A fraught geopolitical backdrop and hotly contested trade stoushes have ultimately been good news for a local rare earths miner, its outgoing boss says.

"Frankly, geopolitics continue to be our friend," Lynas Rare Earths chief executive Amanda Lacaze told shareholders at a quarterly results briefing.

Export controls enacted in April 2025 by China - which producers up to 70 per cent of the world's rare earths - prompted a major trade battle with the US and ultimately led to the Australian government announcing a critical minerals reserve to shore up supply.

Average selling prices across all rare earths products soared to $85.60kg in the December quarter, compared to $49.2kg a year earlier.

The shift showed the market was beginning to appropriately value the materials after years of market dysfunction, Ms Lacaze said.

"Although we are yet to finalise various agreements with government, the policies which have been, particularly, implemented by the US government have already fostered more functional market dynamics," she said.

"As as I've said on many occasions, our objective is a proper functioning market where materials are valued appropriately."

Rare earths minerals are key to a wide range of technology applications including wind turbine magnets, smartphones, and solar panels.

Lynas is the biggest producer of rare earths elements outside of China, which accounts for up to 70 per cent of global output.

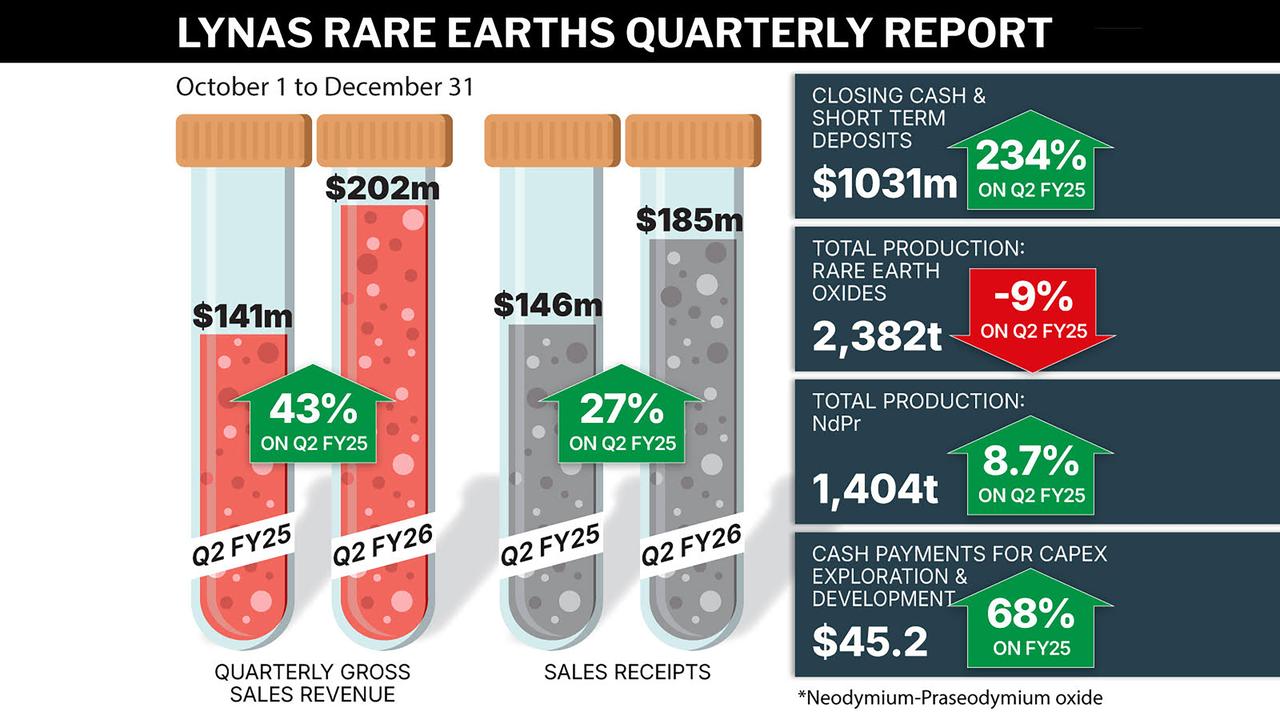

The miner's December quarter revenue came in at $201.9 million smashing the 2024 equivalent quarter result by a whopping 43 per cent.

The figure came despite significant power outages at the organisation's Kalgoorlie ore processing plant, which resulted in 30 per cent lower production compared to the previous quarter.

Lynas rare earths oxide output was 2382 tonnes, down from 3993 tonnes in the three months to September.

The miner found success rectifying power supply issues with the local electricity supplier, but with two outages as recently as Tuesday, it continued to develop plans for an off grid solution.

The ongoing production issues clouded the outlook for a clear production guidance figure.

"What we have provided very clearly is the fact that we've made investment in our production facilities to be able to deliver 10,500 tonnes per annum of NdPr (Neodymium and Praseodymium)," Ms Lacaze said.

"The operations team continues to work on ramping up that number and our objective is to get there as soon as possible."

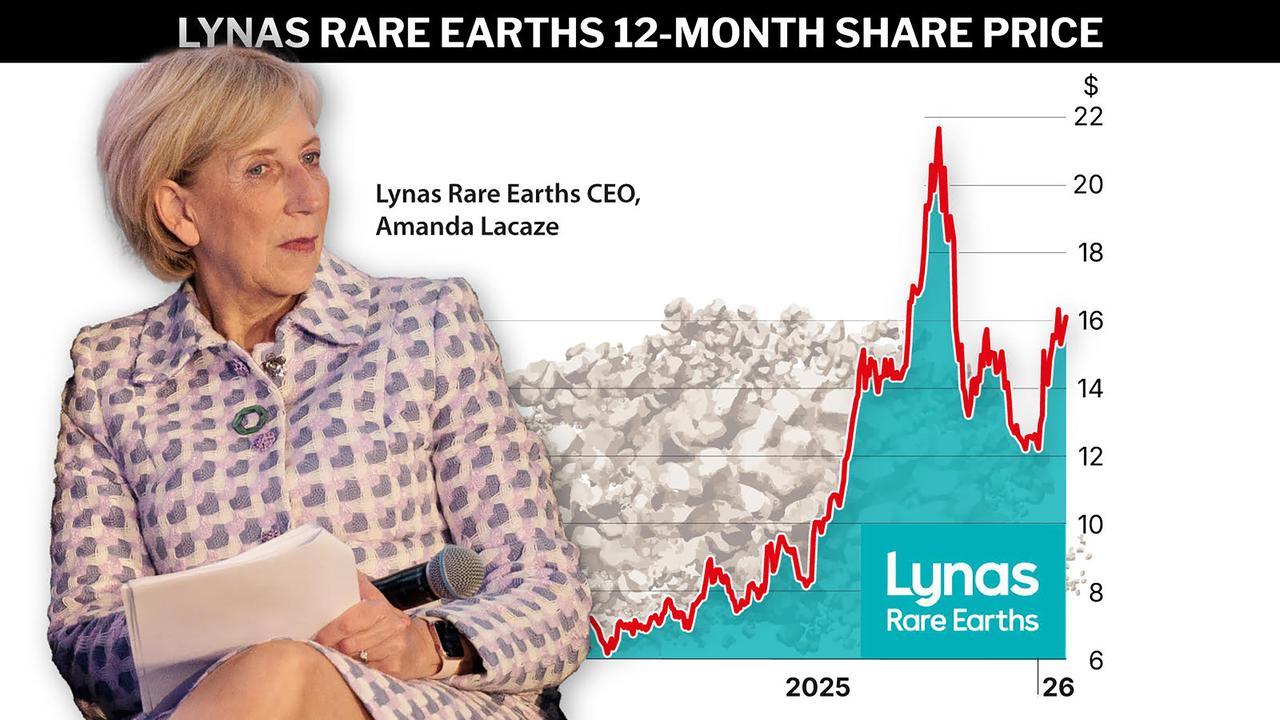

Investors - who had been warned about the production shortfall in November - reacted positively to the report, sending Lynas shares 4.8 per cent higher to $15.97 midway through the trading session.

The report came a week after Ms Lacaze announced she would retire after 12 years at the company's helm, with the search for her replacement ongoing.

She thanked shareholders for their overwhelming support and admitted some of the compliments had made her blush.

"However, as I've said to everybody, this company is not so key person dependent that it should matter and I'm delighted to see that that has been the market sentiment." Ms Lacaze said.

"I've spent 12 years of my life working to build a strong and resilient business at Lynas, and I am delighted to be leaving the company in excellent shape."

Lynas' market value has increased under Ms Lacaze's stewardship from about $400 million in 2014 to more than $16 billion.

She will step down from her role at the end of the financial year.

.png?w=600)