Electric vehicle maker Lucid Group Inc (NASDAQ:LCID) is trading lower on Thursday, hitting a new all-time low. Here’s what investors need to know.

What To Know: The continued decline comes amid investor pessimism after the company’s 1-for-10 reverse stock split and lowered 2025 production guidance.

The reverse split, which took effect earlier this week, was intended to boost the per-share price, but market reaction has been negative. Additionally, the company’s decision to reduce its 2025 production forecast to 18,000-20,000 vehicles has dampened sentiment. This comes after a disappointing second-quarter earnings report.

Lucid’s stock has fallen nearly 50% year-to-date, navigating a challenging market. The electric vehicle sector faces broader headwinds, including the end of federal EV tax credits. Despite a newly announced partnership with Uber, investor confidence remains low, leading to the stock’s continued descent in 2025.

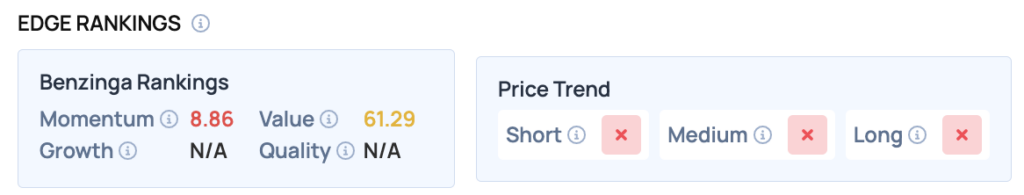

Benzinga Edge Rankings: Benzinga Edge stock rankings show the stock has a Momentum score of 8.86, indicating significant downward recent price movement.

Price Action: According to data from Benzinga Pro, LCID shares are trading lower by 6.6% to $15.67 Thursday afternoon. The stock has a 52-week high of $40.80 and a 52-week low of $15.25.

Read Also: Tesla Gets Some Good News In China Finally: Wholesale Sales Up 22.6%

How To Buy LCID Stock

By now you're likely curious about how to participate in the market for Lucid Group – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock