I don’t think it would be an overstatement to characterize Lululemon’s (LULU) stock performance in 2025 as disastrous. Down 56% year-to-date, LULU shares have now lost 67% of their value since hitting an all-time high of $516.39 in December 2023.

Tariffs, increased competition, a weakened U.S. consumer, and other issues have soured investors and analysts on the apparel brand that, as recently as two years ago, could do no wrong.

I have followed stocks long enough to know that every great company goes through peaks and valleys. It's inevitable. Just look at Starbucks (SBUX), Target (TGT), McDonald’s (MCD), and even Walmart (WMT). They have all suffered through periods of shareholder value destruction in the past decade.

Lululemon’s options volume and unusual options activity in September suggest investors are placing bets on the apparel brand’s future success.

I believe the company will weather the storm and return to its rightful place as one of the world’s best apparel brands, making it a pretty good stock to boot. Others feel otherwise. That’s what makes the markets so interesting.

The stock’s daily options volume over the past two years shows that there were 31 days with volume exceeding 100,000. Of those, 10 were in September, with the highest daily volume of 567,229 on Sept. 5.

Naturally, given the uptick in daily volume, the stock’s unusual options activity has also picked up in recent weeks. In yesterday’s trading, LULU had 12 unusually active options, eight with Vol/OI (volume-to-open-interest) ratios higher than 10.

Using this activity, here are three safer plays to consider for betting on LULU’s future share price movements.

Have an excellent weekend.

