/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

Intuitive Machines (LUNR) has already created history by successfully completing two lunar missions in less than a year, proving that it can do what few private companies have: land on the Moon.

LUNR stock is down 31.9% year-to-date, underperforming the overall market. With NASA contracts in hand, expanding in-house satellite production, and ambitions that extend beyond the lunar surface to Mars, Intuitive is on a roll. Can this space stock soar to its all-time high near $25, or even beyond it? Let’s find out.

About Intuitive Machines

Valued at $2.3 billion, Intuitive Machines is a U.S.-based aerospace company that designs and operates lunar landers, satellites, and deep space communication systems. In short, it creates the infrastructure for space exploration, such as spacecraft that deliver payloads to the moon, satellites that relay data between space and Earth, and navigation and communication systems for NASA, defense, and commercial missions.

A Vision Beyond the Moon

In the second quarter, Intuitive generated revenue of $50.3 million, an increase of 21% year over year, driven by NASA’s CLIPS missions, LTV progress, and NSNS execution. The company’s backlog stood at $256.9 million, which included new work orders for NSNS and OTV. Management expects to recognize approximately 75% of this backlog by the end of 2026.

The company recorded a net loss of $25.3 million due to increased internal production investments. Management highlighted that despite short-term margin compression, Intuitive Machines’ long-term trajectory points toward profitability, reaffirming the goal of achieving positive adjusted EBITDA by 2026.

The company’s strategy revolves around transforming government-backed missions into scalable businesses. Programs such as NSNS and CLIPS produce immediate revenue while also laying the groundwork for ongoing data and communication services. The company concluded the quarter debt-free with a cash position of $345 million, which management believes is sufficient to fund facility development, satellite manufacturing, and ongoing contracts.

After completing two lunar missions in barely a year, Intuitive is transitioning from a lunar lander company into a full-spectrum space infrastructure provider. The company believes that data transmission, or the capacity to connect spacecraft, satellites, astronauts, and ground stations, is critical for scalable spaceflight. Its latest NASA Near Space Network Services (NSNS) contract might propel Intuitive Machines from a one-mission-per-year lunar player to a long-term deep space infrastructure service provider. The NSNS initiative will create a satellite constellation to assist lunar and cislunar missions, with the potential to go much further — to Mars.

To achieve this vision, Intuitive Machines is vertically integrating its satellite manufacturing. By bringing production in-house, the company obtains greater control over cost, schedule, and intellectual property while also expanding into new areas such as national security and commercial communications.

Intuitive also announced plans to acquire Kinetics, the only commercial company certified by NASA for deep space navigation. Kinetics delivers profitable defense and commercial contracts, precision tracking capabilities, and a well-established flight software suite. These could help Intuitive Machines improve its position in satellite constellation design and data services.

Looking Ahead: Multiple Catalysts on the Horizon

The second half of 2025 and beyond could be defining for Intuitive Machines. A few notable catalysts include:

- A new CLIPS task order from NASA

- OSAM-1 mission funding transition to the U.S. Space Force

- Growth in commercial reentry programs

- Commencement of deep space satellite production for NSNS

By combining vertical integration, smart M&A, and deep partnerships, Intuitive Machines is transforming into what management describes as a “new space prime contractor.” The company intends to provide crucial services in all areas of space research, from Earth’s orbit to Mars.

High-Risk, High-Reward

Intuitive is a fast-growing stock, thanks to its rapid expansion in the commercial space industry and rising position in NASA and defense initiatives. The company’s promise stems from its vertically integrated approach, which involves creating lunar landers, satellites, and communication networks in-house. This might position it as a leading provider of deep space infrastructure. However, Intuitive could also face significant challenges, including execution risk and the high capital costs of space manufacturing, which could weigh on short-term profitability.

What Is Wall Street Saying About LUNR Stock?

