Elon Musk‘s strategy to leverage resources across his business empire, including Tesla Inc. (NASDAQ:TSLA), SpaceX, and xAI, has sparked investor concerns, particularly after a recent controversy involving chatbot Grok.

What Happened: Musk is promoting a ‘Muskonomy’ strategy that would allow investors to invest in his various businesses, which include SpaceX, X, xAI, and The Boring Company, reported Business Insider. He has even promised to prioritize “longtime shareholders” if any of his companies go public. This strategy could potentially help Tesla meet its AI demands for autonomous driving by leveraging resources across Musk’s other companies.

Check out the current price of TSLA stock here.

However, this strategy carries notable risks. For example, Grok's recent controversy over anti-Semitic content on X has raised alarms about incorporating the chatbot into Tesla's electric vehicles. Additionally, Musk's move last year to redirect a $500 million shipment of Nvidia (NASDAQ:NVDA) chips—originally meant for Tesla—to X and xAI triggered concern among investors. Musk defended the move, saying it was beneficial for Tesla as the company lacked the infrastructure to utilize the chips at the time.

Analyst Gadjo Sevilla from EMARKETER, expressed concern about Musk’s strategy of “cannibalizing one business to prop up another one could take its toll.” This could potentially delay innovation at Tesla, warned the analyst.

Meanwhile, Garrett Nelson, senior VP and equity analyst at CFRA Research, pointed out that other companies usually conduct the interplay under “one corporate umbrella.” However, with Musk, “the relationship and interplay between his private companies and a public company (Tesla)” is the key distinguishing factor.

See Also: Bitcoin, XRP, Dogecoin Dip But Ethereum Outperforms After Inflation Report – Benzinga

Why It Matters: Musk’s ‘Muskonomy’ strategy comes at a crucial time for Tesla, which is currently facing an identity crisis. Musk recently announced that Tesla shareholders would vote on a potential investment in his AI venture, xAI, raising questions about whether Tesla is evolving into an AI-fueled tech conglomerate.

While veteran investor Gary Black suggested that a shareholder vote would be the fairest way to decide on a potential merger between Tesla and xAI, some are questioning Musk’s plans to sell xAI.

Musk has been vocal about his desire for Tesla to invest in xAI, but has left the final decision to the shareholders. Despite the potential risks, some analysts believe that xAI is worth the bet, as it could significantly benefit Tesla’s AI ambitions.

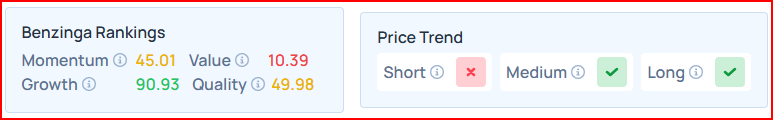

Benzinga's Edge Rankings place Tesla in the 50th percentile for quality and the 91st percentile for growth, reflecting mixed performance. Check the detailed report here.

READ MORE:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.