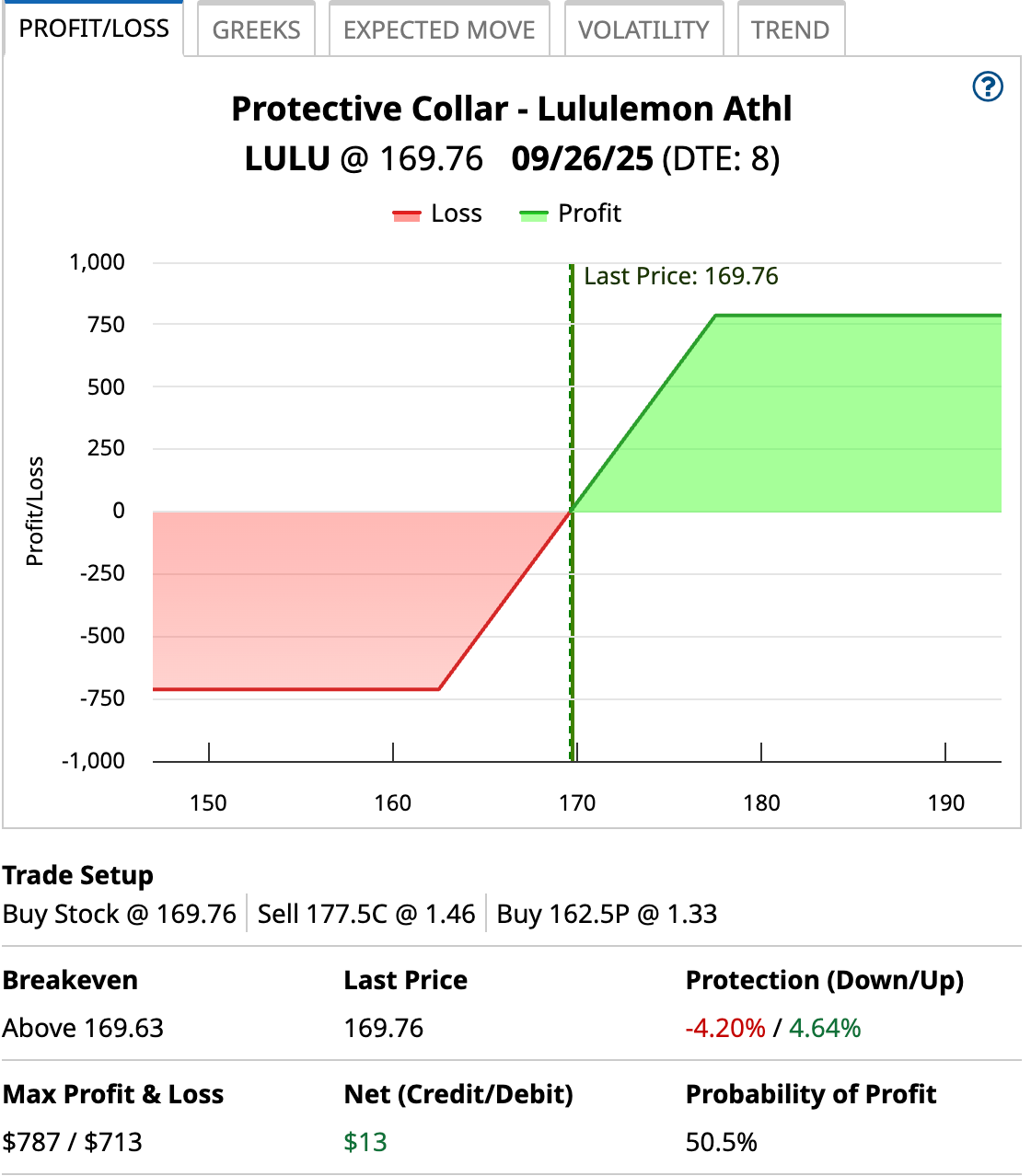

The LULU Collar

The collar option strategy is geared toward existing owners of LULU stock who want to protect the downside at a lower cost than merely buying a put.

The hedge strategy is created when you sell a covered call with a strike price OTM (out of the money) and simultaneously buy a protective put at a lower strike price, also OTM. They have the same expiration date.

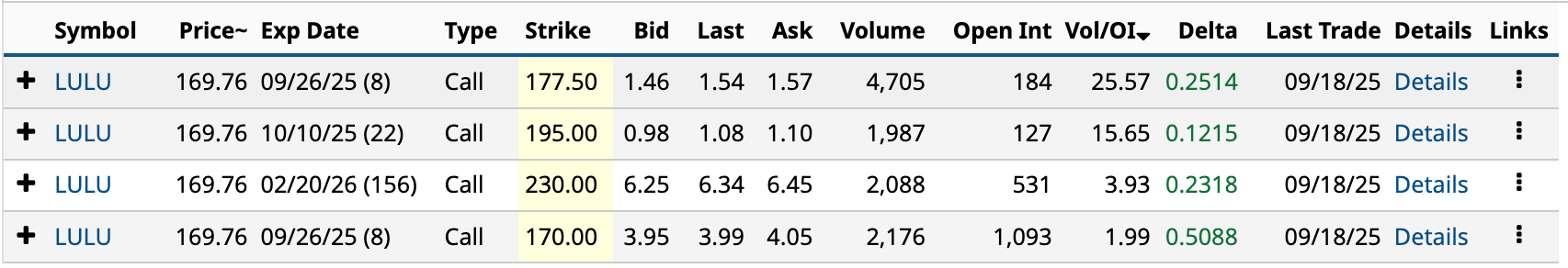

In yesterday’s unusual options activity, LULU had four calls with Vol/OI ratios of 1.24 or higher expiring in seven days or longer.

As you can see from above, one was ATM (at the money) with a $170 strike, while three were OTM, ranging from $177.50 to $230.

As you can see from above, one was ATM (at the money) with a $170 strike, while three were OTM, ranging from $177.50 to $230.

