/Lululemon%20Athletica%20inc_%20phone%20and%20website%20by-%20T_Schneider%20via%20Shutterstock.jpg)

Lululemon Athletica (LULU) has long been a market favorite in the premium athletic wear space, but 2025 has been brutal for the stock. Shares of the company have plunged roughly 53.5% year-to-date, reflecting both a slowdown in U.S. sales and mounting headwinds across the apparel industry.

The steep drop has also compressed Lululemon’s valuation.

However, is LULU stock too cheap to ignore, or does it lack any immediate catalyst to push its share price higher?

What’s Behind the Drop in LULU Stock?

The weakness in Lululemon’s share price is primarily due to its struggles in the U.S. market. Sales have slowed as consumers reduce their apparel spending, particularly in performance wear, and become more selective with their purchases. On its most recent earnings call, management acknowledged that the brand has become too predictable, particularly in its casual lines, and has fallen short in setting new trends.

The company’s lounge and social offerings have failed to generate the same enthusiasm they once did. In other words, Lululemon’s product pipeline hasn’t been resonating, and customers are spending less frequently.

Adding to these challenges are external headwinds. Competition in the athletic apparel market has intensified, with both established rivals and new entrants vying for market share. At the same time, tariffs have added unexpected costs. Roughly two-thirds of Lululemon’s U.S. e-commerce orders are shipped from Canada, many of which previously qualified for tariff exemptions under the $800 de minimis threshold. With that provision removed, Lululemon now has to revamp its network to lower the impact on margins.

While management is working to offset these costs through pricing adjustments, vendor negotiations, and cost-cutting initiatives, these efforts will take time to show results.

The combined impact of sluggish demand, rising costs, and heightened competition forced the company to trim its revenue and earnings outlook for the year, which further rattled investors.

A Look at Lululemon’s Valuation

Given the sharp selloff in Lululemon stock, it trades at a forward price-earnings ratio of 13.3x. This multiple looks historically cheap for a company like Lululemon, which has consistently delivered strong growth in the past and has solid brand power.

On the surface, that discount may appear attractive to investors seeking bargains. But a closer look at the fundamentals suggests that the market is not mispricing Lululemon.

The company has tempered expectations for the year ahead. Management now projects a significant contraction in gross margin, with a roughly 300-basis-point decline compared to 2024. That’s much steeper than the 110-basis-point decrease it had initially guided for. The adjustment primarily stems from higher tariffs, including the removal of de minimis exemptions, while more aggressive markdown activity, approximately 50 basis points worse than last year, is also weighing on profitability as seasonal clearance levels rise.

The impact is clear in earnings guidance. For fiscal 2025, diluted earnings per share are expected to fall in a range of $12.77 to $12.97, down from $14.64 in 2024. Wall Street’s forecast lines up with that view, calling for an 11.8% decline in the bottom line this year and only a modest 2.4% rebound in fiscal 2026.

Put together, the numbers explain why Lululemon shares are trading at a discount. The brand may still hold considerable long-term appeal, but in the near term, growth momentum has slowed, margins are under pressure, and earnings are shrinking.

Is Lululemon Stock a Buy Now?

Lululemon continues to invest in innovation and fresh styles, aiming to keep its products appealing and competitive. The company is also expanding its footprint with new company-operated stores, a move that is expected to provide a steady boost to revenue. Cost-saving initiatives are underway to cushion the impact of tariffs on margins. Another strength is its growing membership program, which has now reached approximately 30 million members, reflecting strong customer loyalty and potential for recurring sales.

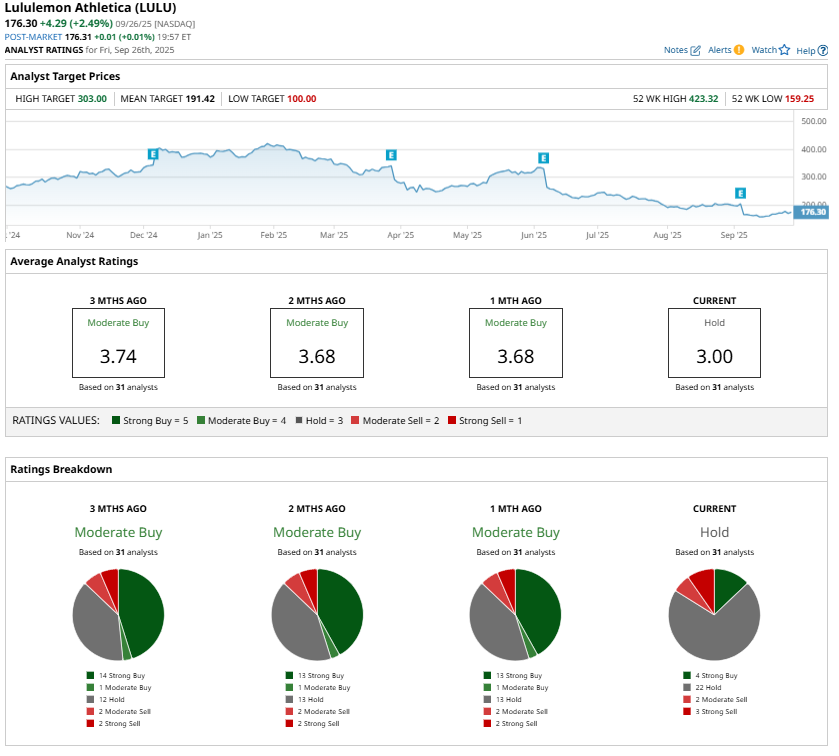

Despite these initiatives, the near-term outlook remains clouded for LULU. Demand in North America has softened, and higher costs are weighing on profitability. These pressures make it more difficult for the stock to stage a sharp rebound in the short term. Reflecting this uncertainty, Wall Street analysts are taking a cautious stance, with most maintaining a “Hold” rating on Lululemon shares.

In short, while Lululemon is well-positioned for long-term growth through innovation, expansion, and customer engagement, its stock may remain under pressure in the near future.