Defense giant Lockheed Martin Corp. (NYSE:LMT) has confirmed that the company is in discussions with the U.S. government about the architecture of President Donald Trump’s proposed “Golden Dome” missile defense system.

Check out the current price of LMT stock here.

What Happened: During its second quarter earnings call on Tuesday, the company said that it was involved in discussions with the U.S. government regarding the architecture of the proposed system, but CEO James Taiclet emphasized that

“There's no contracts out there. There's no bid proposals yet.”

“As soon as we have them, we're gonna be all in on those, and we are talking about architecture with the U.S. government as to how you might architect and lay something like this out over time,” he says.

Taiclet described Lockheed Martin as the “mission integrator with ReadyNow capabilities across all phases of the missile defense mission,” noting that systems such as PAC-3, THAAD, and Aegis were already performing in recent combat operations and could form the core of a domestic defense shield.

“These are the exact solutions needed to make Golden Dome for America a reality,” Taiclet said, referring to Lockheed's broad portfolio of integrated air and missile defense systems.

While there are no contracts yet, the company says that it is preparing for future demand. CFO Evan Scott said that the One Big, Beautiful Bill legislation incentivizes investment in domestic manufacturing, with a special focus tied to missile defense.

“We're getting ourselves ready to invest in additional manufacturing capacity,” Scott said. “The timing is very good.”

While Lockheed appears to lead this effort, company executives acknowledged that the program has yet to materialize in Lockheed's backlog in any meaningful manner. “They haven't announced anything yet that we can actually hang our hat on for backlog,” Taiclet said.

Why It Matters: Two months ago, Lockheed Martin referred to Trump’s Golden Dome project as a “Manhattan Project-scale mission, one that’s both urgent and crucial to America’s security.”

It was also dubbed one of three defense stocks that were set to shine due to the multi-billion-dollar government project, with costs estimated at over $175 billion.

“We clearly have a whole number of product lines that will contribute very well, that are going to fit very well with what is necessary to achieve the mission,” said Tim Cahill, president of Missiles and Fire Control at the company, nearly two months ago, while vying for a key role in the mission.

Lockheed Martin released its second-quarter results on Tuesday, reporting $18.16 billion in sales, missing consensus estimates at $18.63 billion. It posted a profit of $7.29 per share, significantly ahead of analyst estimates at $6.63 per share.

Price Action: Shares of Lockheed Martin were down 10.81% on Tuesday, trading at $410.74, following the company’s earnings release, and it is now up 0.98% after hours.

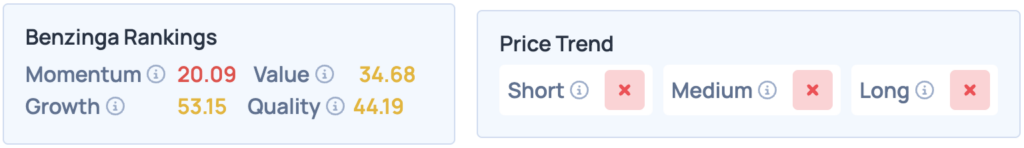

According to Benzinga’s Edge Stock Rankings, Lockheed Martin scores poorly across the board, and has an unfavorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo courtesy: JHVEPhoto / Shutterstock.com