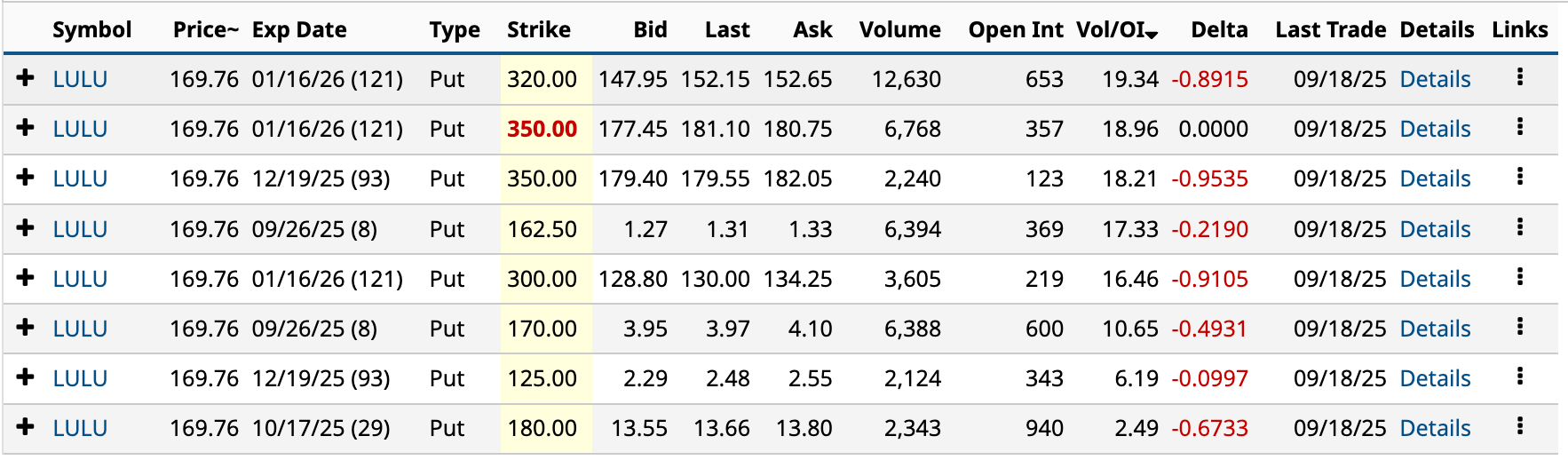

There were eight unusually active puts yesterday, with strike prices ranging from $125 to $350. Since the ones in the $300s are deep ITM (in the money), they’re no good to us. That leaves us with strikes of $125, $162.50, $170, and $180. Given the last two are ITM, I’ll focus on the $125 and $162.50.

As I said, the collar strategy involves owning the stock, so unless you bought at the 52-week low of $159.25, you might not want to use this strategy because you could be forced to sell your shares at expiration, potentially resulting in a loss.

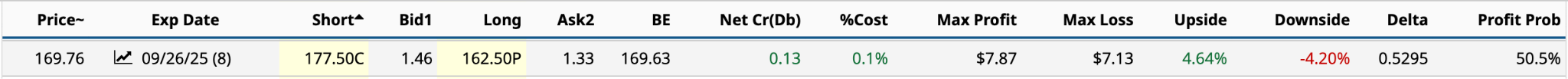

However, if you felt the shares would continue to move lower, selling the $177.50 call and buying the $162.50 put would be worth considering.

In this example, if you buy the $162.50 put on its own, it would cost you $133 ($1.33 ask price). However, if you did the collar, and assuming the share price stayed below $177.50, you would pocket $13.

If, on the other hand, you bought 100 shares of LULU at yesterday’s closing price of $169.76, your maximum profit would be $787 if the share price were higher than $177.50 at expiration. Your maximum loss, if the shares were trading below $162.50 at expiration, would be $713.

