The International Monetary Fund has cut its growth forecast for the global economy in 2023 amid the war in Ukraine, financial turmoil, and three years of COVID-19.

And the Australian share market has ended higher ahead of key US consumer inflation numbers out overnight.

Disclaimer: this blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Markets snapshot 4:15pm AEST

By Sue Lannin

All Ordinaries: 7,539 (up 0.5%)

ASX 200: 7,344 (up 0.5%)

Australian dollar: 66.65 (up 0.2%)

Nikkei 225: 28,114 (up 0.7%)

Hang Seng: 20,361 (down 0.6%)

Shanghai Composite: 3,323 (up 0.3%)

Dow Jones: 33,685 (up 0.3%)

S&P 500: 4,109 (down 0.2%)

Nasdaq Composite: 12,032 (down 0.4%)

FTSE 100: 7,786 (up 0.6%)

DAX: 15,655 (up 0.4%)

CAC 40: 7,391 (up 0.9%)

Brent crude:$US85.78 a barrel (up 0.2%)

Spot gold:$US2,017 an ounce (up 0.7%)

Iron ore: $US119.50 a tonne (up 1.7%)

Bitcoin: $US29,934 (down 0.5%)

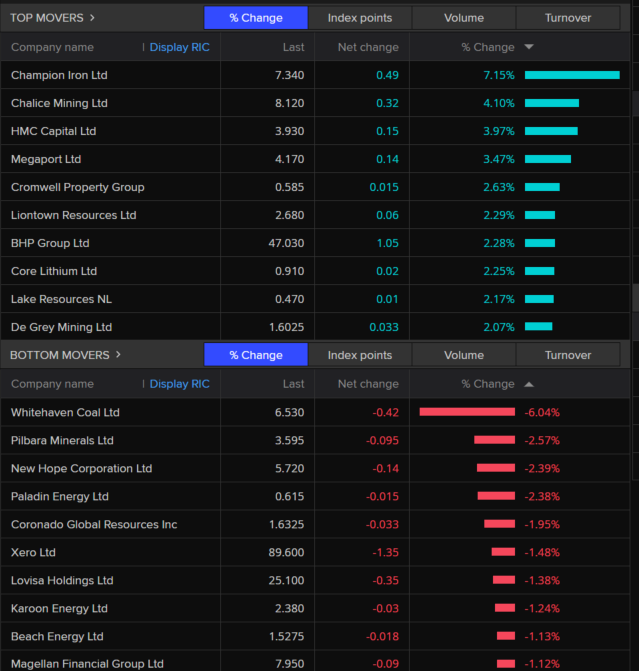

ASX 200 movers

By Sue Lannin

The ASX 200 made modest gains as investors await tonight's consumer inflation data out of the US.

Here's the best and worst performers on the benchmark index.

Iron ore miners drive Australian shares higher

By Sue Lannin

The Australian share market has increased for the 10th time in 11 sessions.

The ASX 200 held onto its gains and finished up 0.5 per cent to 7,344, while the All Ordinaries index also rose 0.5 per cent to 7,539.

Stronger iron ore prices boosted miners as operations at Port Hedland in north west Western Australia were disrupted by the approach of Tropical Cyclone Ilsa.

BHP (+1.8 per cent), Rio Tinto(+2.6 per cent), and Fortescue Metals (+1.6 per cent) all gained ground.

Smaller African focused iron ore miner Champion Iron jumped 7.2 per cent.

Technology firm NEXTDC (+8.2 per cent) did the best on the ASX 200 index, while lithium firm Pilbara Minerals (-3.8 per cent) did the worst.

Markets snapshot at 3.15pm AEST

By Sue Lannin

All Ordinaries: 7,536 (up 0.4%)

ASX 200: 7,341 (up 0.4%)

Australian dollar: 66.71 (up 0.3%)

Nikkei 225: 28,076 (up 0.6%)

Hang Seng: 20,351 (down 0.6%)

Shanghai Composite: 3,327 (up 0.4%)

Dow Jones: 33,685 (up 0.3%)

S&P 500: 4,109 (down 0.2%)

Nasdaq Composite: 12,032 (down 0.4%)

FTSE 100: 7,786 (up 0.6%)

DAX: 15,655 (up 0.4%)

CAC 40: 7,391 (up 0.9%)

Brent crude:$US85.67 a barrel (up 0.1%)

Spot gold:$US2,017 an ounce (up 0.7%)

Iron ore: $US119.50 a tonne (up 1.7%)

Miners do the heavy lifting on the ASX

By Sue Lannin

There's around an hour to go of trade on the local market, and the ASX 200 is holding onto its gains, despite a mixed night on Wall Street.

