW (28.7%) and the NT (-27.3%).

CBA economist Belinda Allen said the picture isn't nearly so grim outside the home building sector.

"Outside of new residential approvals, the value of non-residential approvals rose by 13.5%/mth in April and is up by 29.8%/yr," she noted.

"The strength partly due to a weak base year, but looking at the three month moving change also shows a lift in entertainment, health care, and other commercial buildings.

"Residential alterations & additions were down by 1.2%/mth and 2.7%/yr."

Paladin Energy plunges 20% as Namibia considers stakes in resource companies

By David Chau

Paladin Energy is the worst performing stock on the ASX 200.

The company produces uranium in the African nation of Namibia.

Its shares plummetted by as much as 24% today, before it went into a trading halt.

This was after Bloomberg News reported that Namibia is considering taking minority stakes in mining and petroleum producers to reap more value from its mineral wealth.

"We are making a case that local ownership must start with the state, which holds ownership of our natural resources,” Namibia's Minister of Mines and Energy Tom Alweendo told lawmakers on Monday, according to Bloomberg.

"The proposed state ownership should take the form where the state owns a minimum equity percentage in all mining companies and petroleum production, for which it does not have to pay."

By 1:20pm AEST, Paladin Energy's share price was down 19.6% to 53.5 cents.

Crown Casino agrees to pay $450 million penalty for breaking the law

By David Chau

Crown Melbourne and Crown Perth (together Crown) has agreed to pay a $450 million fine for its breaches of anti-money laundering laws.

Crown and the financial crimes regulator AUSTRAC have filed submissions to the Federal Court, seeking approval for this settlement.

The hearing is scheduled for 10 - 11 July before Justice Michael Lee.

The court has discretion to decide whether that is an appropriate settlement given the severity of Crown's breaches of the law.

'OK until the ATO figures out the joke": PwC emails highlight confidentiality breaches

By David Chau

Consulting firm PwC is under fire once again with a string of emails revealing the depth of its confidentiality breaches (relating to changes to tax avoidance laws back in 2015).

During a Senate Estimates hearing this morning, Labor Senator Deborah O'Neill read out an email in relation to the leaked government information.

The email was sent by PwC's former head of international tax Peter-John Collins to a number of his colleagues):

“OK in practice until the ATO gets grumpy and figures out the joke.

“No need to share this because all supposed to be secret.”

At the hearing, Treasury Secretary Stephen Kennedy was asked for his response to that email from Mr Collins.

He said PwC's exploitation of a secret briefing is "clearly disturbing" and was a major factor in asking the Federal Police to consider a criminal investigation.

For more on this, here's the latest report from senior business correspondent Peter Ryan:

Residential building approvals slump to weakest level in 11 years

By Michael Janda

Figures out from the ABS highlight the crisis confronting the Australian residential construction sector.

Having already seen a raft of builders collapse during a "profitless boom", where surging costs and bad weather wiped out earnings from the construction surge sparked by the pandemic stimulus of HomeBuilder and ultra-low rates, now the industry is facing an historic bust.

April's building approvals data shows 11,594 homes were approved for construction last month — that was down 8.1% on the previous month and by almost a quarter (24.1%) on a year earlier.

That is the smallest number of new home approvals since April 2012.

Both detached houses and units and town houses suffered steep falls.

Approvals for standalone houses were down 3.8% month-on-month and 18.6% over the past year, while apartment approvals slumped 16.5% last month and 35.4% year-on-year.

Spending on renovations was also down month-on-month.

Given that HomeBuilder, by its design, brought forward a lot of building work that ordinarily would have happened over the next few years, it's not surprising that there's now a big hole in the residential development pipeline.

There is a silver lining for those construction firms and workers with skills transferrable to the non-residential sector.

The value of non-residential building work approved in April was $6.1 billion, and the trend for commercial and infrastructure work was at its highest level on record.

Market snapshot at 12:10pm AEST

By David Chau

-

ASX 200: flat at 7,215 points (live values below)

- Australian dollar: +0.2% at 65.5 US cents

- Nikkei: -0.4% at 31,101 points

- Hang Seng: +0.2% at 18,591

- Shanghai Composite: +0.2% at 3,227

- Wall Street and FTSE closed for public holiday

- STOXX Europe 600 : -0.1.% to 461 points

- Spot gold: +0.1% to $US1,945/ounce

- Brent crude: +0.4% to $US77.40/barrel

- Iron ore: +2.7% to $US103.25 / tonne

- Bitcoin: +0.3% at $US27,765

Live updates on the major ASX indices:

Dr Kennedy dismisses Chris Richardson's argument about energy price caps

By Gareth Hutchens

Dr Kennedy is asked about the opinion of economist Chris Richardson that the federal government's price caps for energy will not lower inflation, but will simply rearrange inflation in the economy and cost money to do so.

