Lowe’s (LOW) is rallying on Tuesday, up about 2.5% at last check, after the home-improvement chain reported fiscal-first-quarter earnings before the open.

It’s been a bumpy ride for Lowe’s, and that might continue.

The report was less-than-inspiring.

The retailer delivered a top- and bottom-line beat, while revenue and same-store sales fell 5.5% and 4.3% year over year, respectively. And management lowered its earnings outlook and same-store-sales forecast for the full fiscal year.

Don't Miss: Amazon Stock Has Done Well -- and Now Investors Can Buy the Dip

Shares of Lowe’s fell almost 4% at one point on May 16, after Home Depot (HD) also issued disappointing guidance. But Lowe’s stock ended lower by just 1.1% that day, then jumped 4% in the next session, ending a five-day skid and erasing all those losses.

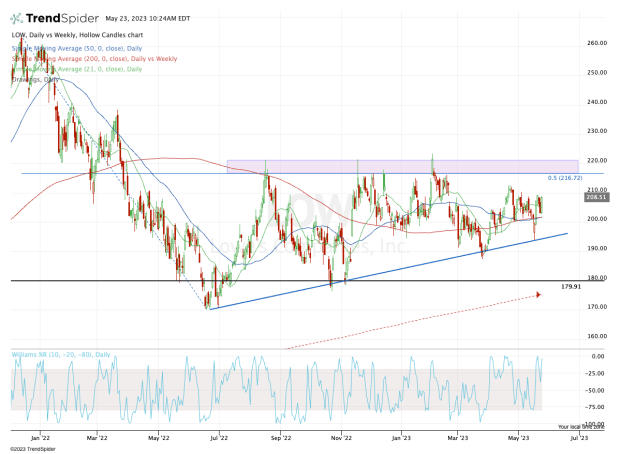

Since then, the shares have bounced between $200 and $210, and investors have been looking for a larger move. Let’s look at the chart for some clarity.

Trading Lowe’s Stock on Earnings

Chart courtesy of TrendSpider.com

Traders tend to find positive reactions to bad news as bullish price action. That can be a difficult takeaway, however, especially when guidance is disappointing.

I see the setup in Lowe’s stock as straightforward. It clears resistance or it doesn’t.

In the short term, that means clearing the $210 area and the April high at $212.50. And the much tougher level to clear is up at $220.

After a painful fall from the $260s down to the $170 area, Lowe’s stock retraced half those losses by rallying to $216.72 in August.

Since then the shares have struggled in the $216 to $220 area, delivering several false breakouts in the process.

For the bulls to feel truly comfortable on the long side, they’ll need to see Lowe’s clear this zone.

Don't Miss: Tesla Stock: About to Run Out of Charge or Heading to $200?

That said, the bulls can also use the downside to navigate the stock.

For instance, bullish traders with a long position will need to see $200 hold as support. If Lowe’s breaks below $200, the stock will have broken below the post-earnings low as well as the 50-day and 200-day moving averages.

That would open the door down to uptrend support (blue line), as well as the current May low at $193.59.

Below the 2023 low of $187.44 and the 200-week moving average could be in play.

For now, though, keep an eye on $200 on the downside and $212.50 on the upside.

Our Memorial Day sale is on now! Get exclusive investing insights from TheStreet’s premium products. Learn more.