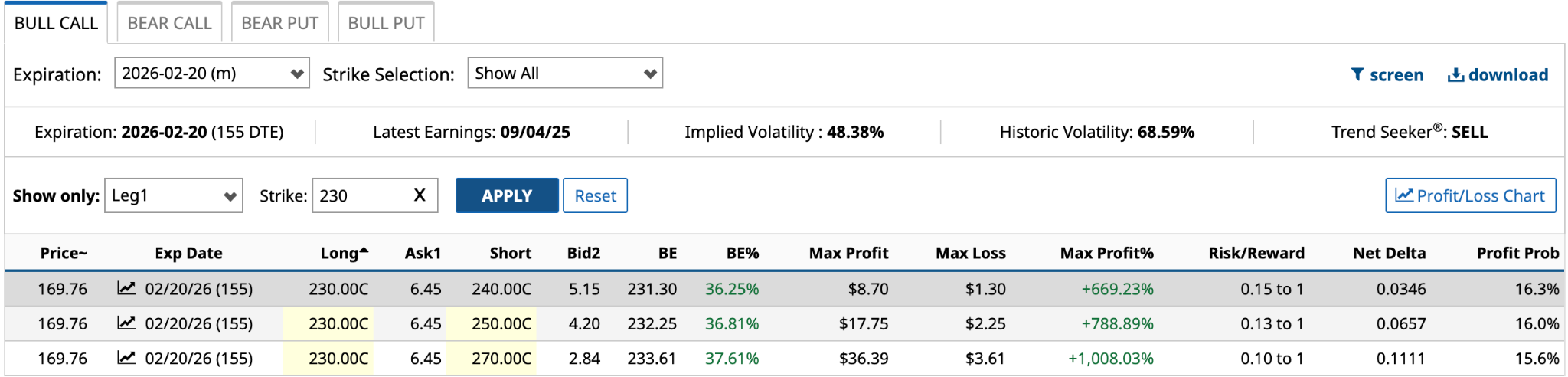

The LULU Bull Call Spread

The bull call spread is a bullish strategy where you expect Lululemon’s share price to increase in value by expiration. It involves buying a call option and selling a call option at a higher strike price.

So, using the four unusually active call options from yesterday, I’ll first focus on the $230 strike, which is the furthest OTM. The risk is negligible, but so too is the profit potential.

As you can see from above, the short $270 call has the highest maximum loss (net debit) of $361. However, the maximum profit of $36.39 means the risk/reward ratio is just 0.10 to 1. This lack of risk explains why the profit probability is just 15.6%.

As you can see from above, the short $270 call has the highest maximum loss (net debit) of $361. However, the maximum profit of $36.39 means the risk/reward ratio is just 0.10 to 1. This lack of risk explains why the profit probability is just 15.6%.

In this situation, the maximum profit would be if the share price in February at expiration were above $270, the higher strike price. If the share price were $250 at expiration, your profit would be $16.39 [$250 share price - $230 strike price - $361 net debit].

Of the three remaining calls, all have low profit probabilities under 20%. The Feb. 20/2026 strike at least gives you more time for the bet to pay off.

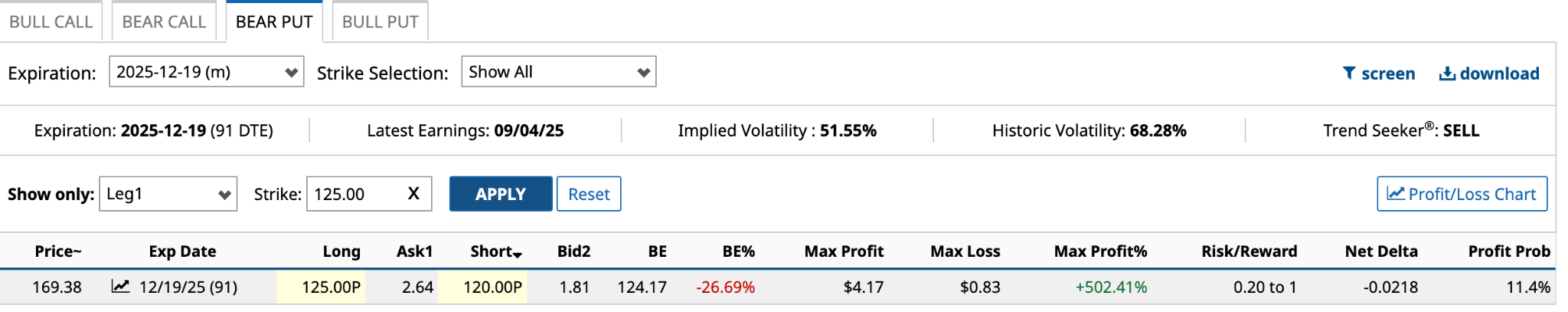

The LULU Bear Put Spread

This is a bearish strategy where you expect Lululemon’s share price to continue falling in value through expiration. It involves buying a put option and selling a put option at a lower strike price. Both have the same expiration date.