Dr Kennedy said he didn't agree with that assessment.

Is there a risk of stagflation?

By Gareth Hutchens

Nationals Senator Matt Canavan asks Dr Kennedy if there's a risk of stagflation in coming years.

"I think the risk of stagflation is low," Dr Kennedy replied.

"Stagflation, I think, would be likely to arise with the emergence of a wage-price spiral ... [or] persistent stickiness with a supply shock."

Dr Kennedy said Treasury officials hadn't tried to replicate (in a modelling exercise) the likelihood of the emergence of 1970s style stagflation, because the economic institutions in Australia were so different today.

Challenges from artificial intelligence? 'At age 78, that's your problem', says Hayne

By Michael Janda

Former High Court justice and banking royal commissioner Kenneth Hayne has not lost his dry sense of humour.

Speaking on a panel at the International Congress of Actuaries, Mr Hayne was asked whether the recent advances in artificial intelligence since his royal commission report would have changed his findings or recommendations.

"We have to be aware of the fact that change is upon us and that the rate of change is increasing exponentially," he said.

"What response we should make? Can I say, at age 78, that's your problem."

Greens senator Barbara Pocock lashes the consulting industry

By Gareth Hutchens

Dr Kennedy says this PwC situation is clearly drawing attention to the role of the big consulting firms in Australia's economy (and society).

But he's urging people not to jump the gun.

He says the consulting industry has many experts working in it, and it would make no sense for Treasury not to draw "from this large expert community."

He says is their evidence that the consulting industry has "systematically failed us on an ongoing basis?"

"No," he says, but adds that the PwC controversy is clearly bad.

However, Greens senator Barbara Pocock (South Australia) says the Australian people are absolutely sick of the behaviour of consulting agencies.

She holds up print-outs of internal emails from the agencies, and says it's clear from the way their staff talk to each other that they have contempt of Treasury officials and officials from the Australian Taxation Office.

She says it's obvious that consulting agencies are interested in "harvesting" as much information as possible from the ATO and Treasury so they can use it to their personal advantage to make profits, and to help other companies avoid tax.

