The share market almost added almost 1 per cent today after foreign stockmarkets jumped following the US and UK governments seeking to reassure markets of the stability of the global financial system. The US Federal Reserve will give its view of the economy overnight on Wednesday, Australian time, when it meets to consider interest rates.

Catch up on all the business news stories as they happened.

Disclaimer: this blog is not intended as investment advice.

Live updates

While we're sleeping

By Rachel Pupazzoni

That's it for today, thanks for joining me.

Tonight on The Business you'll see my colleague Nassim Khadem's story about Australian businesses caught up in the Silicon Valley Bank crisis and what lasting impacts the collapse of the bank could have on the financial system.

Daniel Ziffer is also on the show, looking at what APRA and others are doing to prevent a similar collapse here.

Of course, the BIG NEWS will be overnight - what will the US Fed do? Broad consensus is a 0.25 per cent hike.

Kathryn Robinson will unpick what could happen with chief economist from T Row Price, Blerina Uruci.

Of course, we'll have all the washup of the Fed's decision on the blog tomorrow - and what that might mean for us.

Catch you next time.

How it all ended

By Rachel Pupazzoni

We've come to the end of another day of trading on the ASX.

So let's see how it all ended up.

The top 200 added 62.20 points or 0.87 per cent to close out the session at 7,015.60.

But it's been a rough week or so.

The index has lost 0.75 per cent for the last five days, and is virtually unchanged over the year to date.

Back in January we had the best start to a year ever with the ASX 200 soaring - that's all gone now.

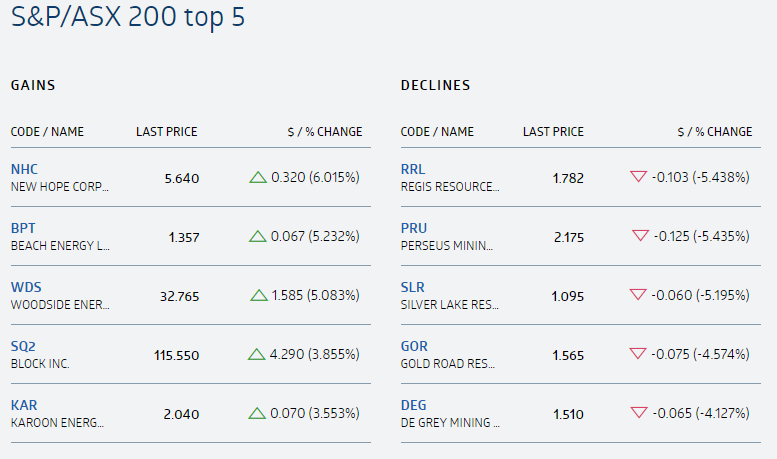

Here are the best and worst performers on the index today.

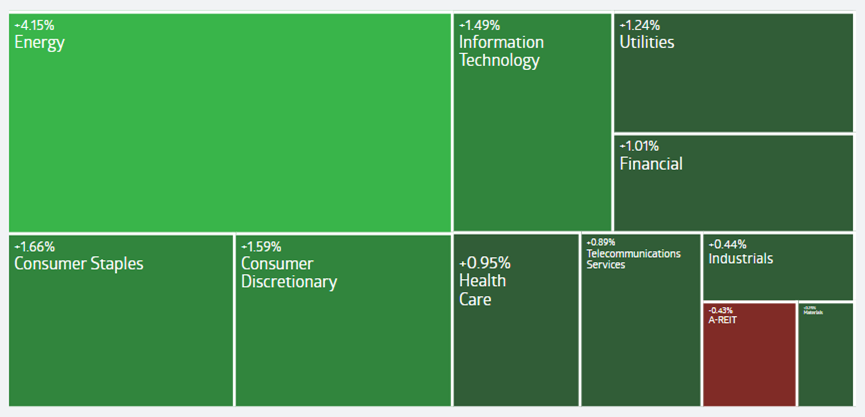

And sector-wise, it was almost a clean sweep of green.

The broader All Ordinaries paints a similar picture.

It added 58.50 points or 0.82 per cent to close at 7,200.70.

It is also virtually unchanged since the start of the calendar year.

