Rep. Marjorie Taylor Greene (R-Ga.) has added considerable Bitcoin (CRYPTO: BTC) exposure to her investment portfolio in 2025, making strategic purchases into iShares Bitcoin Trust ETF (NASDAQ:IBIT).

Greene’s Bitcoin ETF Gambit

The GOP lawmaker first tossed somewhere between $1,000 – $15,000 into the ETF on Jan. 8, according to the Benzinga Government Trades page, ahead of President Donald Trump's inauguration. The stock rose 13% over the next two weeks.

Greene doubled up in March, purchasing between $15,000 – $50,000 worth of IBIT shares just three days before Trump's announcement for a planned Strategic Bitcoin Reserve. Unlike last time, the ETH shares fell 8% over the next week.

According to Benzinga, Greene’s IBIT stake is up 10.2% as of this writing, better than her 2.4% return from Advanced Micro Devices Inc. (NASDAQ:AMD).

Overall, the Congressperson gained 2.80% on average over the last year, lower than the S&P 500. As of this writing, Goldman Sachs Group Inc. (NYSE:GS) and Tesla Inc. (NASDAQ:TSLA) were among the top performers in her portfolio, netting 76% and 57.7%, respectively.

See Also: Bitcoin Flat As US GDP Rebounds In Q2; Ethereum, XRP, Dogecoin Slide: Analyst Says ‘Keep An Eye Out’ For This ETH Level To Confirm ‘Real Breakout’

Examining Bitcoin Investments Of Other Lawmakers

Interestingly, Rep. Brandon Gill (R-Texas), who bought into IBIT, valued between $50,001 and $100,000, on July 17, is down 6.40% on the investment.

Furthermore, Sen. David McCormick (R-Pa.), who made several purchases of Bitwise Bitcoin ETF (NYSE:BITB) in 2025, enjoyed an unrealized profit of 25.60% as of this writing.

Price Action: At the time of writing, BTC was exchanging hands at $111,220.37, down 1.49% in the last 24 hours, according to data from Benzinga Pro. Year-to-date, the coin has rallied 18%.

Shares of IBIT ETF rose 0.57% after-hours after closing 0.11% lower at $63.58 on Wednesday. Year-to-date, the stock has gained 19.76%.

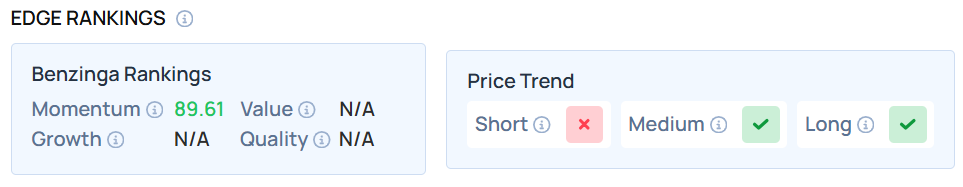

As of this writing, the stock demonstrated a very high Momentum score. Visit Benzinga Edge Stock Rankings to check out how different Bitcoin ETFs have performed over the last month across categories like Momentum, Value, Growth and Quality.

Shutterstock/Consolidated News Photos

Read Next: