Despite surpassing Wall Street expectations in its third-quarter results, Advanced Micro Devices Inc. (NASDAQ:AMD) saw its shares tumble as Futurum Group CEO Daniel Newman said that investors were looking for stronger signals of accelerating AI and datacenter momentum.

Newman Says Market Expected More AI Growth

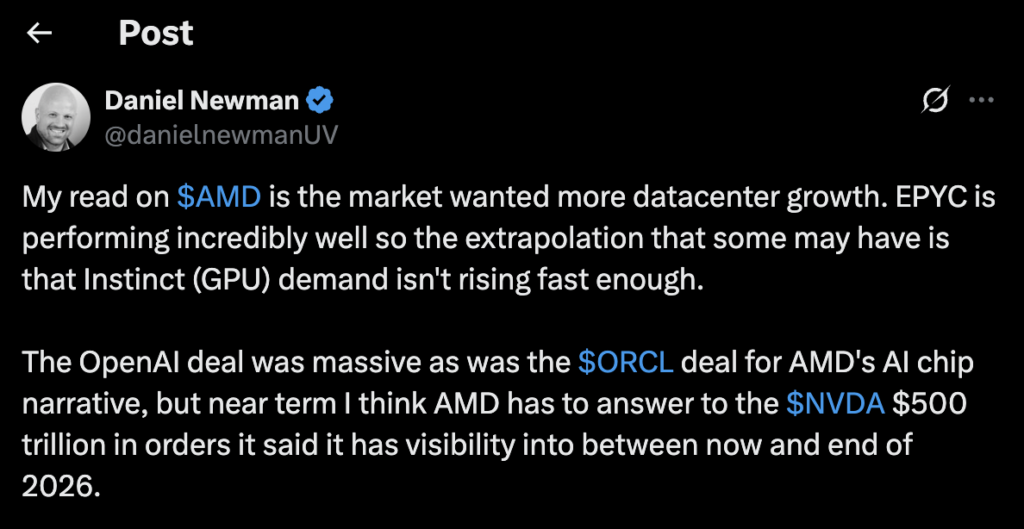

Following AMD's third-quarter earnings release on Tuesday, Newman took to X, formerly Twitter, to share his take on the market's reaction.

"My read on AMD is that the market wanted more datacenter growth," Newman said, noting that while AMD's Extreme Performance Yield Computing processors are performing exceptionally well, investors appear to be concerned that demand for its Instinct AI GPUs is not ramping up fast enough.

He added that AMD's AI-related partnerships — including major deals with OpenAI and Oracle Corp (NYSE:ORCL) — have strengthened the company's AI narrative, but near-term performance is being judged against Nvidia Corp.'s (NASDAQ:NVDA) dominance.

"The OpenAI deal was massive, as was the Oracle deal for AMD's AI chip narrative," he said. "But near term, AMD has to answer to the $500 billion in orders Nvidia says it has visibility into between now and the end of 2026."

Newman later pointed out that overall market conditions played a role in the post-earnings selloff, writing, "Worth noting: nothing really rose today on earnings good or bad. Just a down day."

AMD Beats Expectations But Stock Falls

AMD reported third-quarter revenue of $9.25 billion, topping analyst expectations of $8.74 billion, with adjusted earnings of $1.20 per share, slightly above the $1.16 consensus estimate.

Total revenue rose 36% year-over-year, driven by a record $4.3 billion in Data Center segment revenue, up 22% from last year.

During the earnings call, CEO Lisa Su credited strong demand for 5th Gen EPYC Turin processors and the growing ramp of Instinct MI350 GPUs for the solid performance.

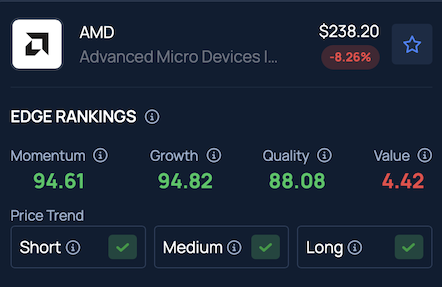

However, despite the beat, AMD shares closed down 3.7% at $250.05 and fell another 4.7% to $238.20 in after-hours trading, according to Benzinga Pro.

AI Focus Deepens Ahead Of MI400 Launch, Says Lisa Su

Su said AMD's AI business is entering "its next phase of growth," with momentum building ahead of the launch of its next-generation MI400 Series accelerators and Helios rack-scale platform in 2026.

Benzinga's Edge Stock Rankings show that AMD scores strongly for Momentum, Growth and Quality, maintaining a positive price trend across short, medium and long-term periods. Click here for a detailed look at how it stacks up against peers and competitors.

Read More:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: Poetra.RH on Shutterstock.com