Miners are holding up the market with slightly more sectors in the green, than in the red.

Education, banks and energy stocks are leading the losers.

Technology firm NEXTDC (+8.3 per cent)is doing the best on a strong rise in customer contracts at its new data centre in Sydney, while lithium miner Pilbara Minerals (-3.;5 per cent).

How scammers are using AI to trick you

By Sue Lannin

Artificial intelligence is increasingly being used by scammers to trick people.

My colleague Tom Williams explains how criminals are using voice cloning, phishing and technologies like ChatGPT to steal identities.

IMF says high risk of mortgage defaults in Australia

By Sue Lannin

The International Monetary Fund says the level of risk in Australia's housing market is the second-highest in the developed world.

The IMF has downgraded its global economic growth outlook to 2.8 per cent this year raising fears of an economic downturn.

Here's my colleagues Kate Ainsworth and Gareth Hutchens with more:

Markets snapshot at 2pm AEST

By Sue Lannin

All Ordinaries: 7,535 (up 0.4%)

ASX 200: 7,340 (up 0.4%)

Australian dollar: 66.70 (up 0.3%)

Nikkei 225: 28,097 (up 0.6%)

Hang Seng: 20,364 (down 0.6%)

Shanghai Composite: 3,329 (up 0.5%)

Dow Jones: 33,685 (up 0.3%)

S&P 500: 4,109 (down 0.2%)

Nasdaq Composite: 12,032 (down 0.4%)

FTSE 100: 7,786 (up 0.6%)

DAX: 15,655 (up 0.4%)

CAC 40: 7,391 (up 0.9%)

Brent crude:$US85.60 a barrel (steady)

Spot gold:$US2,018.29 an ounce (up 0.8%)

Iron ore: $US119.50 a tonne (up 1.7%)

ACCC chair says merger laws benefit takeovers

By Sue Lannin

The boss of the competition regulator has called for reforms to merger laws saying that the current laws are tilted too much towards potentially anti-competitive takeovers.

The Australian Competition and Consumer Commission chair Gina Cass-Gottlieb told the National Press Club that Australia's merger laws need to be toughened to protect competition.

“I am concerned that consumers and the Australian economy are particularly exposed in the current environment of uncertainty and vulnerability from supply chain pressures, geopolitical issues and the climate change transition,” Ms Cass-Gottlieb said.

"Australia’s current merger regime is not well placed to deal with these issues.”

The ACCC boss said that Australia’s current laws prohibit mergers that are likely to result in a substantial lessening of competition.

But parties are not required to notify the competition watchdog of planned mergers, or to wait for ACCC clearance before they complete the merger.

This means that the ACCC must apply to the Federal Court to have the merger halted or unwound if parties do not abandon or revise transactions that the ACCC considers are anti-competitive.

“The ACCC needs to have the tools necessary to be able to properly scrutinise and, if necessary, prevent mergers that are likely to substantially lessen competition,” Ms Cass-Gottlieb said.

“Without these tools, some markets are particularly vulnerable to being adversely affected by further consolidation."

" In particular, markets that already have large incumbents with positions of market power and markets where it is difficult for new rivals to enter.”

The ACCC wants law changes to bring Australia in line with other OECD countries and has submitted its plan to the Federal Treasurer Jim Chalmers.

A formal clearance model would mean that merger parties would need to convince the ACCC that the proposed transaction is not likely to substantially lessen competition.

The Australian Competition Tribunal would have the ability to review ACCC decisions.

What does the ACCC want?

The ACCC also wants a legal requirement for the watchdog to be notified about mergers that meet specified materiality thresholds, a requirement that these transactions be suspended without ACCC clearance and a “call in” power for the ACCC to scrutinise transactions that don’t meet the notification threshold but still raise competition concerns.

“We are finding that businesses are pushing the boundaries of the informal regime."

