Lululemon Athletica (LULU) shares finally bucked the selloff, enjoying a strong post-earnings reaction.

At last check the stock is up about 12%, although at the session high it was up almost 18%. The rally follows nine straight daily declines, where the shares fell more than 13%.

Why the selloff? Hard to know. The company’s prior earnings report led to strong gains in late March and fueled Lululemon’s run to 52-week highs.

The weakness in the SPDR S&P Retail ETF (XRT) has been concerning, as many retailers continue to falter. Target (TGT), Nike (NKE) and others are on that list as well.

Don't Miss: Did Target Stock Just Bottom?

As for the quarter, LULU delivered a top- and bottom-line beat of Wall Street expectations. Its earnings soared more than 50% year over year and management gave a boost to its full-year outlook.

For as good as the quarter was and as bullish as the reaction is, from a technical perspective Lululemon stock is struggling with a key resistance area.

Trading Lululemon Stock on Earnings

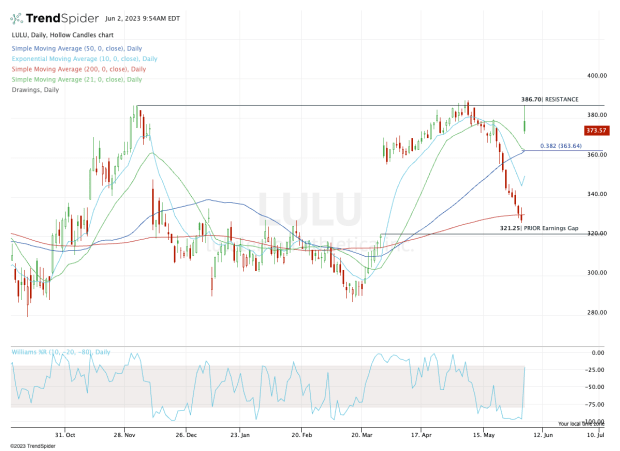

Chart courtesy of TrendSpider.com

The December high is $386.70. This area also acted as resistance in April following a bullish earnings response. Interestingly, the shares this morning came within spitting distance of this mark before fading almost $20 a share.

As far as the technicals are concerned, this zone is clear resistance. A breakout over this zone would help set up a move to $400, then potentially to the $435 area for traders who are using a longer time frame.

As far as the downside is concerned, the bulls will want to see Lululemon stock find support in the mid-$360s.

That’s where the 38.2% retracement comes into play, (as measured from Friday’s high down to this week’s low). That’s also where the 50-day and 21-day moving averages come into play.

Don't Miss: Salesforce Stock Dips on Earnings. Here's When to Buy

If Lululemon stock can’t hold this mark, buyers could emerge in different areas (such as the mid-$350s). But losing this zone would be a blow to short-term sentiment, since it’s a key level and the shares have already faded notably from the post-earnings high.

So what’s the bottom line? Lululemon Athletica stock endured a surprisingly painful pre-earnings pullback. This is a great reaction after a strong result, but it needs to hold the mid-$360s.

If it can do so, keep an eye on the $386 area on the upside.

Receive full access to real-time market analysis along with stock, commodities, and options trading recommendations. Sign up for Real Money Pro now.