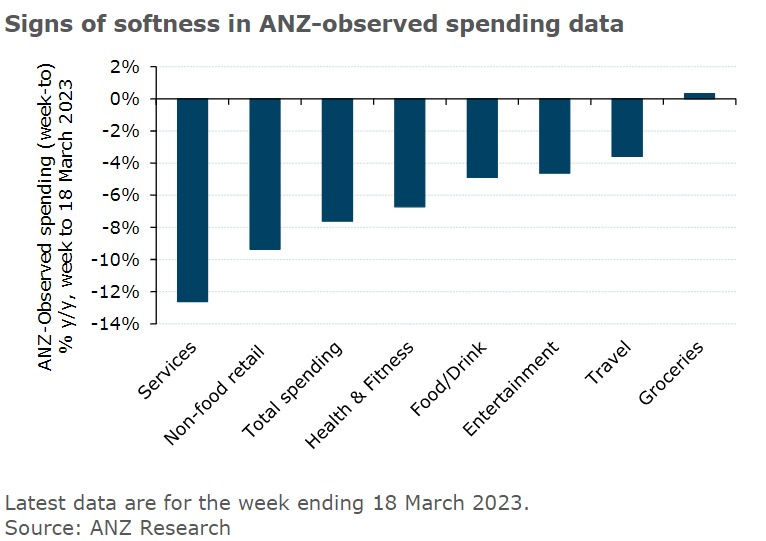

ANZ data shows spending is down in March

By Rachel Pupazzoni

We'll get the ABS retail trade numbers on Monday, but the big banks also monitor sales on their eftpos terminals.

ANZ shows broad based decline in spending in March.

"Spending is down 7.5% y/y in the week to 18 March, while average daily spending is down 6.2% y/y in the month of March," economists Madeline Dunk and Adelaide Timbrell wrote in their note.

"The fall has been driven by a drop in non-food retail (ie shopping).

However discretionary services categories such as entertainment and travel, which have performed exceptionally well throughout 2023, are also down.

This suggests the long-anticipated spending slowdown may be starting to come through.

Our base case expectation is for spending momentum to slow through 2023, as households juggle the impacts of rising rates and high inflation."

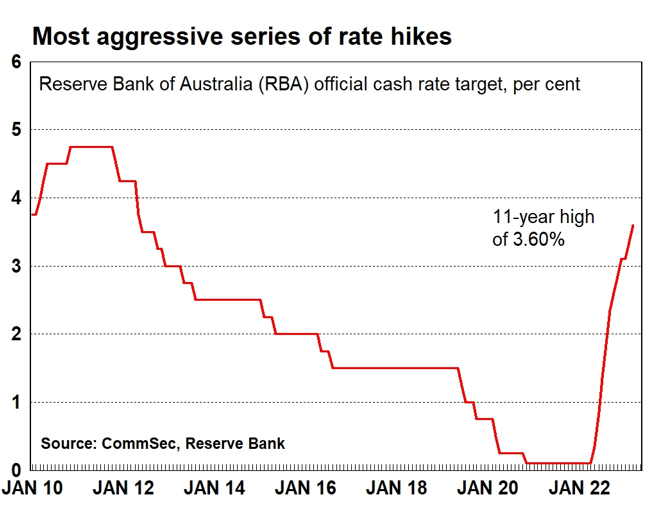

How we spend our money will also be a key indicator for the RBA when it meets on April 4 to determine if it will list the cash rate above its current 3.6 per cent.

Final countdown

By Rachel Pupazzoni

There's about an hour or so of trade left on the ASX.

Here's a snapshot of the top and bottom movers at this stage.

The list is topped by energy, with cola producer New Hope, Beach Energy and Woodside adding more than five per cent to their share price.

The other end of the scale are all gold producers.

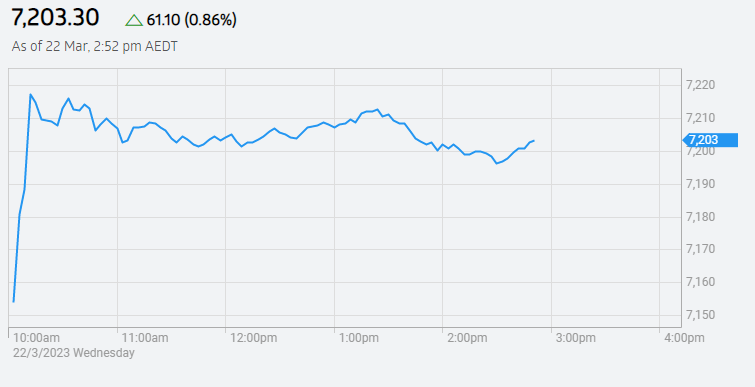

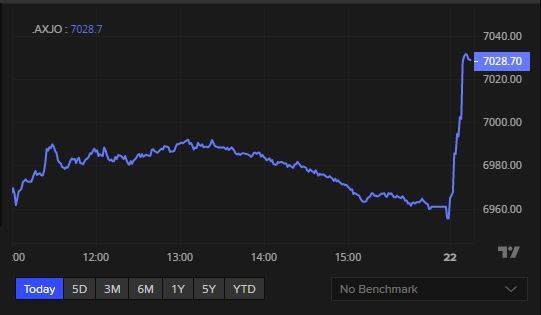

Here's what the ASX 200 chart is looking like shortly before 3pm AEDT.

And here's the broader All Ordinaries.

Both are almost one per cent in front.