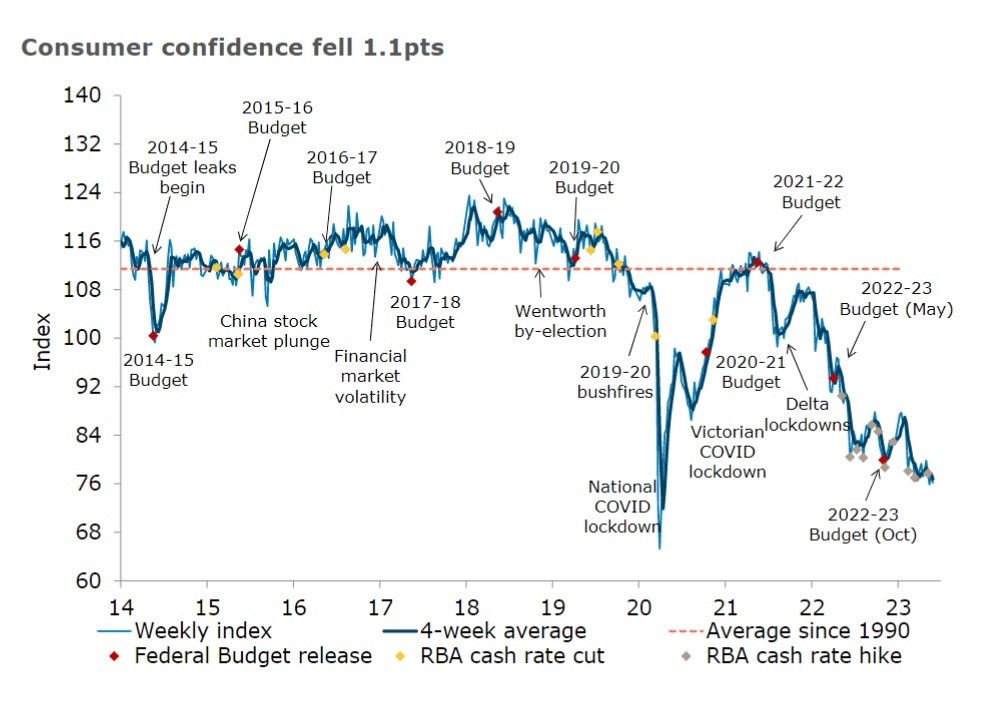

Consumer confidence slumps to weakest level since 1990

By David Chau

Cost-of-living pressures and aggressive interest rate hikes have led to consumer confidence sinking to its lowest level in at least 33 years.

That's according to ANZ and Roy Morgan's weekly report tracking consumer behaviour.

Their measure of confidence fell to 76.8 points in May, its weakest monthly average since December 1990.

A result below 100 points means the pessimists outweigh the optimists.

"The weekly result (76.2 points) was the fifth worst since January 2020 and represented the 13th consecutive week below 80 (points)," said ANZ senior economist Adelaide Timbrell.

"Those paying off their homes still have far lower average confidence than renters and outright owners, despite housing prices lifting since mid-February."

PwC are the internal auditors of Treasury

By Gareth Hutchens

Greens Treasury spokesman Nick McKim is asking Dr Kennedy about PwC.

Kennedy says PwC has the contract to be the internal auditor of Treasury, and that contract ends later this year.

Senator McKim wants to know how PwC can possibly be responsible for auditing the good governance of Treasury, given the current controversy over its own governance.

"We've had no cause for concern across the delivery of that contract," Dr Kennedy said.

However, Dr Kennedy added that Senator McKim's point was "well made and understood."

Gold miners shine as ASX trades flat

By David Chau

There's no clear direction for the Australian share market this morning, given the much larger US and British stock markets were closed for public holidays.

The ASX 200 index was up 0.1% to 7,222 points, by 10:40am AEST. with the materials sector posting the largest gains.

Several of today's best performers are gold miners like Silver Lake Resources (+1.6%),Gold Road Resources (+1.6%) andNorthern Star Resources(+1.2%).

On the flip side, some of today's worst-performing stocks include Sayona Mining (-11.9%), Paladin Energy and Imugene (-4.6%).

Is the government's budget inflationary?

By Gareth Hutchens

Opposition senators have a long list of questions for Dr Kennedy about the Albanese Government's budget, specifically regarding the likelihood (or otherwise) that the budget is inflationary.

Dr Kennedy has batted those questions away.

"We don't believe the budget as a whole is inflationary, adding to inflationary pressures," he said at one point.

He's also reminded senators that, given the rapid increase in interest rates and the coming slowdown in global growth, there are clear risks that current inflation forecasts will be too high.

He said there were risks that Australia's economy could slow by more than expected, and inflation could fall by more than people think.

Speaking of royal commissions … Kenneth Hayne speaks to actuaries

By Michael Janda

We're in the middle of the International Congress of Actuaries, being held in Sydney this week — good timing, with the Vivid festival of lights underway to brighten up what some might view as a grey event.

One of today's keynote speakers was Kenneth Hayne, the former High Court justice who presided over the banking and financial services royal commission of 2018.

Mr Hayne spent a great deal of his keynote address focused on the issue of remuneration and its connection to misconduct.

"Income, profit and sales can all be measured and monitored, but compliance with the law and ethics cannot be measured in the same ways," he observed.

"If an individual is remunerated according to income or profit generated, or sales made, the individual's pursuit of higher remuneration may swamp other relevant considerations including considerations of compliance with the law and compliance with basic standards of probity."

Mr Hayne same back to the topic later in his address.

"Remuneration and incentives tell employees what an entity values. Remuneration both affects and reflects culture."

They say he who pays the piper calls the tune, but it's also true that how he pays them affects the way in which they play.

Market snapshot at 10:15am AEST

By David Chau

-

ASX 200: flat at 7,215 points

- Australian dollar: flat at 65.4 US cents

- Wall Street and FTSE closed for public holiday

- STOXX Europe 600 : -0.1.% to 461 points

- Spot gold: -0.2% to $US1,943/ounce

- Brent crude: -0.1% to $US77/barrel

- Iron ore: +2.7% to $US103.25 / tonne

- Bitcoin: +0.2% at $US27,754

Live updates on the major ASX indices:

ABC/Reuters