" Given that there are no up-front information requirements for an informal review, merger parties are increasingly giving us late, incomplete, or incorrect information,” Ms Cass-Gottlieb said.

“An increasing number are threatening to complete their transaction before we have finalised our review."

She said this leads to the situation where the ACCC has to negotiate with the companies in order to obtain enough information and time to carry out the review.

“In global transactions, we often find that merger filings in other regimes that require mandatory clearances are prioritised over our voluntary informal regime."

"This has hamstrung the ACCC’s ability to assess mergers and prevent potentially anti-competitive mergers,” Ms Cass-Gottlieb said.

For instance, the ACCC boss said the regulator was not able to assess the planned merger between Faceboook owner Meta and gif creation website Giphy, which was later abandoned.

Ms Cass-Gottlieb also called for mandatory codes of conduct for major digital platforms, which would control misconduct in relation to influencers, harmful practices, scams and fake reviews.

Iron ore shipments halted as TC Ilsa crosses WA

By Rachel Pupazzoni

TC Ilsa has forced the world's largest bulk export port to shut down.

Pilbara Ports Authority (PPA) is sending all ships waiting to berth at the Port Hedland Port in Western Australia, out to sea.

The port is our biggest exporter of iron ore, it shipped 38.8 million tonnes of iron ore in February.

It will be empty of all ships by 1pm WST today and won't resume operations until the cyclone all clear has been given - that's expected some time on Friday.

So for the next 36 hours or so, our biggest export operation will be out of action.

The port normally exports eight to 10 ships full of iron ore in every 24 hour period.

The final three ships still berthed at the port are being loaded and will be sent out to sea within the next hour.

BHP, FMG and Roy Hill all export their iron ore from the Port Hedland Port.

The PPA said it typically expects to shut down for a cyclone once a season, so this is not particularly unusual.

But the last time the Port Hedland Port was forced to halt operations was when TC Veronica passed, in March 2019.

A spokesperson from the PPA said the port at Dampier, near Karratha, is being monitored, but it's unlikely it will need to be shut down.

Read more about TC Ilsa from my colleagues on the ground.

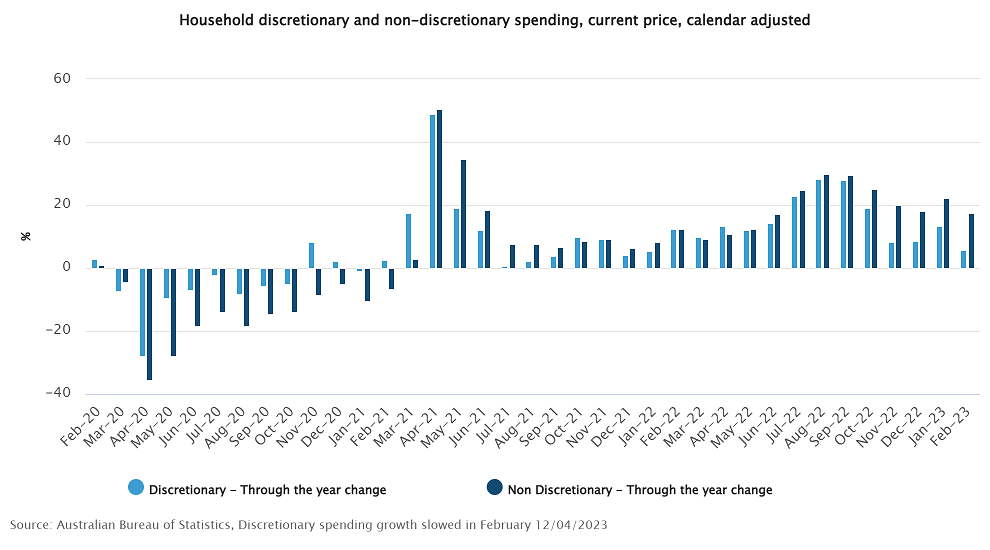

Households spend big, but growth moderates

By Michael Janda

New official and private sector figures show Australian households are proving much more resilient to rising interest rates than many feared.

Australian Bureau of Statistics data show that households spent 11.8 per cent more in February than they did at the same time a year ago.

Although this was the weakest growth since March last year, with a drop off in discretionary spending growth.

