Lockheed Martin (LMT) just reported its third-quarter results, posting $18.6 billion in revenue and $1.6 billion in net earnings. Shortly after, management announced a 5% dividend hike, lifting the quarterly payout to $3.45 per share. This marks the 23rd year in a row the company has raised its dividend. The company’s consistency isn’t new, but the timing of its latest move couldn’t be sharper.

At the same time, global defense spending is set to climb to $2.69 trillion in 2025. That’s a 4.9% increase from last year. Countries are pushing harder to upgrade military technology and build out air power. These trends place Lockheed in a strong position as demand for its products ramps higher.

With shares trading near $490 and analysts projecting more moderate gains, investors face a familiar question. Does LMT stock still have enough spark for new buyers after this double dose of good news? Let’s find out.

LMT’s Recent Q3 Earnings Report

Lockheed Martin specializes in advanced aircraft, missile systems, cybersecurity solutions, and integrated defense technologies for governments worldwide.

Given its focus on mission‑critical programs, the company offers an annual dividend of $13.20, with a trailing yield of 2.61% and a forward yield pegged at 2.67%. The most recent dividend of $3.30 was paid on Sept. 2, with the next ex-dividend date marked for Dec. 1.

The stock is up 1% year-to-date (YTD), down 14% in the past 52 weeks, and currently trades at around $490.

The company’s total market value stands at $118.1 billion, trading at a price-to-earnings ratio of 17.03x compared to the sector median of 21.54x. This ratio moves to 17.89x forward, again below the sector’s 21.26x. The price-to-earnings-to-growth ratio is 1.74x, while the sector clocks in at 1.85x.

The October Q3 earnings report delivers clarity for investors. This quarter, sales reached $18.6 billion, a jump from $17.1 billion last year. It posted net earnings of $1.6 billion, or $6.95 per share, quite close to last year’s $6.80 per share. The cash from operations tallied $3.7 billion, surpassing the previous quarter’s $2.4 billion.

The free cash flow this time came in strong at $3.3 billion, compared to $2.1 billion a year earlier. This boost came from decreased working capital needs, thanks to the F‑35 Lots 18‑19 contract. It was driven further by lower tax obligations, resulting from the One Big Beautiful Bill Act.

High-Powered Contracts and Payouts Fuel Strength

Lockheed Martin just locked in a $720.1 million contract with the U.S. Army to build Joint Air-to-Ground Missiles (JAGM) and Hellfire missiles. The job will be done in Ocala, Florida, and is set to finish by September 30, 2028. This contract is a significant step, supporting key U.S. defense initiatives and also supplying NATO allies and partners such as the UK, Poland, Spain, Italy, and Canada. That’s not just extra revenue; it’s a reminder that Lockheed’s capabilities meet rising global military demand.

With the ink barely dry, the company’s total backlog climbed to a record $179 billion as of the third quarter. That’s coverage for more than two and a half years of future sales. A packed order book like that signals long-term visibility and certainty for investors. It helps support the company’s commitment to consistent returns.

Alongside the missile contract, Lockheed increased its share repurchase authority by $2 billion. That move brings the total buyback war chest to $9 billion and shows a strong focus on capital discipline. During the latest quarter, $1.8 billion went straight back to shareholders through a combination of dividends and share buybacks.

Analysts See Limited Room to Run

Lockheed Martin’s next earnings report will draw keen attention from investors, as the company’s projected earnings for the current quarter stand at $6.88 per share, slightly below last year’s $7.67. The upcoming quarter is estimated at $7.02 per share. For the full fiscal year 2025, analysts expect $22.25 in EPS, dropping from $28.47 in 2024.

The consensus expects 2025 to be a transition year, with earnings growth rates of -10.30% in Q4 and -21.85% for the full year. That reverses in 2026, with earnings growth projected to rebound, up 32.36%. The combination of defense contract wins and expanding cash flows suggests Wall Street is generally positive on the company’s medium-term outlook.