1 in 200 homeless

By Rachel Pupazzoni

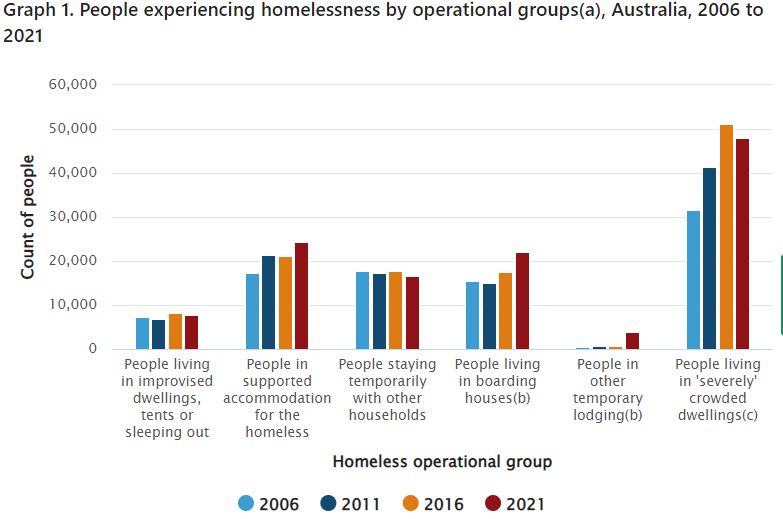

Here's a stat from the 2021 census that caught my attention.

The ABS has published some data from the census that showed 122,000 people were homeless on census night.

That's 1 in 200 people.

Though ABS head of homelessness statistics, Georgia Chapman, said it's fewer than the 2016 census.

"Measures to reduce the spread of COVID-19 throughout 2021 contributed to some of the changes in the homelessness data that we've released today.

"During the 2021 Census, we saw fewer people 'sleeping rough' in improvised dwellings, tents or sleeping out, and fewer people in living in 'severely' crowded dwellings and staying temporarily with other households.

"However, we saw more people living in supported accommodation for the homeless, boarding houses and other temporary lodgings, such as a hotel or motel."

Most of them were men, with 68,000 experiencing homelessness, while the number of women experiencing homelessness increased by about 10 per cent from 2016 to almost 54,000.

Has inflation peaked?

By Rachel Pupazzoni

Ah, the question we all want an answer to.

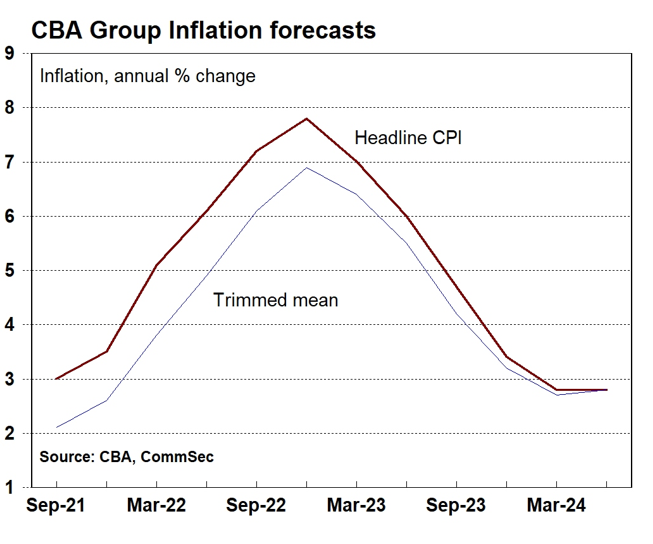

We might get it next week when the Australian Bureau of Statistics releases its monthly CPI data for February.

The January monthly read shows CPI at 7.4 per cent for the 12 months to January.

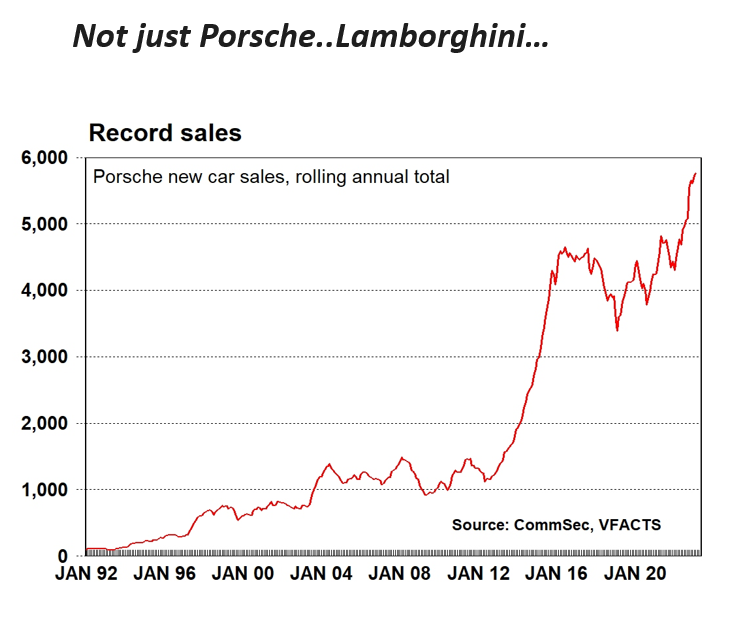

I was at a presentation with CommSec chief economist Craig James to accounting firm RSM this morning, and he showed us this chart, about where the nations' biggest lender thinks inflation is headed.

