MARA Holdings Inc. (NASDAQ:MARA) CEO Fred Thiel addressed concerns on Tuesday about the perceived undervaluation of the company’s stock in the Bitcoin (CRYPTO: BTC) mining sector.

MARA Execs Optimistic About Power, AI Segments

During the firm’s third-quarter earnings call, Thiel admitted that investors “don’t put a lot of value’ on the Bitcoin mining infrastructure and business.

However, he expressed optimism that as MARA’s business evolves, particularly with the addition of energy generation and AI segments, the company will receive “more attention.”

Salman Khan, MARA’s Chief Financial Officer, added that the company has secured enough power capacity to gain a competitive advantage. He said that a combination of Bitcoin mining, AI infrastructure services and integrated power would drive value for stockholders in the long term.

See Also: Bitcoin’s ‘Worst-Case Scenario’: A Sharp Decline To $96,000 If One Level Isn’t Reclaimed Fast

MARA’s Key Initiatives In Q3

Marathon announced a partnership with MPLX, a publicly traded company established by Marathon Petroleum Corporation to develop power generation facilities and data center campuses in West Texas.

Earlier in Q3, it agreed to acquire a 64% stake in Exaion, a subsidiary of the French energy company EDF, to expand its capabilities in high-performance computing and secure cloud services sectors.

MARA Reports Mixed Q3 Results

This discussion comes after MARA reported mixed third-quarter results. The company reported earnings of 27 cents per share, missing the consensus estimate of 44 cents by 38.22%. However, it beat the Street estimate of $250.67 million with quarterly revenue of $252.41 million.

The firm’s Bitcoin stockpile grew 98% year-over-year to 52,850 BTC, worth over $5 billion, making it one of the biggest corporate hoarders of the apex cryptocurrency.

Price Action: MARA shares slid 1.02% in after-hours trading after closing 6.68% lower at $16.62 during Tuesday’s regular trading session, according to data from Benzinga Pro. Year-to-date, the stock is down 0.89%.

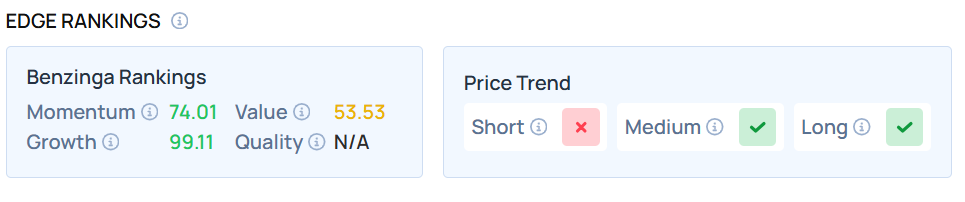

The stock exhibited a very high growth score — a measure of the stock’s combined historical expansion in earnings and revenue across multiple periods. How does it compare with Riot Platforms Inc. (NASDAQ:RIOT) and similar BTC mining-related stocks? Visit Benzinga Edge Stock Rankings to find out.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.