The Australian share market has closed deep in the red, while markets across the region have also been hit after the Silicon Valley Bank collapse spooked investors and hit global bank stocks.

Earlier, a choppy session on Wall Street saw US bank stocks drop the most in 2.5 years.

Look back over the day's financial news and insights from our specialist business reporters.

Disclaimer: This blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Market snapshot at 4:30pm AEDT

By Stephanie Chalmers

- All Ordinaries: -1.5% to 7,201 points

- ASX 200: -1.4% to 7,008 points

- Australian dollar: -0.3% to 66.47 US cents

- NZ 50: -0.7% to 11,595 points

- Nikkei 225: -2.2% to 27,215 points

- Hang Seng: -1.6% to 19,385 points

- Shanghai Composite: -0.8% to 3,244 points

- Brent crude: -1% to $US79.94/barrel

- Spot gold: -0.6% to $US1,901/ounce

NAB still tips two more RBA interest rate hikes

By Stephanie Chalmers

Markets are winding back expectations of interest rate rises in Australia and globally, particularly in the wake of the Silicon Valley Bank failure and concerns about any contagion effect.

But National Australia Bank economists are still expecting the RBA to hike rates at its next two meetings.

NAB senior economist Brody Viney says the bank's closely-watched business survey highlights the resilience of the Australian economy.

Business conditions remained strong despite a fall in confidence among firms.

Brody Viney says since it's still three weeks til the RBA's next meeting, they have plenty of time to watch the fallout of the SVB situation and dissect incoming data.

Watch the full interview with Alicia Barry here:

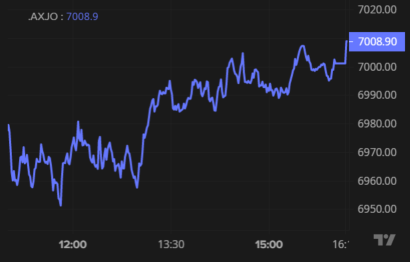

Australian share market ends in red but off lows

By Stephanie Chalmers

The Australian share market fell sharply at the open and remained deep in the red for the duration of today's session.

A small relief though — at one point the All Ordinaries and the ASX 200 were down more than 2 per cent, but they closed closer to 1.5 per cent lower in the end.

As you can see here, things improved in afternoon trade:

Every sector of the market ended in negative territory, with just 27 out of 200 stocks on the benchmark index managing a gain.

The losses in Australia are fairly middle-of-the-road when looking around the region — there have been more modest declines in New Zealand and Shanghai, with heavier falls in Tokyo and Hong Kong.

A major contributor to the afternoon improvement was the major bank stocks clawing back some ground — Commonwealth Bank shares even managed to turn positive and end 0.2 per cent higher, while regional banks and financials posted heavier falls.

Technology stocks were also hard hit, while gold miners dominated the list of stocks that rose.

Australian regulators, Treasurer monitoring US bank collapse

By Stephanie Chalmers

Treasurer Jim Chalmers says he's closely monitoring the situation in the United States following the failure of Silicon Valley Bank, and any potential impacts here, alongside Australian regulators and government officials.

Yesterday afternoon, the Treasurer convened a meeting of banking regulator APRA, corporate regulator ASIC, the Reserve Bank and Treasury, as well as relevant government ministers, to get an update on the situation.

"Australians should be reassured that we have a resilient, well-capitalised banking system that has strong liquidity coverage," Mr Chalmers said in a statement.

"We will continue to work closely with our regulators, the tech sector, investors and the broader financial sector to understand the implications as the situation evolves, including the impact on Australian industry.

"While Australia is not immune from ongoing uncertainty in the global economy, our own economy and financial system are well placed in the face of these challenges."

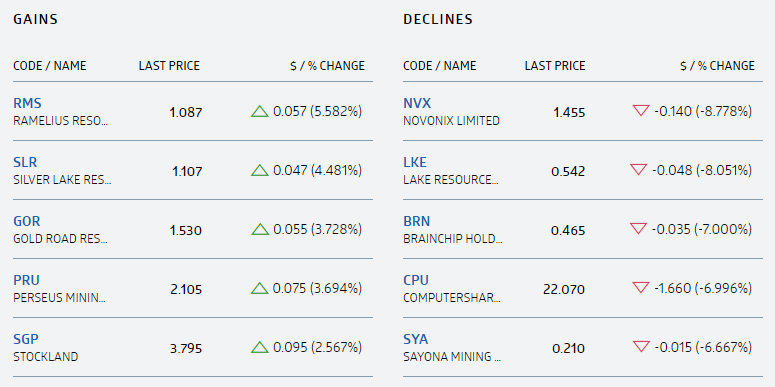

Best and worst performing stocks

By Stephanie Chalmers

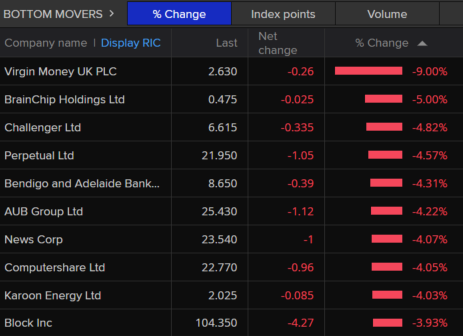

Not too long left in the session, so let's check in on the best and worst performers on the ASX 200:

As it's been for most of the day, gold miners are among the few stocks on the rise.

