/A%20Lucid%20Motors%20vehicle%20parked%20in%20front%20of%20a%20showroom_%20Image%20by%20Michael%20Berlfein%20via%20Shutterstock_.jpg)

Electric vehicle (EV) stocks have had a turbulent run over the past year, as production delays, rising costs, and shifting trade policies shake up the sector.

This time, Lucid Group (LCID) now finds itself caught in a “tariff trap,” with newly imposed duties cutting into margins and forcing management to lower its production outlook despite posting record deliveries. Management now guides for 18,000-20,000 vehicles produced in 2025 and revealed a $54 million tariff hit that pushed its gross margin deeply into the negative. Executives say localized sourcing should blunt the pain, but volatility remains.

So which way for LCID in 2025: A collapse to $1 or a rebound to $7?

About Lucid Stock

Based in California, Lucid Group is an electric vehicle maker focused on premium, long-range EVs. Best known for the Lucid Air sedan, the company builds vehicles at its Arizona facility and targets the luxury EV market as a rival to Tesla (TSLA). Recently, Lucid’s growth story has been clouded by production tweaks and tariff-driven margin pressure.

With a market cap near $7 billion, Lucid’s shares have lagged the broader market over the past year, falling 22.5%.

Despite underperforming, LCID faces a challenging valuation landscape. Its trailing EV-sales ratio is 9.4x, significantly higher than the sector median of 1.28x, indicating a very expensive stock compared to its peers. However, the price-book ratio of 2.12x is slightly undervalued compared to the sector median of 2.69x.

Lucid Misses Q2 Earnings Estimate

Lucid Group shares slid 9.7% on Aug. 6 after the EV maker missed Wall Street’s Q2 2025 expectations for both revenue and earnings. The company posted a loss of $0.24 per share, falling short by $0.22, while revenue rose 29% year over year to $259.4 million, missing estimates for $283.2 million.

Despite delivering a record 3,309 vehicles in the quarter, headwinds from tariffs and a trimmed production outlook weighed heavily on investor sentiment. Tariffs alone shaved $54 million off quarterly results, hitting the gross margin by 21 percentage points and leaving it deeply negative at -105%. Management said these pressures were anticipated and outlined plans to blunt the impact through localized sourcing, vertical integration, and cost optimization.

Looking ahead, Lucid lowered its 2025 production guidance to 18,000-20,000 vehicles, down from the prior 20,000 target, and trimmed its capital spending forecast to between $1.1 billion and $1.2 billion.

On the strategic front, Lucid is doubling down on partnerships. A newly announced collaboration with Uber (UBER) and Nuro aims to develop a premium robotaxi platform, supported by a planned $300 million Uber investment pending regulatory approval. The deal could see 20,000 Lucid Gravity vehicles deployed over six years, marking a major push into autonomous mobility. To boost brand awareness ahead of its midsize EV launch, Lucid also named actor Timothée Chalamet as its first global ambassador.

While near-term profitability remains elusive, management is betting that its technology edge, disciplined capital allocation, and brand-building initiatives will pay off in the long run.

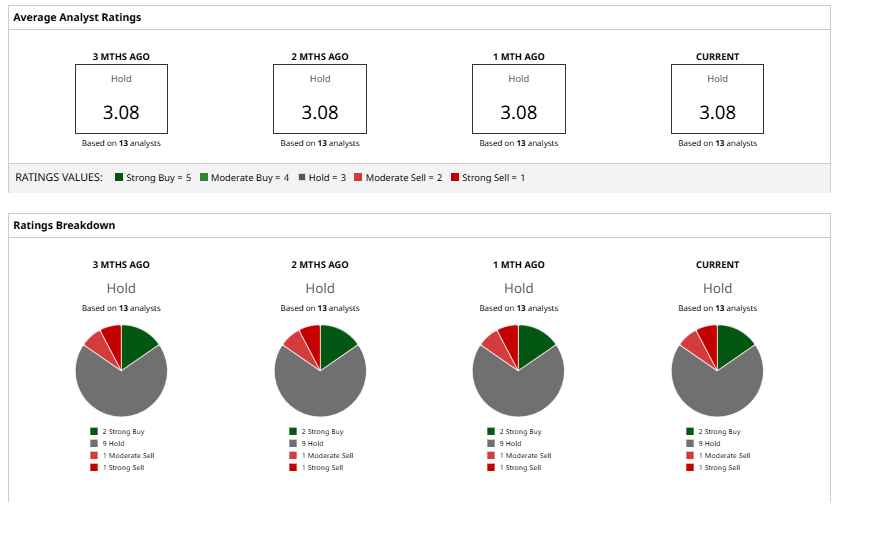

What Do Analysts Think About Lucid Stock?

After Lucid’s Q2 print, Bank of America reiterated an “Underperform” rating and kept a $1 price target, pointing to the hefty tariff hit and severe margin pressure as the main concerns.

Robert W. Baird trimmed its price target to $2 from $3 while maintaining a “Neutral" rating, citing the company’s pulled-back 2025 production guidance and the resulting uncertainty for near-term profitability.

Overall, Wall Street has taken a cautious stance on Lucid Group, with many firms assigning a “Hold” rating. The stock is trading near a mean price target of $2.76, but the Street’s wide range, a $1 low and a $7 high, issued by Ladenburg Thalmann, shows it could swing sharply either way.

With tariff headwinds and a trimmed production outlook, downside risk looks more probable in the near term, though successful cost cuts or localized sourcing could push the shares toward the high case.