A remarkable dichotomy is unfolding at the moment.

On the one hand, earnings season is delivering the best corporate results in four years. On the other hand, the hottest stocks are unprofitable.

Where does that leave Warner Bros Discovery (WBD), the media conglomerate run by CEO David Zaslav, in one form or another, since January 2007?

I’ve spoken on several occasions of my distaste for the man’s cumulative compensation as CEO of the current company and its predecessors. He’s been paid way too much for far too long.

Now eager to solidify his legacy as a media bigwig, he’s looking to deliver a financial payday for long-suffering shareholders.

I don’t think there’s any doubt that someone will buy the company — Paramount Skydance, Comcast, Netflix, Amazon, and Apple are just a few potential suitors —which explains why the stock is up 94% in 2025.

It also explains why both its share and options volume these days are considerably higher than historical norms.

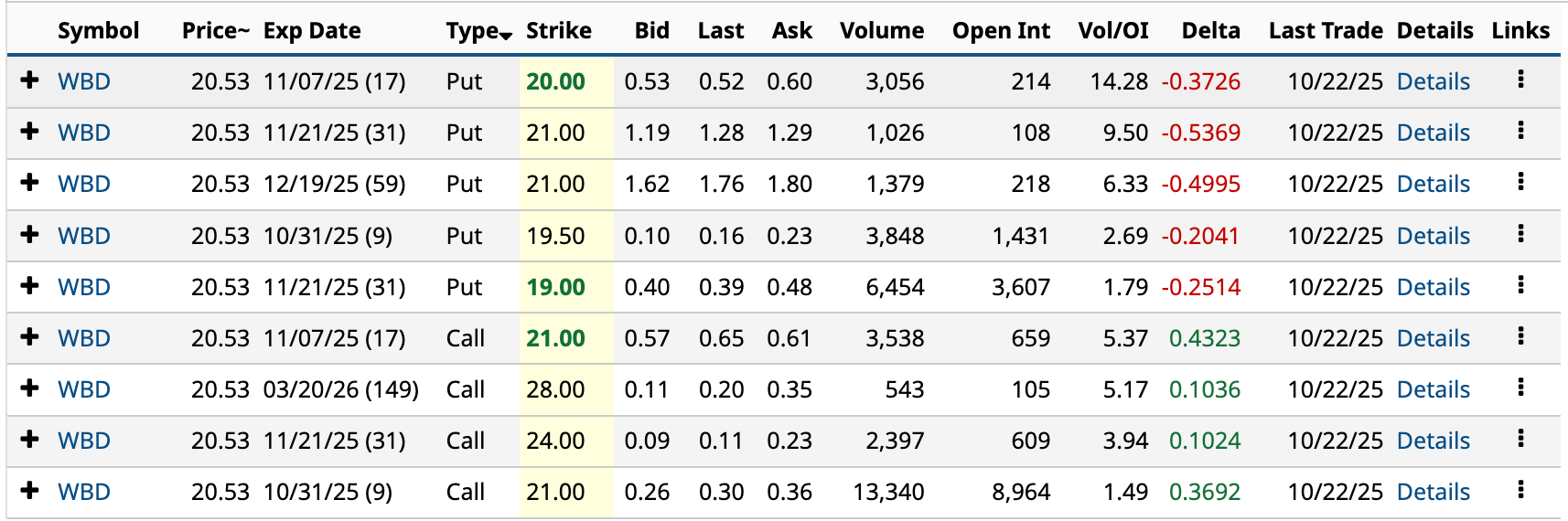

On Wednesday, WBD’s share volume was 52.23 million, nearly 20 million higher than its 30-day average. Meanwhile, its options volume was 219,639, nearly double its 30-day average, and the seventh-highest so far in 2025—all seven in September or October.

Investors can sense there’s blood in the water. The sharks are circling. It’s only a matter of time.

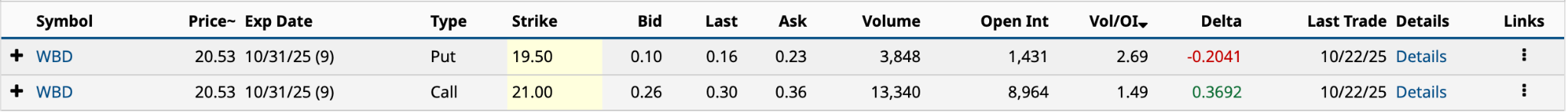

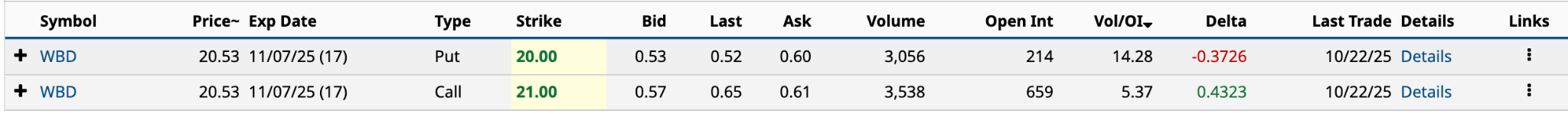

Also, yesterday, there were nine unusually active options, with Vol/OI (volume-to-open-interest) ratios ranging from a low of 1.49 to a 14.28 high.

