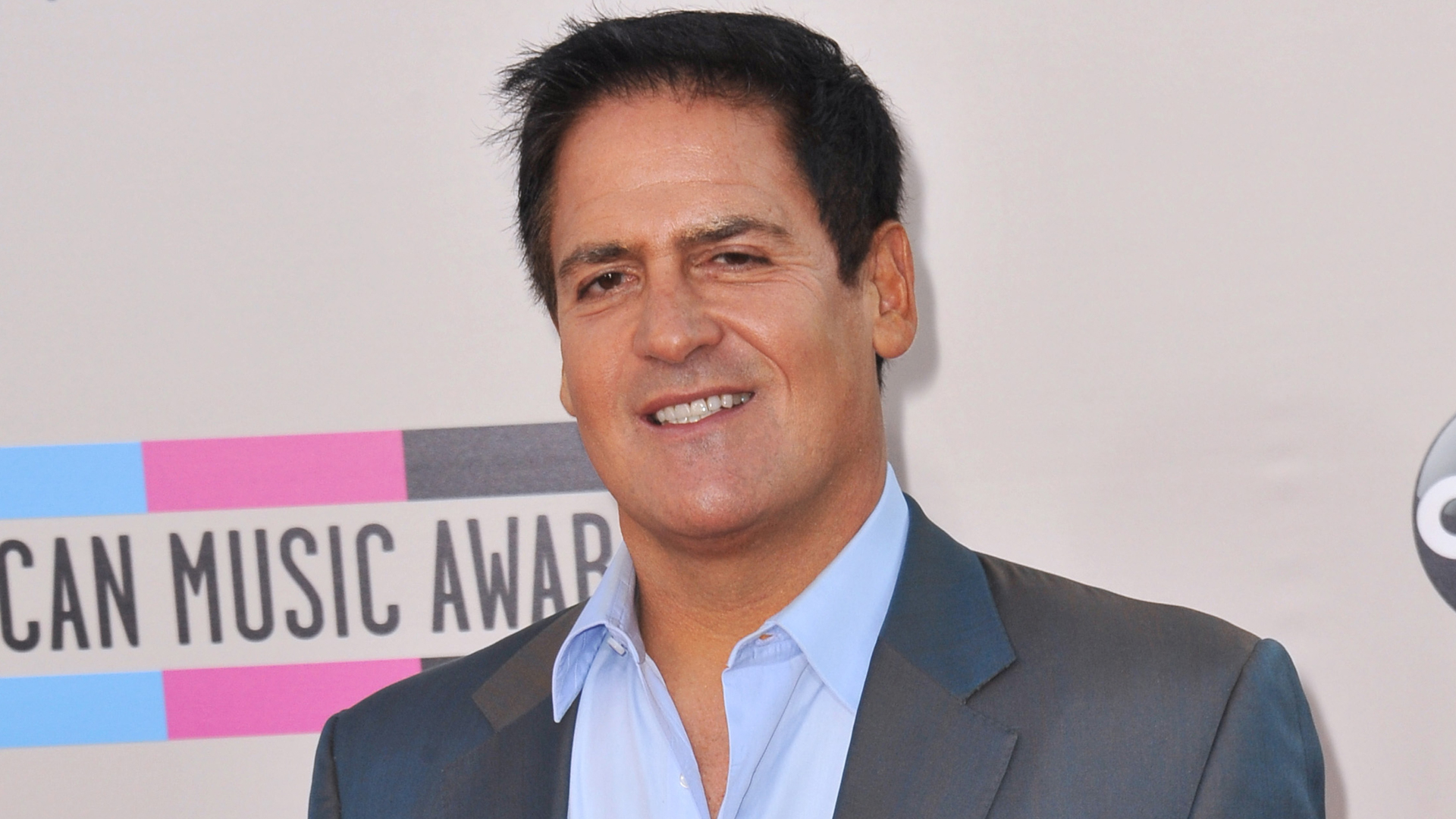

Mark Cuban hasn’t been afraid to share his thoughts on business and investing, even if he has ruffled some feathers along the way. Some of his investment takes are pretty basic and politically correct. Avoid debt, learn constantly, be patient and only invest in what you understand.

That’s pretty straightforward, but Cuban hasn’t always given investing tips that everyone agrees with. The billionaire entrepreneur stirred up controversy in a 2011 Wall Street Journal interview by saying that “diversification is for idiots.”

For You: Mark Cuban Reveals His Formula for Side Hustle Success

Read This: 10 Used Cars That Will Last Longer Than the Average New Vehicle

Cuban’s hottest take got a lot of pushback in the comments. One person mentioned that Cuban made this bold claim despite having options, master limited partnerships (MLPs), Government National Mortgage Association bonds (GNMAs), cash, real estate, a basketball team, stocks and small businesses. There is some logic to what Cuban suggested, but it’s not a one-size-fits-all model — find out below if he’s right.

You Can Make More Money With a Single Stock

Every few years, there is one stock that captures headlines and makes people wish they had bought it earlier. Palantir is that stock right now. It has more than doubled year-to-date and has surged by more than 1,500% over the past five years. Tesla was that stock in 2021, while Nvidia showed up in those types of headlines often as artificial intelligence (AI) became a bigger deal.

Investing in one of those stocks at the right time would have produced much higher gains than just putting your money into an index fund. Not every investor has the conviction to put most of their capital into a single stock. You have to be smart enough to see that type of opportunity, but you also need a high-risk profile to go all-in or mostly all-in on a single stock.

Check Out: Mark Cuban: Trump’s Tariffs Will Affect This Class of People the Most

Some investors prioritize a single sector or industry that they know like the back of their hand. You have to be very smart to have that type of conviction, but some people who put their money into a single stock are just following the herd. This phenomenon plays out often with meme stocks and when those stocks collapse, the investors holding the bag don’t look very smart anymore.

Diversification Is for Risk-Averse Investors

Investing in Tesla, Nvidia or Palantir at the right time would have worked out well, but some investors loaded up on Gamestop at the top of the meme bubble, bought speculative electric vehicle (EVs) like Nikola Motors and Workhorse that rode on the coattails of Tesla’s success and invested in an altcoin that proceeded to collapse.

Not every investor wants to put their eggs in one basket. It’s not smart or dumb to have this approach. Instead, a diversified portfolio signals a risk-averse investor who prefers to build their portfolio with singles and doubles instead of going for a big home run.

Diversification acknowledges that you can be wrong about your favorite investments. Not all of Cuban’s “Shark Tank” investments panned out and his ability to diversify across many small businesses helped him mitigate those losses.

You can argue that some investors diversify into many companies within the same sector, so it’s not the traditional diversification you see in the S&P 500. However, Cuban’s statement about diversification being for idiots runs against how he has approached constructing his own portfolio.

You Can Be Overdiversified

Index funds like the S&P 500 and Nasdaq Composite make it easy to diversify into a basket of stocks. These benchmarks have delivered attractive long-term returns and make investing easy to access for beginners. Even experts put their capital into these benchmarks because they have performed well in the long run.

However, you can be overdiversified with your stock portfolio. Each asset you buy requires time and attention. You have to follow the latest news around each stock you buy to determine if it is still good to hold your shares. Following your investments can also help you gauge which ones are worth expanding when you receive your next paycheck.

Diversifying into five to 10 stocks is pretty doable, but if you have more than 30 individual stocks, it can get overwhelming to stay on top of each one. It’s possible to be over-diversified if you have to stay on top of each investment. However, ETFs simplify this entire process for you since a fund manager monitors the fund for you.

More From GOBankingRates

- 5 Old Navy Items Retirees Need To Buy Ahead of Winter

- I Paid Off $40,000 in 7 Months Doing These 5 Things

- 4 Housing Markets That Have Plummeted in Value Over the Past 5 Years

- 6 Big Shakeups Coming to Social Security in 2025

This article originally appeared on GOBankingRates.com: Mark Cuban’s Hottest Take Regarding Investing — Is He Right?