/Pool%20Corporation%20site%20magnified-by%20Casimiro%20PT%20via%20Shutterstock.jpg)

I honestly can’t remember the last time both the NYSE and Nasdaq had more new 52-week lows than 52-week highs. It’s been weeks, probably months.

Yesterday, the NYSE had 40 new 52-week highs compared to 101 52-week lows, while over on the Nasdaq, the numbers were even worse, with 73 new 52-week highs compared to 297 52-week lows.

It’s incredible how a single day’s correction can alter these numbers. Thanks to red across the board yesterday -- Dow Jones Industrial Average down 0.53%, S&P 500 (-1.17%), Nasdaq (-2.04%) and Russell 2000 (-1.78%) -- there are a heck of a lot more opportunities for value investors searching for that needle in a haystack.

What will happen today after yesterday’s election results? The futures are down as I write this, about an hour to the opening bell.

To make sure I provide something from both stock exchanges, I’ll pick at least one stock hitting a new 52-week low from each.

Whirlpool (WHR)

First up is Whirlpool (WHR). The NYSE-listed stock hit its 20th new 52-week low of the past 12 months at $69.01. That’s not only a 52-week low, it’s also a 2-year, 3-year, and 5-year new low.

As a result, WHR stock is down 65% over the past year. It’s been a gradual decline from a May 1, 2021, all-time high of $257.68.

Despite the value destruction, the opportunity to buy low and sell high in the future suggests that risk-tolerant investors consider the down-and-out appliance maker.

I selected Whirlpool, in part, because my wife and I just bought a KitchenAid kettle to replace the one that burnt up after a kitchen snafu during a cocktail party over the weekend. Don’t ask.

I’ve forgotten about Whirlpool in recent years. The stock and business always seemed to be struggling, so I moved on to more fertile territory. Add in current tariff concerns, and it’s made it tough to get behind the iconic American brand.

However, the Michigan-based company recently released its Q3 2025 results; they weren’t half bad.

For example, sales were up 1% year-over-year to $4.03 billion, while non-GAAP EBIT (earnings before interest and taxes) were $180 million, or $2.09 a share, down 22.7% from $233 million in Q3 2024.

Forget the nearly 23% decline in EBIT for a moment and consider the company’s guidance for 2025. It expects sales of $15.8 billion, flat with last year, with earnings of $7.00 a share. Its shares trade at 9.9 times its 2025 estimate. That’s not ridiculously cheap, but it’s not expensive either.

The conference call after earnings revealed some positives moving into 2026.

For starters, KitchenAid’s market share hit historical highs in the third quarter with healthy profit margins to boot. Secondly, CEO Marc Blitzer told analysts that any promotional activities driven by tariffs and other factors would return to pre-COVID levels, pushing gross and operating margins higher in 2026. Lastly, new product launches in 2025 should lead to sales growth next year.

In 2019, Whirlpool’s free cash flow was $698 million, according to S&P Global Market Intelligence. In 2025, it should be $200 million, and it is likely to be considerably higher in 2026.

In mid-October, it said it would invest $300 million in two of its Ohio laundry manufacturing facilities, including its Clyde plant, which is the largest of its kind in the world. Its focus on increasing its U.S. manufacturing (already very high) should pay off in the future.

I wouldn’t buy WHR stock based on today’s financials, but what should come in 2026 and beyond.