The unusual options activity provides investors with several profitable opportunities. Here are three bullish ones that I see.

WBD Bullish Strategy # 1

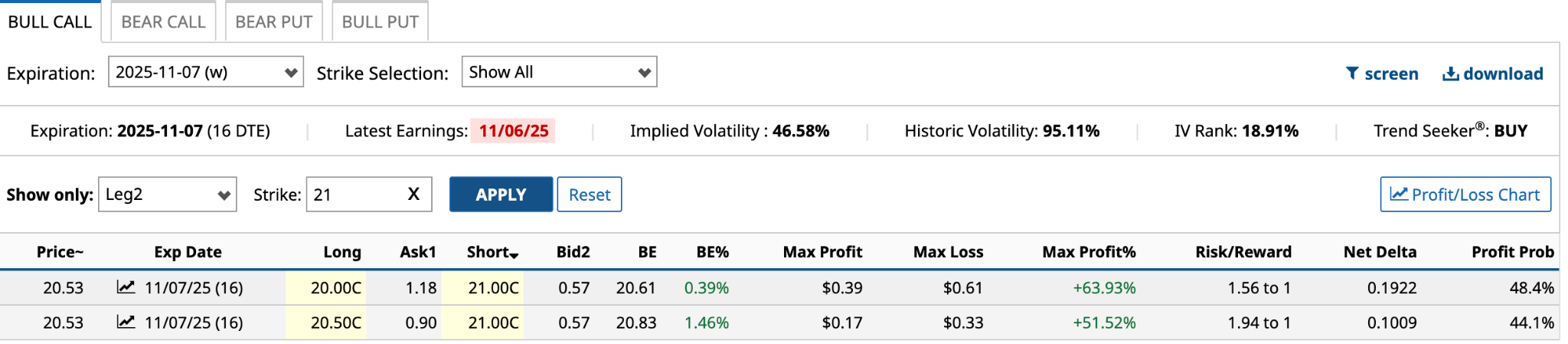

The first possible strategy is a Bull Call Spread.

This strategy involves one long call and one short call at a higher strike price. Both have the same expiration. For maximum profit, you want the share price at expiration above the higher strike price.

Looking at the four calls from yesterday, the only one I wouldn’t consider is the March 20/2026 $28 strike price. The 149 DTE (days to expiration) is too long for my taste. Generally, keeping the DTE 60 or less makes sense.

I’ve taken a look at the bear call spread possibilities from the four calls. I’m focusing on profit probabilities above 40% while minimizing the outlay, maximum loss, and risk/reward ratio.

The Nov. 7 $21 call looks good.

In this situation, I’ve got two possibilities to go along with the short $21 call: the $20 and $20.50 calls. Either one is good. At a maximum loss of $61, the long $20 call won’t cost you as much as you’ll pay for the concessions at an upcoming World Series game, and your profit probability is 430 basis points higher.

WBD Bullish Strategy # 2

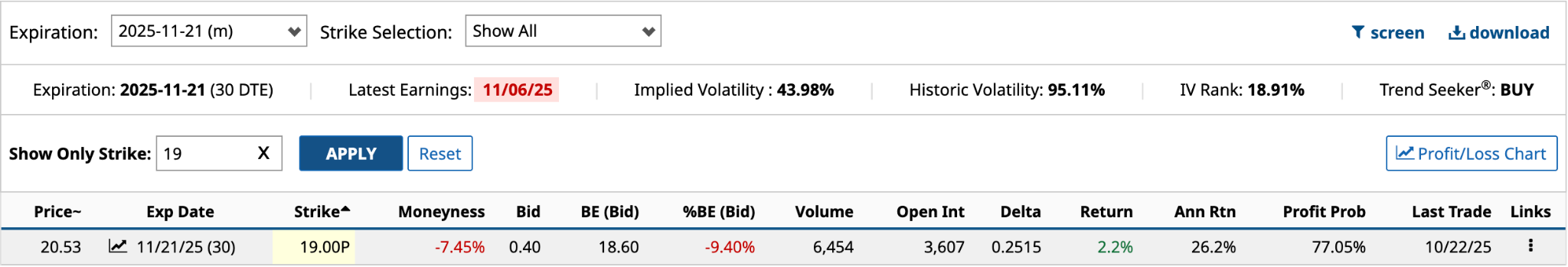

The second possible strategy is a cash-secured put.

