U.S. tech giants Mark Zuckerberg-led Meta Platforms, Inc. (NASDAQ:META), Elon Musk's X, formerly Twitter and Microsoft Corporation's (NASDAQ:MSFT) LinkedIn are reportedly fighting back against a tax case in Italy that could reshape how digital services are taxed across the European Union.

What Happened: Meta, X and LinkedIn have filed an appeal against a landmark value-added taxes demand issued by Italian authorities, reported Reuters on Monday, citing four sources with direct knowledge of the matter.

Italian authorities argue that free access to social media platforms in exchange for users’ personal data constitutes a taxable transaction under VAT laws. This marks the first time Italy has moved beyond settlement talks with tech companies and into formal litigation.

Italy is seeking €887.6 million ($1.03 billion) from Meta, €12.5 million from X and about €140 million from LinkedIn.

See Also: Meta Commits ‘Hundreds Of Billions’ To Build Massive AI Clusters In Race For Superintelligence

Meta pushed back, telling the publication it has "cooperated fully with the authorities" but "strongly disagrees with the idea that providing access to online platforms to users should be subject to VAT." LinkedIn said it had "nothing to share at this time."

Why It's Important: The case could impact a wide range of businesses beyond social media—from airlines to supermarkets—that offer free services in exchange for data or cookie consent, the report said.

Italy plans to seek advisory guidance from the European Commission's VAT Committee in November, with a formal opinion expected by spring 2026.

If Italy's interpretation is upheld, the legal precedent could transform how digital services are taxed throughout the 27-nation EU.

The case has gained added significance amid broader trade tensions between the EU and the U.S. under President Donald Trump’s administration.

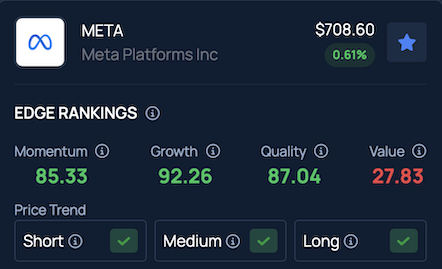

According to Benzinga’s Edge Stock Rankings, META demonstrates consistent upward momentum over short, medium and long-term periods. While the company’s growth indicators are strong, its value rating is relatively lower. Additional performance details can be found here.

Read Next:

Photo Courtesy: Viktollio on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.