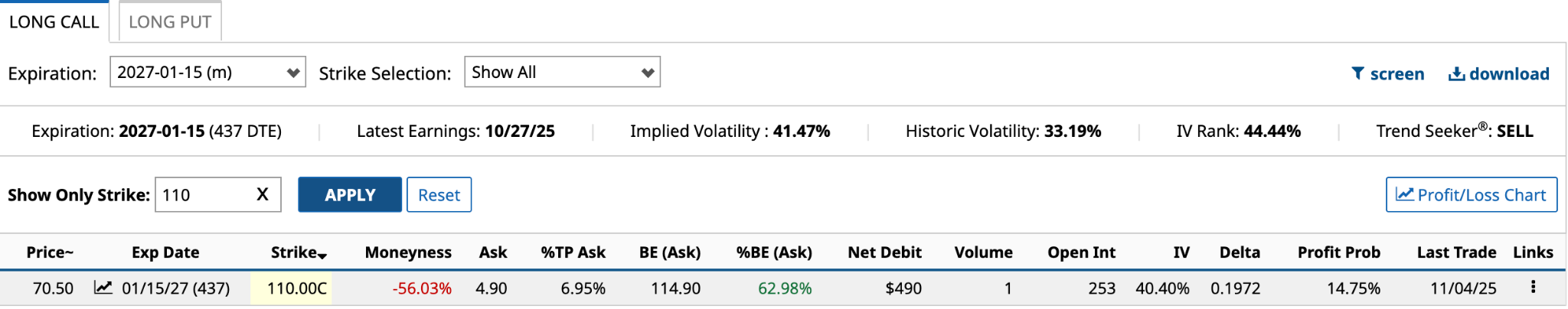

Here’s a possible long call to reduce your initial outlay.

Pool Corp. (POOL)

Pool Corp. (POOL) is a Nasdaq-listed stock. It hit its 25th new 52-week low of the past 12 months at $254.83. That’s not only a 52-week low, it’s also a 2-year, 3-year, and 5-year new low.

Pool is the world’s largest wholesale distributor of swimming pool supplies. It has over 450 sales centers across North America, Europe, and Australia.

I have followed this company for years. From its March 1, 2009, 20-year low of $11.18, to its all-time high of $582.27, its shares generated a CAGR (compound annual growth rate) of 27.1%. Who wouldn’t want in on that action?

I’ve always believed that the company’s business was somewhat recession-proof because no matter how broke you are, you are still going to keep your pool clean. Two reasons come to mind: First, if you want to sell your home and you have a pool, you have to keep it clean to avoid turning off potential buyers. Secondly, if you are broke and own a pool, you won’t be going out much, so the pool becomes your oasis.

I’m being somewhat facetious about those two reasons. At the end of the day, all companies go through downturns. Pool is no different.

For Pool, COVID-19 was a blessing and a curse. The former because its sales nearly doubled from $3.2 billion in 2019 to $6.18 billion in 2022 as people sought outdoor refuge during the pandemic. The latter because it built up investor expectations to unreasonable levels. In the 33 months since, it’s given back $885 million in annual sales.

So, where’s it at now?

Just 17 analysts cover POOL stock, with only four rating it a Buy (24%) and a median target price of $333, 31% above its current share price.

According to S&P Global Market Intelligence, the analyst's earnings per share estimate is $10.85 in 2025, rising to $11.58 in 2026, $12.64 in 2027, and $13.28 in 2028. It currently trades at 19.2 times the 2028 estimate.

That might seem high. However, over the past decade, it’s relatively low by historical standards.

Source: S&P Global Market Intelligence

In the trailing 12 months ended Sept. 30, Pool’s operating cash flow was $456.3 million, with $394.7 million in free cash flow after accounting for $61.6 million in capital expenditures. Based on its enterprise value of $10.87 billion, its free cash flow yield is 3.6%. Anything between 4% and 8% is in fair value territory; neither overpriced nor underpriced.

I’m looking for a catalyst that may accelerate its sales and cash flow. Berkshire Hathaway (BRK.B) could be the ticket. Warren Buffett’s holding company first bought 404,057 shares of Pool in Q3 2024. It added to its holdings in Q4 2024 (194,632), Q1 2025 (865,311), and Q2 2025 (1,994,885). It reports Q3 2025 holdings in mid-November.

According to Berkshire’s Q3 2025 earnings report, its net stock sales in the quarter were $6.1 billion. It’s possible that Buffett chose to trim his stake in Pool. However, the average price paid for its $1 billion stake in Pool is an estimated $325.71, according to WhaleWisdom.com. Owning the shares for just five quarters, I doubt it would be a big sale.

To be safe, I wouldn’t consider buying POOL stock until after Berkshire reports its Q3 2025 13F. I’d suggest an options play, but the stock has limited volume.