"Spending on discretionary goods and services rose 5.8 per cent, the smallest through-the-year percentage growth since January last year, as households continued to adjust to cost of living pressures," said ABS head of business indicators Robert Ewing.

"Non-discretionary spending recorded a larger rise of 17.5 per cent, as households spent more on transport and food."

The ABS noted that the overall increase in household spending was driven by hotels, cafes and restaurants (+25.9 per cent) and transport (+25.7 per cent).

Spending on food rose 12.8 per cent, the highest through-the-year percentage rise since March 2020, partly reflecting higher grocery prices.

If you take out the effect of inflation, which was 6.8 per cent over the year to February, and population growth likely to be around 2 per cent, then real per capita spending didn't increase by nearly as much as the headline suggests.

A survey of a thousand adults by investment bank UBS showed that consumers were moderating their spending plans, but most were not drastically cutting back yet.

"Australian consumers still expect spending growth to remain quite strong over the next 12 months," the bank's economists and analysts reported.

"However the survey indicates a turning point, with this quarter's results showing the largest moderation in years."

Lower and middle income earners are expected to cut back most dramatically, based on their survey responses.

"There is a widening gap between high-income vs lower-income earners," UBS noted.

"High income earners (>$120k) remain most optimistic on spending, income growth, savings, home purchases, home renovations, travel and vehicle spending.

"Middle-income earners have joined lower-income earners in revealing a significant increase in cost-of-living pressures.

"The survey showed pain concentrated amongst low-income earners (<$48k), who remain outright negative on their financial outlook. Q1 results show low-income earners expect their income to contract over the coming 12 months, while their expectations on savings remain at their most negative on record."

UBS retail analysts have looked at the numbers to form views on which listed-stocks may hold up best in the consumer spending downturn.

"The less affluent are more impacted by cost of living pressures with mortgage/rental stress another headwind, with the affluent less exposed," they noted.

"Young consumers benefit from the tight labour market while cost of living pressures can be shared with family; older consumers are likely to be home owners & enjoy higher interest rates.

"Middle aged consumers have the greatest spending burden, are more exposed to household debt & have exhausted their excess household cash savings buffer."

UBS has a buy rating on Lovisa Holdings, Metcash, Treasury Wine Estates, Universal Store Holdings and Wesfarmers.

It has a sell on Harvey Norman due to its skew towards selling big ticket items and declining market share.

Interestingly, the UBS findings tally quite neatly with Australia Institute research that shows most income gains over the past decade have gone to the top 10 per cent of income earners, reported on by my colleague Dan Ziffer.

Whitehaven Coal lowers production forecast

By Sue Lannin

Whitehaven Coal (-4 per cent) shares have slipped after it lowered its annual production forecast because of staff shortages, and other issues including bad weather at its Maules Creek mine in New South Wales.

Australia's biggest independent coal miner expects run of mine coal production to come in between 18 million to 19.2 million tonnes of coal for the 2023 financial year.

That's down from its previous forecast of between 19 million and 20.4 million tonnes.

"Labour shortages are being felt across the business, but the impact of several additional operational constraints at Maules Creek meant its production only increased by 9 per cent relative to the December quarter," the company told the ASX.

"This lower than planned increase reflects labour constraints, congestion arising from limited dumping locations, while keeping manned and unmanned fleets separate, and intermittent weather interruptions in the month of March."

IMF: Australian economy faces dire straits

By Sue Lannin

Here's more from my colleague Peter Ryan on ABC News Channel on what could be a bleak year for the Australian economy according to the International Monetary Fund.

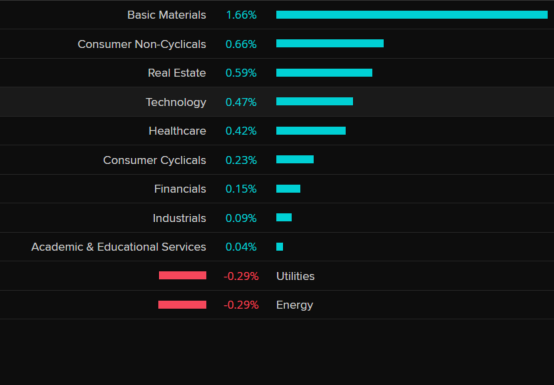

ASX 200: best and worst sectors

By Sue Lannin

Here are the sectors that are moving the market this morning. Miners are doing the best, while utilities and energy stocks are doing the worst.

