Lowe’s Companies, Inc. (NYSE:LOW) reported better-than-expected earnings for the second quarter on Wednesday.

Adjusted diluted EPS rose 5.6% to $4.33 from $4.10, topping analyst estimates of $4.24. Quarterly sales reached $23.96 billion, compared with $23.59 billion a year earlier, and came in slightly above Wall Street’s estimate of $23.96 billion. Comparable sales increased 1.1%.

Lowe’s updated its fiscal 2025 guidance to reflect the ADG acquisition. It now expects total sales of $84.5 billion to $85.5 billion, raised from $83.5 billion to $84.5 billion, and ahead of analyst estimates of $84.28 billion.

"This quarter, the company delivered positive comp sales driven by solid performance in both Pro and DIY," said Marvin R. Ellison, Lowe's chairman, president and CEO. "In June, we closed on the acquisition of ADG, which strengthens our ability to capture a greater portion of Pro planned spend and expands our reach into the new home construction market."

Lowe’s shares gained 0.3% to close at $257.14 on Wednesday.

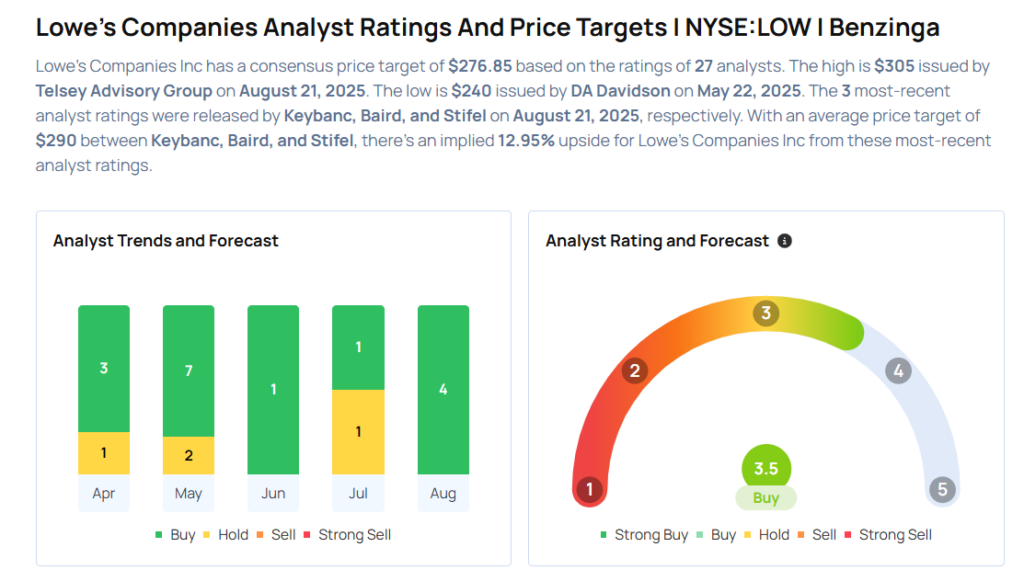

These analysts made changes to their price targets on Lowe’s following earnings announcement.

- Piper Sandler analyst Peter Keith maintained Lowe’s with an Overweight rating and raised the price target from $269 to $294.

- Stifel analyst W. Andrew Carter maintained the stock with a Hold and raised the price target from $265 to $275.

- Baird analyst Peter Benedict maintained Lowe’s with an Outperform rating and raised the price target from $285 to $295.

Considering buying LOW stock? Here’s what analysts think:

Photo via Shutterstock