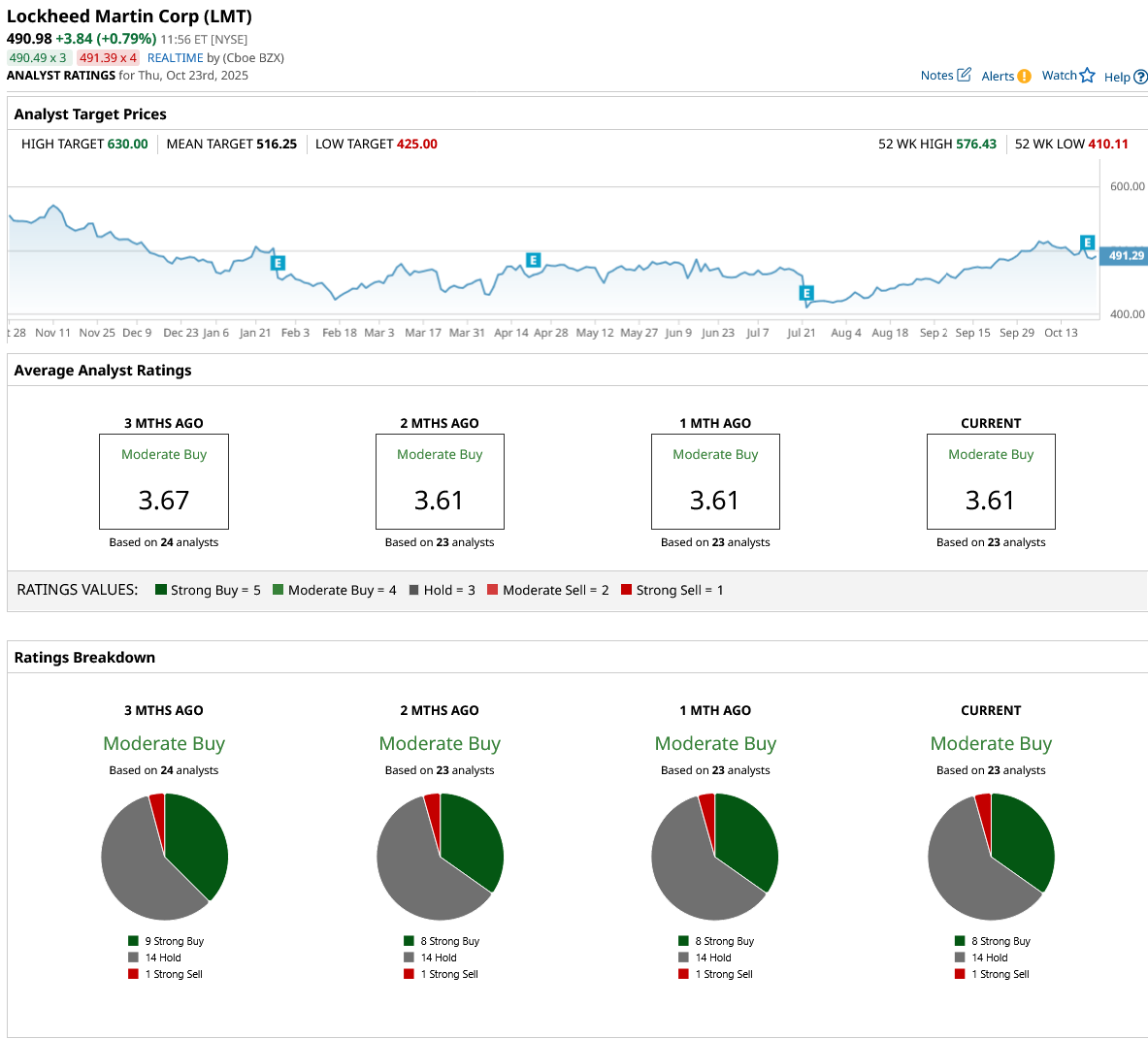

Digging deeper into analyst sentiment, the 23 surveyed professionals rate LMT stock as a consensus “Moderate Buy.” The average price target is $516.25. With the stock currently trading at $490, that target implies an upside of roughly 5% from current levels.

Lockheed Martin’s latest moves and strong core metrics definitely sweeten its case. With a growing backlog and higher dividends, the foundation looks solid. Analyst consensus points to moderate upside, and the stock has room to run. Most signs suggest shares will head higher as contract momentum and free cash flow improve. Presently, buying looks attractive for investors who want reliability and growth.