ASX 200 Movers and Shakers

By Sue Lannin

Here are the stocks that are moving the ASX 200 index, Australia's top 200 listed companies, today:

Treasurer says Australia may avoid a recession

By Sue Lannin

And here's Federal Treasurer Jim Chalmers talking to the ABC's Patricia Karvalas on RN Breakfast this morning about the IMF's recession warning:

Australian market opens higher

By Sue Lannin

In the first few minutes of trade, the ASX 200 index is in the green, following yesterday's stellar more than 1 per cent rise.

The ASX 200 is up 0.4 per cent to 7,340, while the All Ordinaries index has put on 7,533.

Nearly all sectors are higher in early trade, with miners, real estate, healthcare, and banks leading the way.

Tupperware in trouble as recession looms

By Sue Lannin

This is a real blast from the past in the present.

Remember those Tupperware parties that your Mum held when you were a kid to buy and sell cooking products and food storage containers.

Well, Tupperware Brands in big trouble now after experiencing a pandemic resurgence, as everyone worked from home and made sourdough.

Tupperware shares fell by half on Monday to a record low after the company said last week that it had hired financial advisers to help it secure financing and "remediate doubts regarding its ability to continue as a going concern", (translation: it's very bad when a company says something like this because it means it may go under).

"The Company has concluded that there is substantial doubt about its ability to continue as a going concern for at least one year from the expected issuance date of its Form 10-K financial statements."

"Accordingly, management also expects that the report of the Independent Registered Public Accounting Firm that will accompany the audited consolidated financial statements for the year ended December 31, 2022 will contain an explanatory paragraph expressing substantial doubt about the Company’s ability to continue as a going concern."

Its shares regained a small amount of lost ground overnight.

The 77 year old company wants investors to help bail it out, so it can avoid being delisted (kicked off) the New York Stock Exchange.

"Tupperware Brands Corporation (the “Company”) received a notice from the New York Stock Exchange (the “NYSE”) indicating the Company is not in compliance with Section 802.01E of the NYSE Listed Company Manual as a result of its failure to timely file its Annual Report on Form 10-K for the year ended December 31, 2022 (the “Form 10-K”) with the Securities and Exchange Commission (the “SEC”)."

Tupperware made a loss of $US35 million ($53 million) over the last few months of 2022, rattling investors who were expecting a profit.

Sales have tumbled from nearly $US500 million ($751 million) in the fourth quarter of 2020 to just over $US300 million ($470 million) in the last quarter of last year.

It also said last month that its network of direct sellers was down by nearly one fifth last year compared to 2021.

I note that Tupperware Australia is having a sale on snack food containers.

Here's Tupperware's statement to the US securities regulator, the Securities and Exchange Commission.

Global recession fears increase

By Sue Lannin

Here's the ABC's senior business correspondent Peter Ryan with his take on the IMF's new World Economic Outlook:

Global markets overnight

By Sue Lannin

Global stocks were mainly higher and bond yields edged higher overnight as traders anticipate that interest rates will peak soon.

That's even as the market bets that the US Federal Reserve will increase borrowing costs again in May to tame inflation.

US stocks were mixed, but the FTSE 100 and the Dax gained in Europe.

Pharmaceutical firm Moderna lost ground after the company said its closely watched flu vaccine failed to meet the criteria for "early success" in a late stage trial.

First quarter earnings season kicks off on Friday with results from banking giants JP Morgan Chase, Citigroup, and Wells Fargo.

Gold climbed above $US2000 per ounce again as the greenback came off its peak.

Investors are eagerly awaiting tomorrow's US consumer inflation data.

Economists surveyed by Reuters expect core inflation to rise 0.4 per cent last month, and 5.6 per cent on an annual basis.

Oil prices rose even though Chinese inflation data pointed to persistently weak demand.

The yield on the two year US treasury bond rose 2.7 basis points to 4.035 per cent, double the Fed's inflation target of 2 per cent.

South Korea's central bank held rates steady for a second consecutive meeting yesterday, while the Bank of Canada is also expected to leave rates unchanged tomorrow.

Bitcoin touched a fresh 10-month high at $US30,438 per digital coin, before pulling back.

Reuters