The strategy involves selling a put OTM (out of the money) for income, while setting aside the cash to buy shares if the buyer assigns them to you. However, that shouldn’t be a problem if you’re bullish on its stock price over the next 6-12 months.

There were five unusually active puts yesterday. If you want income and want the puts to expire worthless, you’d sell them with OTM strike prices. On the other hand, if you are looking to acquire more WBD shares, puts that are ATM (at the money) or slightly ITM (in the money) make sense.

So, for income, consider the $20, $19.50, and $19 puts. Of the three, the Nov. 21 $19 put has the highest probability of profit at 77.05%. The annualized return of 26.2% is more than adequate. Worst-case scenario, you’re forced to buy WBD stock at $18.60. The Barchart Technical Opinion is a Strong Buy, suggesting this won’t happen.

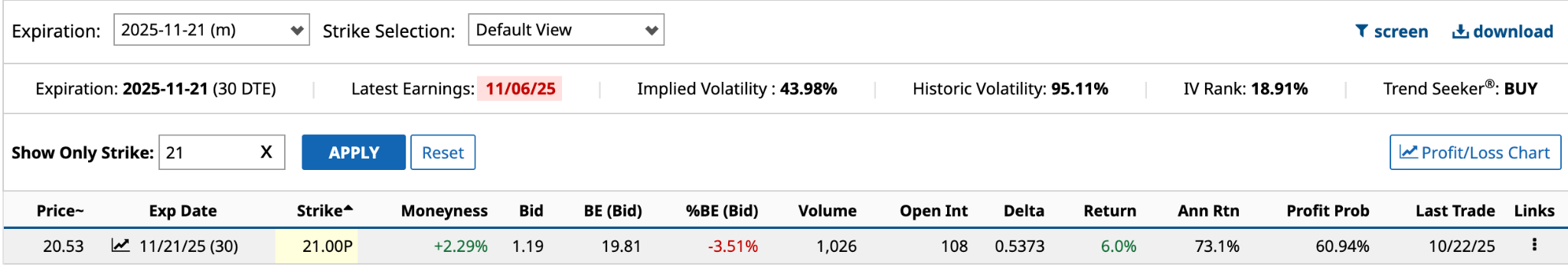

For stock acquisition, go for one of the $21 strikes. If you’re really bullish and think earnings on Nov. 6 will be positive, or a bona fide offer will surface, the Nov. 21 $21 put generates an annualized return of 73.1% with a breakeven of $19.81

The Dec. 19 $21 put has a profit probability 91 basis points higher at 61.85%, an annualized return of 52.6%, and a breakeven of $19.38. If you’re not quite as bullish and don’t want to take on another 100 shares, this put provides a little room for error.

WBD Bullish Strategy # 3

The third and final strategy is a Risk Reversal.

This third strategy involves combining a short put with a long call to create a synthetic long position on a stock you don’t own. Conversely, it can be the opposite when you’re bearish, where you combine a long put and a short call. When you already own the stock, this would be considered a Protective Collar, which combines a Covered Call with a long put.

Both risk-reversal strategies are used to reduce the cost of the option premium while benefiting from the stock’s price movement. Both options have the same expiration date and should be OTM.

Since we’re considering bullish strategies, we’ll go with a short put and a long call. The expiration dates of Oct. 31, Nov. 7, and Nov. 21 all fit the bill.

Based on yesterday’s trading, the Oct. 31 combination would cost $26 [$0.36 ask price for $21 call - $0.10 bid price for $19.50 put]. The Nov. 7 would cost $8 [$0.61 ask price for $21 call - $0.53 bid price for $20 put] and the Nov. 21 combination -- ignore the $21 put because it’s ITM -- would be a net credit of $17 [$0.40 bid price of $19 put - $0.23 ask price for $24 call].

Naturally, you’ll gravitate to the Nov. 21 combo because of the net credit as opposed to a net debit for the other two. However, you’re betting on a big swing higher. The profit probability for the $24 call is under 10% — so unlikely to be higher than $23.83 at expiration [$24 strike price - $0.17 net credit]. Meanwhile, the profit probability of the $19 put -- the likelihood that the share price at expiration will be below the downside breakeven price of $18.83 [$19 strike price - net credit] -- is over 81%.

If you’re bullish, your choice narrows to the first two combinations. The Nov. 7 $21 call has a profit probability of 35.81% and the $20 put’s profit probability is 74.98%. The Oct. 31 $21 call has a 33.97% profit probability, while the $19.50 put’s profit probability would be around 86%.

If you’re bullish, I think you have to go with the Nov. 7 combination. It costs less and has the best chance of reaching the breakeven price of $20.92 [$21 strike price - $0.08 net debit].