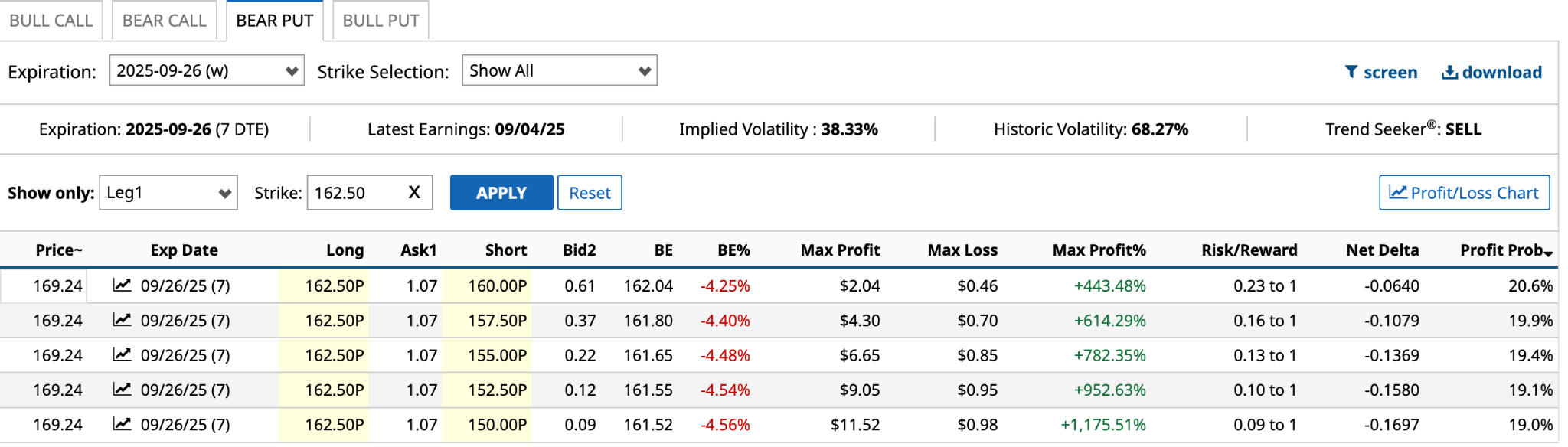

Using the eight put options from yesterday, I’ll focus on the $125 and $162.50 strike prices that are OTM. The former’s expiry date is Dec. 19, while the latter’s is Sept. 26.

As you can see from above, buying the $125 put and selling the $120 put produces a net debit of $83. That’s 69% less than the $264 you’d pay to buy the $125 put without selling the $120 put. However, the maximum profit is capped at $417 [$125 strike price - $120 strike price - $0.83 net debit] with a profit probability of just 11.4%.

As you can see from above, buying the $125 put and selling the $120 put produces a net debit of $83. That’s 69% less than the $264 you’d pay to buy the $125 put without selling the $120 put. However, the maximum profit is capped at $417 [$125 strike price - $120 strike price - $0.83 net debit] with a profit probability of just 11.4%.

I generally prefer options with at least 30-day DTEs (days to expiration). It gives you enough time to profit from your strategy. However, in this case, the Sept. 26 $162.50 put, combined with selling the $160 put, comes with a similar risk/reward ratio to the December DTE, but the profit probability is 920 basis points higher at 20.6%, while the net debit is 37 cents less.