Bank stocks were heavily weighing on the broader market earlier in the session but have come off their lows, which has seen the All Ordinaries and the ASX 200 also recoup some losses — both indices are still down 1.5 per cent, it must be said.

Around the region, banks are amongst the biggest losers — Tokyo's bank index is down 5 per cent, putting it on track for its steepest drop in six months.

Bank shares are also declining in Singapore and Hong Kong.

Australian app accesses around $2m held with SVB

By Stephanie Chalmers

A positive update from a local tech firm caught up in the Silicon Valley Bank collapse.

ASX-listed company Tinybeans says it's been able to access the $US1.3 million (nearly $2 million) it had on deposit with SVB.

The Australian-founded family photo sharing app informed shareholders yesterday that it had funds held with the bank.

In an update today, Tinybeans says as of Monday US time, the funds have been made available, based on the announcements from regulators.

The stock jumped as much as 13 per cent on the news, to a near one-year high.

Market snapshot at 2:35pm AEDT

By Stephanie Chalmers

- All Ordinaries: -1.6% to 7,192 points

- ASX 200: -1.5% to 6,999 points

- Australian dollar: -0.3% to 66.44 US cents

- NZ 50: -0.5% to 11,613 points

- Nikkei 225: -1.9% to 27,302 points

- Hang Seng: -1.9% to 19,322 points

- Shanghai Composite: -1% to 3,235 points

- Brent crude: -1.3% to $US79.70/barrel

- Spot gold: -0.5% to $US1,904/ounce

Will we see a rate pause or rate cut based on SVB's collapse?

By Michael Janda

What about the feds interest rates? And the RBA? Will we finally see a pause or when a reduction in them?

- JJ

A good question from JJ.

The answer is that markets certainly think so.

Before last week's Reserve Bank meeting, another rate rise was priced in as all but a certainty.

But a change of language from RBA governor Philip Lowe, emphasised in a speech last week, and the latest financial market ructions now see rates on hold being the firm favourite for April.

Markets are pricing in a greater than 90 per cent chance of the RBA holding rates next week, with the next most popular bet being a rate cut (albeit at less than 10 per cent).

Likewise, while traders had bet on a 70 per cent chance of the Fed raising rates by half a percentage point next week, those odds are now on a quarter of a percentage point rise, with a 30 per cent chance of the US central bank staying on hold.

What a difference a few days and a bank collapse makes.

'Total panic': Are SVB and a few regional banks the only things the Fed will 'break'?

By Michael Janda

Huge moves and volatility on the markets today.

While the share market falls are grabbing most of the headlines, it's actually the bond market where the really dramatic action is taking place.

Rabobank's Michael Every with his take:

"Total panic, with 2-year US bond yields falling the most in one day since Volcker, eclipsing declines seen post-2008, 9/11, and 1987.

"That's what we got yesterday despite President Biden saying the banking system was fine, the Fed saying the same, the FDIC [Federal Deposit Insurance Corporation] backstopping depositors, and every bank analyst saying there is no systemic risk.

"Regardless, small banks were hammered not just in the US but globally, large banks given a kicking to boot, and everyone bought bonds."

When investors rush to buy bonds it pushes their prices up and the yield (or interest rates) on them down — coincidentally the first question Ross Gittins asked me in a job interview many, many years ago.

With Australia's market heavily weighted to banks, especially the big four banks, it's no surprise that the local indices have been off more than 2 per cent at points today (the ASX 200 is currently down 1.6 per cent).

IG's Tony Sycamore says the collapse of Silicon Valley Bank and associated fallout to other regional banks "provides yet another example that the Fed will tighten until something breaks."

"The ASX financial sector accounts for about 28.8% of the ASX200. The big four, CBA, NAB, Westpac, ANZ, and Macquarie Bank, account for a 23.5% weighting in the ASX200 alone.

"Until the dust settles in the U.S, investors will continue to ask questions of all banks."

The other thing investors are questioning is whether this now means a pause, or even the end, of the interest rate rise cycle.

More from Tony Sycamore:

"A potential banking crisis threat trumps high inflation any day of the week.

"Reflecting the repricing of the Fed's priorities, 2-year yields in the U.S. are trading at 4% from 5.08% last week.

"After being 70% priced for a 50bp [basis points] rate hike last week, there is now just 12bps priced for the upcoming FOMC meeting.

"In Australia, the interest rate market is almost fully priced for a 25bp RBA rate cut by July."

Michael Every doubts that financial markets will get what they wish for.

"The financial economy that produces 'assets' is not the real economy that produces goods and services.

"The first is in trouble because of rising rates and a lack of hedging. The second is not doing as well as some might say either: but is seeing high inflation.

"If rates are not to address this then, as a political realist, there is nothing to stop inflation other than saying 'what goes up must come down'. And, of course, assets can then only go up.

"Maybe central banks will pivot [to cutting rates]. If so, don't expect me, or markets, to take anything they say seriously again. More likely, there is a mismatch between the financial-economy's screaming and what central banks think the *real* economy requires."

Customers of collapsed US banks waiting at branches

By Stephanie Chalmers

Customers of the collapsed Silicon Valley Bank, as well as the New York-based Signature Bank, have waited outside bank headquarters and branches for answers about their funds.

Regulators and US President Joe Biden are trying to reassure customers that their deposits are safe, but many are still concerned about their immediate cash flow.

ABC North America correspondent Barbara Miller has the latest:

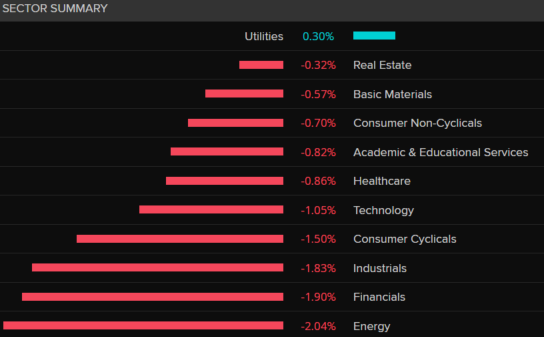

All sectors on the slide

By Stephanie Chalmers

The losses have only become more broad as the session has gone on — gold miners are really the only bright spot so far this session.

Here's how the sectors are stacking up at lunchtime:

Market snapshot at 12:25pm AEDT

By Stephanie Chalmers

- All Ordinaries: -1.9% to 7,170 points

- ASX 200: -1.9% to 6,974 points

- Australian dollar: -0.2% to 66.51 US cents

- NZ 50: -0.8% to 11,575 points

- Nikkei 225: -2.2% to 27,239 points

- Brent crude: flat at $US80.79/barrel

- Spot gold: -0.1% to $US1,910/ounce

Volatility in business confidence continues

By Stephanie Chalmers

NAB's business survey shows the confidence of firms turning negative in February, continuing what NAB economists call a recent period of volatility.

That's despite conditions remaining at historically strong levels, despite declining one point in the month.

Conditions in the retail sector rose most strongly, offset by a decline in the wholesale and construction sectors.

Business confidence fell 10 points, after rising into positive territory last month.

The fall was driven by wholesale, recreation & personal services, and finance, business & property.

Here's what NAB economists make of the result:

"Overall, the survey confirms the ongoing resilience of the economy through the first months of 2023 despite high inflation and the ongoing pass-through of higher interest rates to households.

"While we expect inflation likely peaked in Q4, price growth remains elevated and the survey suggests that while global goods-side pressures have abated somewhat, there has been less evidence of easing in services-side pressures.

"NAB continues to expect a more material slowdown in demand, but this will likely come later in 2023 when the full effect of rate rises has passed through."

Business confidence and conditions decline

By Stephanie Chalmers

We've just had the NAB business survey for February released and here are some initial headline figures:

- Business conditions declined marginally but remain strong

- Business confidence has turned negative

More details shortly as we take a look through that release

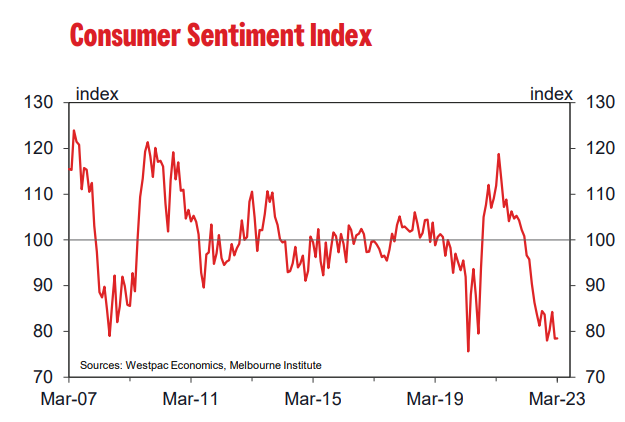

Sentiment remains near 30-year lows: Westpac

By Stephanie Chalmers

The Westpac consumer sentiment report doesn't make for rosy reading — phrases featured include 'bleak', 'starting to wane', 'takes a tumble', 'weakest level since 1989'… and that's just in the summary.

