Meta Platforms Inc. (NASDAQ:META) CEO Mark Zuckerberg has acknowledged the possibility of an AI-driven market bubble, comparing today's frenzy to the dot-com era, but said failing to invest aggressively would be an even bigger mistake.

Zuckerberg Acknowledges Bubble Risk

Speaking on the Access podcast that was posted on Friday, Zuckerberg said the rapid pace of artificial intelligence spending could spark a market correction.

"There's definitely a possibility, at least empirically, based on past large infrastructure buildouts and how they led to bubbles, that something like that would happen here," he said.

He drew parallels to railroads and the dot-com bubble, which saw overbuilding and debt-fueled growth lead to crashes.

Despite these risks, Zuckerberg argued the AI buildout could be an exception if demand for more capable models continues to grow each year.

"And if the models keep on growing in capability year-over-year and demand keeps growing, then maybe there is no collapse," he added.

Over-Investing Better Than Falling Behind: Zuckerberg

Zuckerberg said that even if overspending happens, the cost of underinvestment is far worse.

"If we end up misspending a couple hundred billion dollars, that's going to be very unfortunate. But I would say the risk is higher on the other side."

He added, "If you build too slowly, and superintelligence is possible in three years but you built it out assuming it would be there in five years, then you're out of position on what I think is going to be the most important technology," he explained.

Meta has committed at least $600 billion through 2028 for U.S. data centers and AI infrastructure, while also launching a superintelligence lab to recruit top researchers.

Altman And Taylor Also Sound Caution

Zuckerberg's comments echo those of OpenAI CEO Sam Altman, who has previously said AI is in a bubble fueled by hype and cash chasing inflated valuations.

"When bubbles happen, smart people get overexcited about a kernel of truth," Altman said in August.

OpenAI chairman Bret Taylor also compared today's surge to the dot-com boom. While many companies failed then, he noted Amazon.com, Inc. (NASDAQ:AMZN) and Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) emerged stronger, showing that bubbles can still produce transformative winners.

Wall Street Split On AI Outlook

Bank of America strategist Michael Hartnett has flagged bubble signals, citing the S&P 500's price-to-book ratio surpassing levels from 2000. He warned investors, saying, "It better be different this time."

Meanwhile, Wedbush Securities analyst Dan Ives disagreed, calling the current cycle the "fourth industrial revolution."

Following Altman's comments, Ives said AI demand is only growing and argued, "We are only in the second inning of the game."

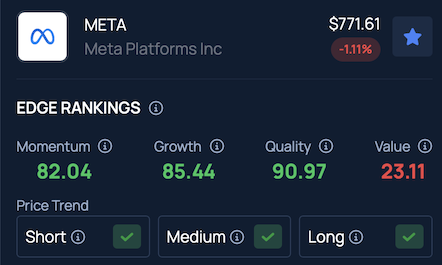

Benzinga's Edge Stock Rankings indicate that META is trending upward in the short, medium and long term, with additional performance details available here.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock