Rep. Marjorie Taylor Greene (R-Ga.) has been one of the most active stock investors from the political fraternity, and several of her trades have received significant media attention.

What happened: The lawmaker has expanded her portfolio with stocks from several large-cap companies, including Berkshire Hathaway Inc. Class B (NYSE:BRK). Greene purchased Berkshire Hathaway Class B shares, with a reported value range between $1,001 and $15,000, on April 4.

The congressperson bought the market dip, precipitated by President Donald Trump's sweeping tariff measures. The stock had slipped more than 8% over the previous two days.

But if the idea was to accumulate the stock before it began a sustained rally, that hasn’t precisely happened.

While shares rebounded on easing tariff measures, the upsurge was short-lived. After hitting yearly highs of $539.80, BRK.B reversed course and went on to slide below $500. Since the purchase, the shares have been down 2.62%

See Also: Marjorie Taylor Greene Increases These 2 Stocks In Portfolio, Including This AI Name Up Over 100% YTD

Let's assume instead of Warren Buffett's high-profile holding company, the Republican would have chosen to buy Bitcoin (CRYPTO: BTC), the world's largest cryptocurrency. Since we don't know the exact amount invested, let’s go with the top range.

A $15,000 investment in Berkshire Hathaway Class B stock would have been reduced to $14,607.On the other, a $15,000 investment in Bitcoin on the same date would now be worth $20,700.

| Asset | Price (Recorded on April 4, 2025) | Price (Recorded at 2:52 a.m. ET) | Gains +/- |

| Berkshire Hathaway Class B | $493.54 | $480.60 | -2.6% |

| Bitcoin | $83,100 | $115,370.79 | +38.83% |

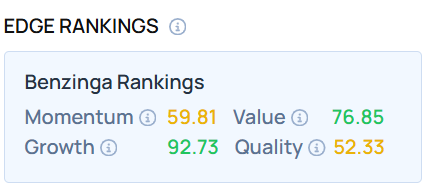

The BRK.B stock exhibited a very high Growth score but lagged in Momentum as of this writing. Use Benzinga Edge Stock Rankings to see how it compares to ”Mag 7” equities.

Notably, Greene was ranked 23rd among members of Congress who made stock transactions based on a return of +30.2% in 2024.

However, her trades have drawn scrutiny, particularly for well-timed stock purchases around market events, such as those before and after Trump’s tariff pause announcement. Greene has dismissed the criticism as “laughable.”

Read Next:

Photo courtesy: Shutterstock