/Lululemon%20Athletica%20inc_%20storefront%20by-%20Robert%20Way%20via%20iStock.jpg)

With a market cap of $26.3 billion, lululemon athletica inc. (LULU) designs, distributes, and retails technical athletic apparel, footwear, and accessories for women and men under the lululemon brand. The company operates globally through a mix of company-operated stores, e-commerce, and innovative retail formats like pop-ups and re-commerce programs.

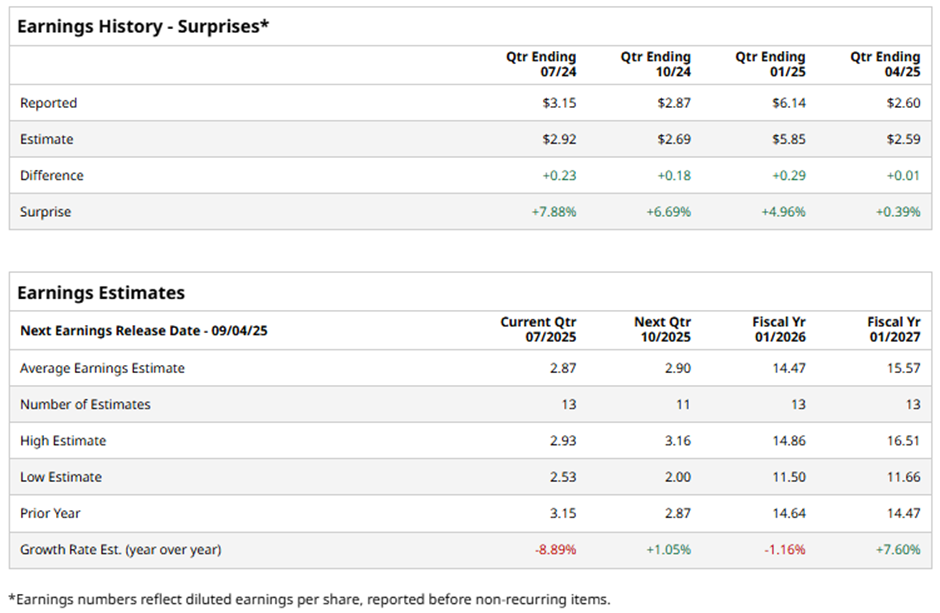

The Vancouver, Canada-based company is expected to announce its fiscal Q2 2025 earnings results on Thursday, Sept. 4. Ahead of this event, analysts expect lululemon athletica to report an EPS of $2.87, down 8.9% from $3.15 in the year-ago quarter. However, it has surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts expect the athletic apparel maker to report an EPS of $14.47, down 1.2% from $14.64 in fiscal 2024. However, EPS is anticipated to rebound and grow 7.6% year-over-year to $15.57 in fiscal 2026.

Shares of lululemon athletica have declined 11.3% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 18.3% gain and the Consumer Discretionary Select Sector SPDR Fund's (XLY) 24.5% return over the period.

Despite reporting better-than-expected Q1 2025 earnings of $2.60 per share and revenue of $2.4 billion on Jun. 5, Lululemon Athletica's stock plunged 19.8% the next day due to its reduced full-year EPS guidance to $14.58 - $14.78. The company also issued a weaker-than-expected Q2 EPS forecast of $2.85 - $2.90, significantly below Wall Street’s estimate. Investor sentiment was further dampened by a 2% decline in America's sales and management’s warning that rising tariffs would pressure margins more than expected, with full-year gross margin forecast to shrink by 110 basis points.

Analysts' consensus view on LULU stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 30 analysts covering the stock, 13 recommend "Strong Buy," one has a "Moderate Buy," 12 indicate “Hold,” two advise "Moderate Sell," and two give "Strong Sell." As of writing, the stock is trading below the average analyst price target of $304.41.