With interest rates stabilizing at higher levels, investors can still lock in attractive yields from bonds.

As the Fed signals a potential shift toward rate cuts later this year, the risk of further capital losses is diminishing, making fixed-income investments more appealing than they have been in recent years.

As sophisticated investors, we can generate increase the yield provided by bond ETFs through the use of options. The strategy is a known as a covered call which involves selling call options against a stock position.

Let’s use TLT as an example.

TLT Covered Call Example

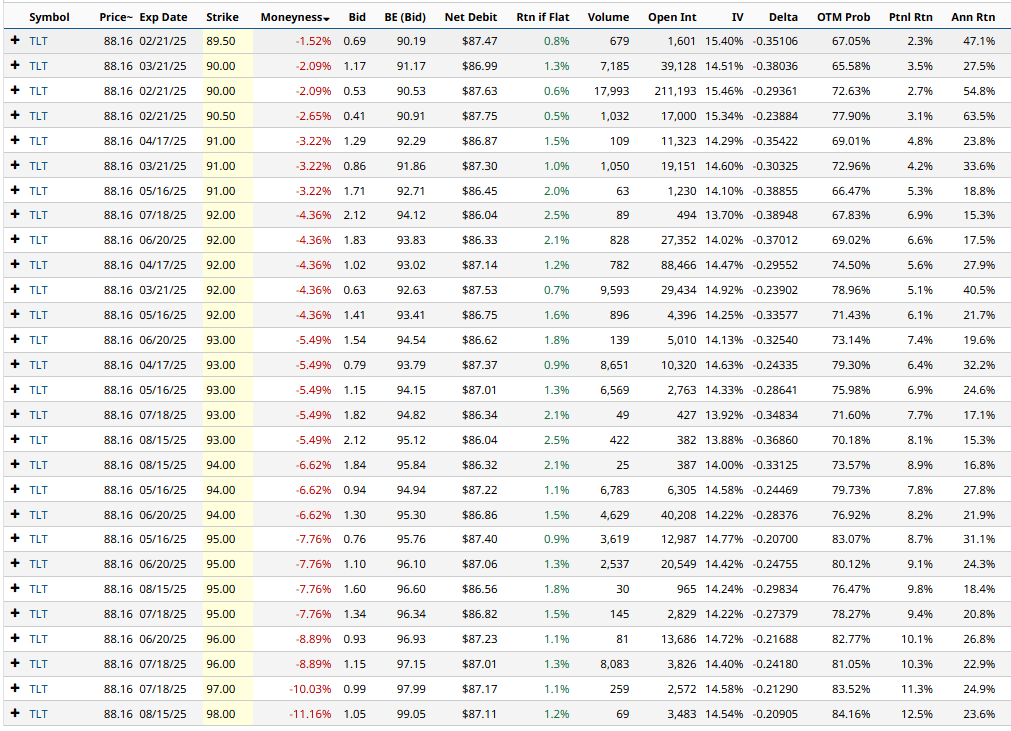

When running the Covered Call Screener for TLT, we find the following results:

Let’s evaluate the first TLT covered call example. Buying 100 shares of TLT would cost $8,816. The February 21, $89.50 strike call option was trading yesterday for around $0.69, generating $69 in premium per contract for covered call sellers.

Selling the call option generates an income of 0.79% in 18 days, equalling around 16% annualized. That assumes the stock stays exactly where it is. What if the stock rises above the strike price of $89.50?

If TLT closes above $89.50 on the expiration date, the shares will be called away at $89.50, leaving the trader with a total profit of $203 (gain on the shares plus the $69 option premium received). That equates to a 2.32% return, which is 47.06% on an annualized basis.

Let’s look at another example, this time using a further out-of-the-money call which provides less income but allows for more capital appreciation.

Instead of the February $89.50 call, let’s look at the $90.50 call. Selling the February $90.50 call option for $0.41 generates an income of 0.47%, in 18 days, equalling around 9.47% annualized.

If TLT closes above $90.50 on the expiration date, the shares will be called away at $90.50, leaving the trader with a total profit of $275 (gain on the shares plus the $41 option premium received).

That equates to a 3.1% return, which is 63.5% on an annualized basis.

Of course, the risk with the trade is that the TLT might drop, which could wipe out any gains made from selling the call. Traders that think bond yields will continue to rise (and prices drop) would not enter this trade.

Barchart Technical Opinion

The Barchart Technical Opinion rating is an 88% Sell with an Average short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

Implied volatility is at 14.58% compared to a 12-month low of 10.82% and a 12-month high of 20.50%.

The implied volatility rank is 38.85% and the IV percentile is 59%.

TLT currently yields around 4.26% annually.

Profile

The iShares 20 plus Year Treasury Bond ETF seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities greater than twenty years.

Bond investments are a common component of most investment portfolios, but they have suffered significant capital losses recently. Using covered calls can increase the yield component of your bond investments.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.