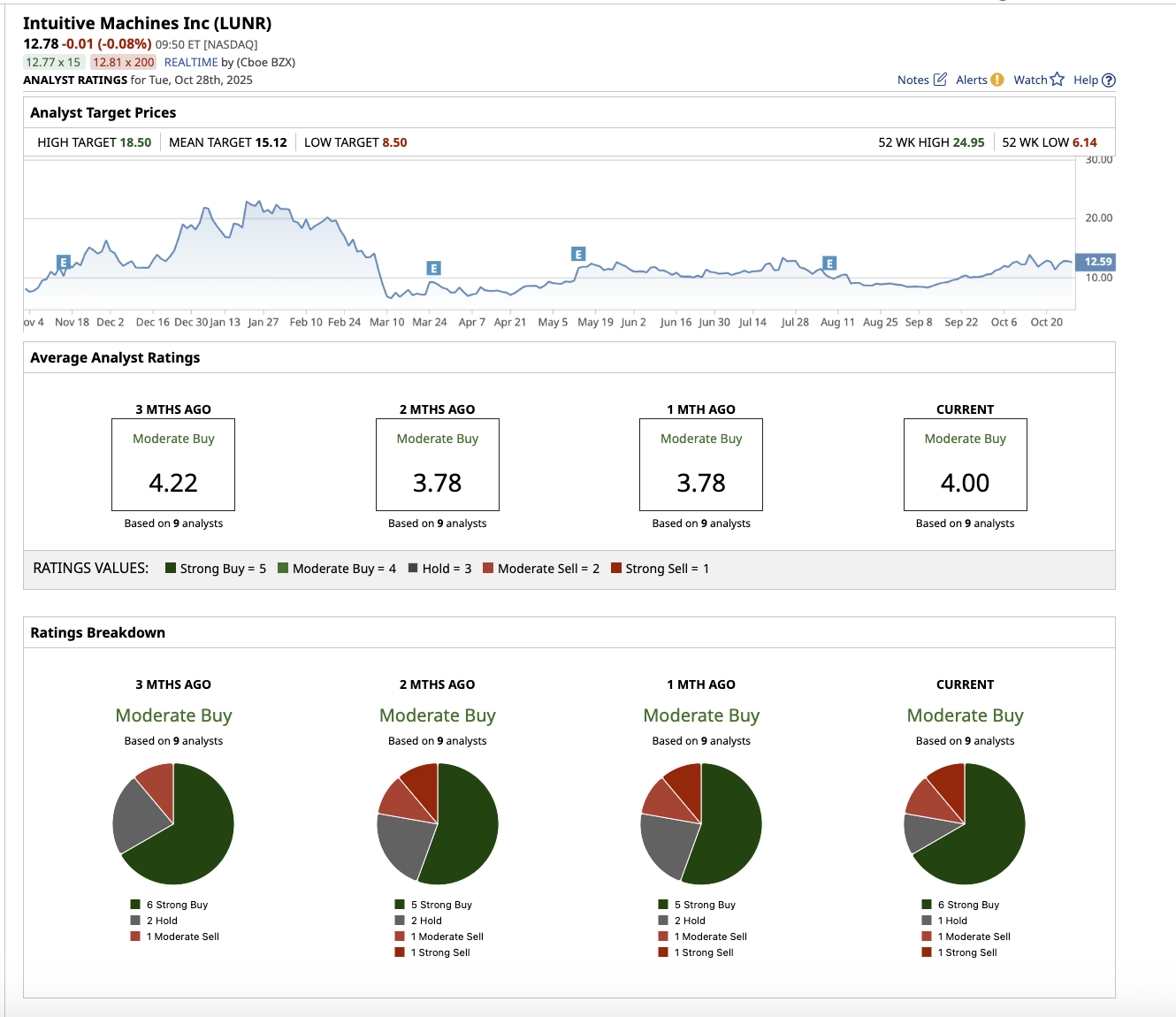

Overall, LUNR stock remains a “Moderate Buy” on Wall Street. Of the nine analysts in coverage, six rate it a “Strong Buy,” one rates it a “Hold,” one suggests a “Moderate Sell,” and one says it is a “Strong Sell.” The mean target price of $15.12 suggests the stock has upside potential of 18.3% from current levels. However, the high price estimate of $18.50 implies the stock can rally 44.7% over the next 12 months.

Intuitive Machines is not just landing on the moon; it is working relentlessly to become a key provider of deep space infrastructure. If the company continues to grow at this pace, reaching or even crossing its 52-week high of $24.95 is not an impossible target for LUNR stock.