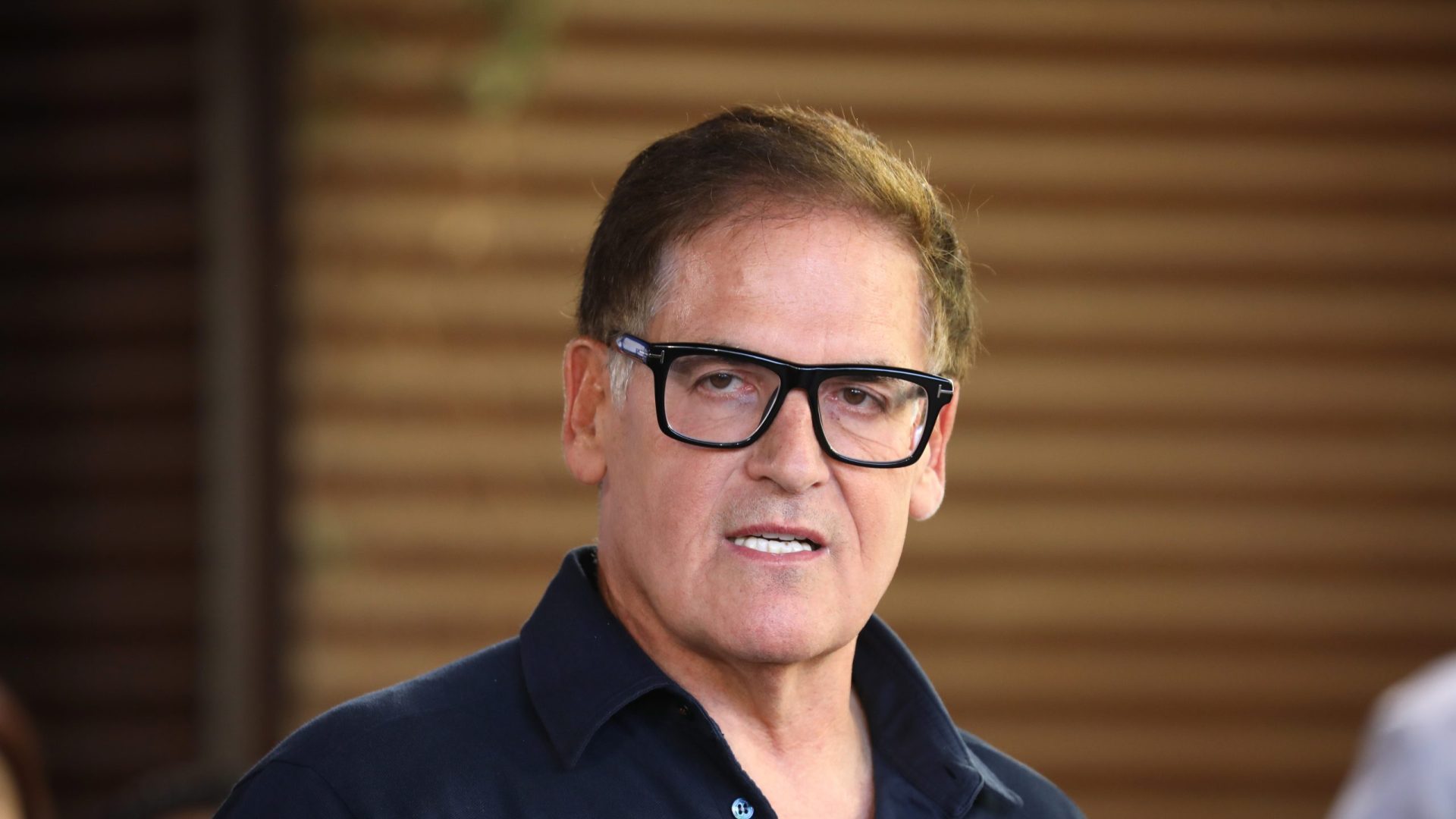

If you regularly tune in to the blogs, podcasts and videos of popular personal finance influencers, you’ll hear a lot of advice that they all seem to agree upon. One area of overlap is that you should invest a certain portion of your income. While this is solid financial advice, some finance experts, like entrepreneur Mark Cuban, think a large portion of your portfolio should be in cash.

Be Aware: Key Signs Your Credit Card Is Quietly Wrecking Your Finances

For You: Here's the Minimum Salary Required To Be Considered Upper Class in 2025

Here are some of the reasons for keeping cash on hand.

Financial Opportunities

When it comes to investing, few can match the accomplishments of Berkshire Hathaway CEO Warren Buffett. Over the years, Buffett has made a name for himself as a top investor who preaches patience and holding for the long term. However, Buffett doesn’t just invest; he also holds a lot of cash.

Toward the end of 2024, Berkshire Hathaway’s cash reserves reached $325 billion, doubling the amount of cash it had at the end of 2023. Having cash on hand gives Buffett the upper hand in terms of flexibility. When a stock’s price dips and he determines it’s undervalued, other companies might not have the liquidity to buy it up on the spot. However, Buffett’s cash reserve allows him to jump at the chance and maximize his profits.

Not everyone runs a multinational conglomerate like Berkshire Hathaway, but holding cash can still give you the chance to take advantage of opportunities that may later arise. Whether it’s an undervalued stock, a property or a rare watch, if you have enough cash on hand, you won’t need to rush to sell any other investments to acquire it.

On the Flipside: Fidelity Says This Is a Surprising Risk of Holding Too Much Cash — Do You Have Too Much?

Market Volatility

Buying low and selling high may be the most common investing advice out there. However, market volatility isn’t always great. Cuban, a successful entrepreneur, investor and TV personality, always keeps a large portion of his portfolio in cash because, whether it be political unpredictability, a global event or a new innovation, he isn’t a fan of losing money and doesn’t want to take big risks.

On Jan. 27, 2025, Nvidia’s stock dropped 17%, dropping its market cap by almost $600 billion — the largest plunge for a U.S. company in history. While the company quickly rebounded, Cuban didn’t feel right about buying in as he thought there was still too much uncertainty. Other market-shaking events, such as President Donald Trump’s tariff announcements, have also kept Cuban from investing. By keeping his money in cash, he’s been unaffected by the market swings and can stay confident about preserving his wealth.

Emergencies

There are also reasons to keep a lump sum of cash available that don’t involve investing, such as building up an emergency fund.

Rachel Cruze, a personal finance expert and co-host of the popular “Ramsey Show,” is a big proponent of saving enough to cover three to six months’ worth of expenses in case something terrible happens. If you get laid off, face a medical emergency or have your car break down, you’ll be happy you built up that emergency fund.

More From GOBankingRates

- 5 Old Navy Items Retirees Need To Buy Ahead of Winter

- I Paid Off $40,000 in 7 Months Doing These 5 Things

- Warren Buffett: 10 Things Poor People Waste Money On

- Mark Cuban Tells Americans To Stock Up on Consumables as Trump's Tariffs Hit -- Here's What To Buy

This article originally appeared on GOBankingRates.com: Mark Cuban Says He Keeps a Large Part of His Portfolio in Cash — Here’s Why