While the headline result initially looked somewhat okay, or at least, not as bad as it could've been — the details are pretty weak.

The index was unchanged in March, so no further deterioration but that leaves consumer sentiment near historical lows at 78.5.

"Index reads below 80 are rare, back-to-back reads even rarer," says Westpac chief economist Bill Evans.

"Indeed the COVID shock and the Global Financial Crisis saw only one month of sentiment at these levels."

What's behind the negativity? Expectations for family finances and the broader economy over the year ahead both declined, as did whether it is now a good time to buy a major household item.

Assessments of current finances versus a year ago improved marginally, but off a low base.

And people are feeling better about the economic outlook over the next five years.

The overall effect was sentiment left unchanged.

Interestingly, expectations for house prices continued to lift, despite the recent run of interest rises and expectations there are more to come.

The house price expectations index hit an 11-month high, and that contributed to a further decline in views on whether it's a good time to buy a dwelling, as hopes of improved affordability fade.

Consumer sentiment steady in March

By Stephanie Chalmers

People seem to have taken heart from last week's indications that the Reserve Bank could be close to pausing its interest rate hikes.

Accord to the Westpac-Melbourne Institute monthly index, consumer sentiment was unchanged in March.

That's following a 6.9 per cent fall in February.

More details to come

Mostly one-way traffic on ASX

By Stephanie Chalmers

In case there was any doubt about market sentiment, just 13 of the top 200 stocks are on the rise this morning.

Taking a look at the worst performers on the benchmark index so far, there are a fair few financial stocks lagging, with tech and energy also in the mix:

On the flipside, it's mainly gold miners on the up as investors look for a safe haven from the volatility:

Market snapshot at 10:20am AEDT

By Stephanie Chalmers

- All Ordinaries: -1.5% to 7,199 points

- ASX 200: -1.5% to 7,001 points

- Australian dollar: flat at 66.61 US cents

- Dow Jones: -0.3% to 31,819 points

- S&P 500: -0.15% to 3,855 points

- Nasdaq: +0.5% to 11.188 points

- FTSE: -2.6% to 7548 points

- CAC: -2.9% to 7,011 points

- EuroStoxx 50: -2.1% to 3,773 points

- Brent crude: flat at $US80.77/barrel

- Spot gold: -0.2% to $US1,910/ounce

- Iron ore: +1.8% to $US131/tonne

Red across the boards in early trade

By Stephanie Chalmers

We're just minutes into the session on the Australian share market and… it's not looking too crash hot.

The major banks are all down more than 1 per cent so far, some losing around 2 per cent, and the regional banks are also in the red, after heavy losses across the global banking sector.

Energy stocks are dragging after a sharp drop in oil prices.

That leaves the ASX 200 down 1.2 per cent at 10:10am AEDT.

Here's how the sectors are tracking in very early trade:

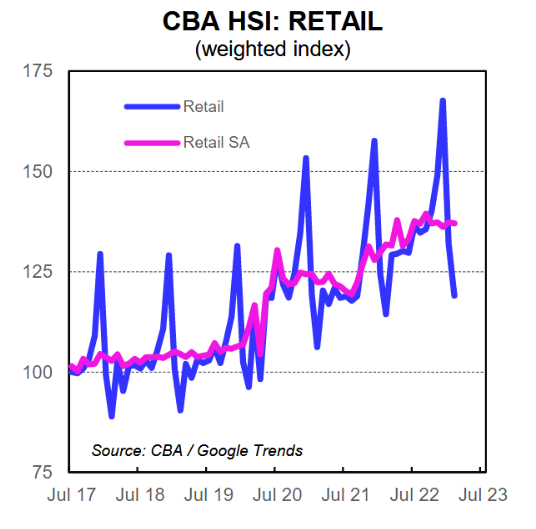

Household spending intentions slow

By Stephanie Chalmers

In what's unlikely to be news to anyone dealing with rising home loan repayments, increasing rent and climbing grocery bills, people are intending to slow down their spending.

The Commonwealth Bank Household Spending Intentions index for February showed a small decline (-0.1%) in the month, while in seasonally-adjusted terms, it was up just marginally.

It follows a 6.8 per cent monthly fall in January and sees the annual increase in the HSI slow to 4.5 per cent.

Looking specifically at retail spending intentions, they fell sharply over January and February, which isn't unexpected after Christmas — taking seasonal factors into account, they're fairly flat over the past few months.

Here's what CBA senior economist Belinda Allen makes of it:

"Higher prices are playing a key role, as is the slowing consumer environment given the material lift in interest rates since May 2022.

"With the RBA not quite finished lifting the cash rate and the lagged impact of rate rises still to come we would expect to see the HSI index weaken in coming months as consumer spending slows."