Shares of Lucid Group Inc (NASDAQ:LCID) are trading marginally lower Tuesday morning, consolidating after a slide on Monday. The recent volatility comes despite a string of announcements from the EV maker as it pushes into autonomous driving.

- LCID is facing resistance from sellers. Get the complete picture here.

What To Know: Last week, Lucid revealed a major partnership with Nvidia to use its DRIVE AGX Thor platform, accelerating its path to Level 4 autonomous vehicles. The company also announced a collaboration with Uber and Nuro to develop a next-generation robotaxi, with the first vehicles expected on the Uber app in 2026.

These initiatives follow a challenging period for Lucid, which underwent a 1-for-10 reverse split in August and lowered its 2025 production guidance to just 18,000 to 20,000 vehicles after a disappointing second-quarter report.

Investors are now focused on the company’s upcoming third-quarter earnings, scheduled for release after Wednesday’s market close. Analysts are forecasting a quarterly loss of $2.26 per share on revenue of $352.62 million.

Despite the headwinds, some analyst ratings have shown optimism. In September, Cantor Fitzgerald maintained a Buy rating with a $26 price target, and Morgan Stanley increased its target to $30.

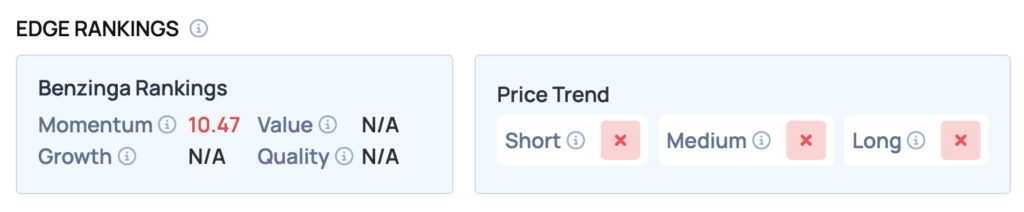

Benzinga Edge Rankings: According to Benzinga Edge stock rankings, LCID currently shows a weak Momentum score of 10.47.

LCID Price Action: Lucid Group shares were down 0.75% at $16.51 at the time of publication on Tuesday, according to Benzinga Pro data.

Read Also: Uber’s Strong Performance Gets Overshadowed By CEOs Robotaxi Comment

How To Buy LCID Stock

By now you're likely curious about how to participate in the market for Lucid – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock