It’s a sign that’s impossible to ignore. As you soon as you pull up the Price Overview for Recursion Pharmaceuticals (RXRX), you’re greeted with a clear message: Barchart’s Technical Opinion indicator rates RXRX stock as a 72% Strong Sell. From an empirical perspective, suggesting a contrarian position would place you on shaky ground.

Since the start of the year, RXRX stock is down nearly 28%, which in many respects is understandable given the uncertainties associated with the broader healthcare ecosystem. A clinical-stage biotechnology firm, Recursion focuses on innovations tied to biology, chemistry, automation, data science and engineering. However, with question marks surrounding drug pricing and other matters, even major pharmaceuticals like Eli Lilly (LLY) and Pfizer (PFE) have failed to deliver the goods for shareholders this year.

What’s just as problematic for RXRX stock is that it hasn’t really enjoyed (on a consistent basis) the general run-up in the equities space since early spring. Notably, in the trailing six months, RXRX is down 25%. Granted, much of the red ink can be tied to the choppiness of the security. With a share price of just under five bucks at time of writing, most people would likely consider Recursion to be a penny stock.

Obviously, such entities are incredibly risky. At the same time, if enough people bet against them, a counterintuitive move may also materialize.

Right now, the short interest of RXRX stock stands at 31.55% of its float. Essentially, this means that roughly two-thirds of the pool of publicly available shares are linked to short transactions. To be clear, not every short position is entered into because the trader is bearish. Mechanically, though, all shorts are credit-based transactions.

As such, the lending creditor (broker) that provided the shares that were shorted must be made whole. That’s the essence of the tail risk that drives the dreaded short squeeze.

How Investors Can Plan for a Possible Spike in RXRX Stock

In risk management, you’re not really hoping for disaster to strike but you also need to understand the probability of devastation occurring. That’s the main goal behind insurance companies’ use of catastrophe modeling, which asks a simple question: what’s the probability that losses exceed X?

However, rather than attempting to calculate the financial risk of a hurricane touching down and wreaking havoc, we can adapt cat modeling for the equities market: given a specific signal or milestone, what’s the probability that the target stock price exceeds X by week N?

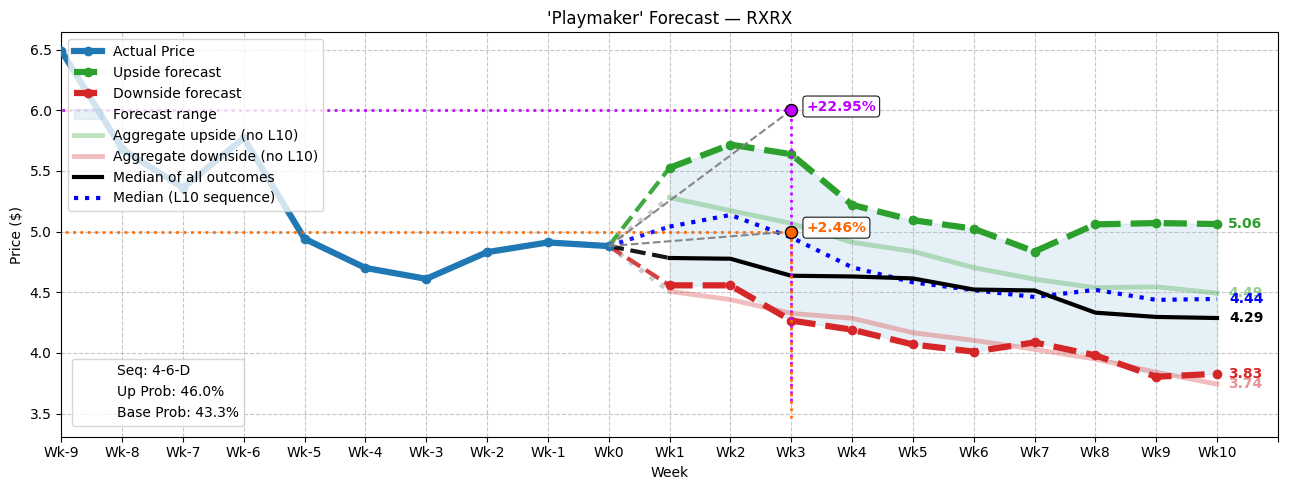

In the trailing 10 weeks, RXRX stock printed a 4-6-D sequence: four up weeks (calculated as the difference between Monday’s open and Friday’s close), and six down weeks, with an overall negative trajectory. At first glance, this sequence doesn’t seem particularly promising. Of the 37 times that the signal flashed on a rolling basis since Recursion’s April 2021 initial public offering, RXRX has only been up eight times 10 weeks later.

Put another way, the exceedance probability of RXRX stock (under the conditional probability of the 4-6-D sequence) is only 21.62% at 10 weeks out. That’s statistically poor — and if it weren’t for the short-squeeze potential, Recursion would be a no-go.

However, past analogs show that in the first four weeks following the flashing of the aforementioned sequence, the median price of conditional outcomes (that is, outcomes tied to the 4-6-D sequence) is higher than the median price of all outcomes. What’s more, the conditional median is projected to be above RXRX stock’s Wednesday closing price of $4.88 during the first three weeks — in other words, a dead-cat bounce.

It goes without saying that as a bullish investor, you want your quantitative trading signal’s 50th percentile to be as high as possible.

At the Week 3 marker — which coincides with the monthly options chain expiring Oct. 17 — the sequential median is projected to land at approximately $4.95. Statistically, half of outcomes associated with the 4-6-D sequence are calculated to be above $4.95 and half below. Strategically, this area may serve as a benchmark to place a vertical spread’s breakeven point.

From there, you can address where to place the second-leg strike price target, depending on your individual risk-reward profile.

Looking at a Specific Trade for Recursion

To get a better idea of the “true” upside and downside potential of the 4-6-D sequence, I plotted two additional pathways: one showcases the median pathway when the first week is positive and the other when the first week is negative. Historically, when the bulls engage RXRX stock following the sequence flashing, the buy-ins tend to be unusually aggressive in the early weeks.

My speculation? With the heightened short interest, RXRX stock may pop higher than normal.

Aggressive traders may then want to consider the 4.50/6.00 bull call spread expiring Oct. 17. This transaction involves buying the $4.50 call and simultaneously selling the $6 call, for a net debit paid of $50 (the most that can be lost in the trade).

Should RXRX stock rise through the second-leg strike price ($6) at expiration, the maximum profit is $100, a payout of 200%. Breakeven for this transaction is at $5, which is just a nickel away from the previously mentioned sequential median. This may provide some measure of relative safety while allowing you to stretch for a massive payout.

.jpg?w=600)