Looking at that chart, inflation appears to have peaked.

If that's true, the Reserve Bank may just pause when it meets in two week's time. Watch this space.

Which would be welcome relief to some, after the sharp increase to rates.

Though, according to Craig James' presentation, interest rate hikes and rising inflation haven't hurt fancy car sales.

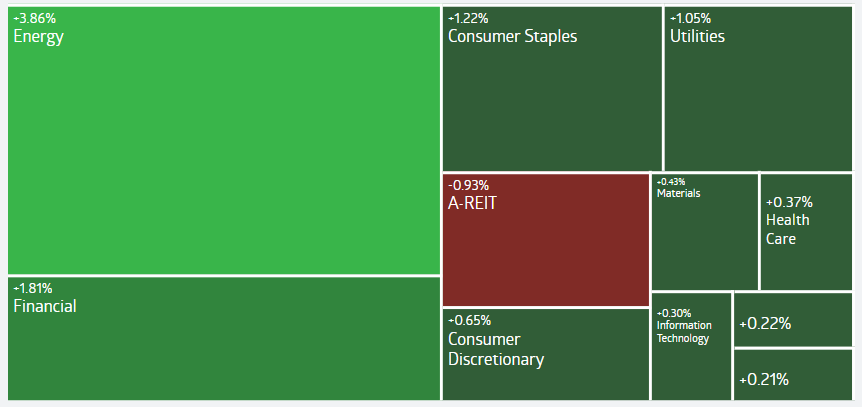

Market sector snapshot at 1.20pm AEDT

By Rachel Pupazzoni

Ten of the 11 sectors are higher along with the S&P/ASX 200 Index in lunchtime trade.

Energy is the best performing sector, gaining 3.86% and rebounding from its recent decline.

For context, the energy sector is off 1.00% lower across the past five days.

Our biggest export, iron ore, to fall this year

By Rachel Pupazzoni

Iron ore has been on a wild rise these last few years - it nudged $US240 a tonne back in May 2021, before falling to about $US80 last November.

Today it's been between about $US130-$US140 a tonne.

Vivek Dhar, Commonwealth Bank's commodities analyst, thinks it'll fall to about $US100 by the end of this year.

That's still higher than the $55 a tonne price the federal government bases its budget estimates on - and also still delivers the likes of Rio Tinto, BHP and FMG a sizable margin on the amount it costs them to dig and ship iron ore from the Pilbara.

Here's part of a note Mr Dhar put out this morning.

"Pent-up demand, linked to the re-opening of China's economy at the end of last year, is likely to keep iron ore prices well supported in H1 2023.

Subdued levels of steel and iron ore stockpiles should support iron ore prices in the short term as well."

But that won't last.

"Current policy settings suggest that China's steel demand impulse should ease through 2023.

However, a deepening financial crisis in advanced economies could be the trigger for China to deploy more infrastructure stimulus as China's economic growth target of 5% in 2023 comes under threat."

He says coking coal, a critical steel making component, will also see prices fall as demand slips in China.

"We expect premium coking coal spot prices will decline through 2023 on expectations that export supply will outpace import demand.

Export growth will be led by Australia, Mongolia and the US.

An increase in global coking coal imports will likely need India's coking coal import demand to offset lower imports from advanced economies and China this year.

It's a tough ask given India accounts for 20-25% of the world's coking coal imports."

Hello

By Rachel Pupazzoni

Hi there, Rachel Pupazzoni subbing in for Dan who has passed the markets blog baton on to me.

I'll be keeping you company until the close of trade.

I've turned comments on, click the blue box at the top to submit your questions and I'll do my best to answer them.

Top movers, but not a golden day for miners

By Rachel Pupazzoni

As noted earlier, energy stocks are pumping, with most of the big increases in companies exposed to commodity prices.

Except for one type of commodity... gold.

Australian gold stocks fell by as much as 4.3% and are set for their worst day since November if losses continue.

Gold prices dropped about 2% yesterday as Treasury yields jumped and worries eased over the banking crisis - which prompted some investors to return to riskier assets. (Gold is, and has been for thousands of years, considered a 'safe' asset).

Newcrest Mining is our largest gold miner, it's down as much as 3.3% to $24.950

Northern Star Resources fell by as much as 5.8% to $10.97.

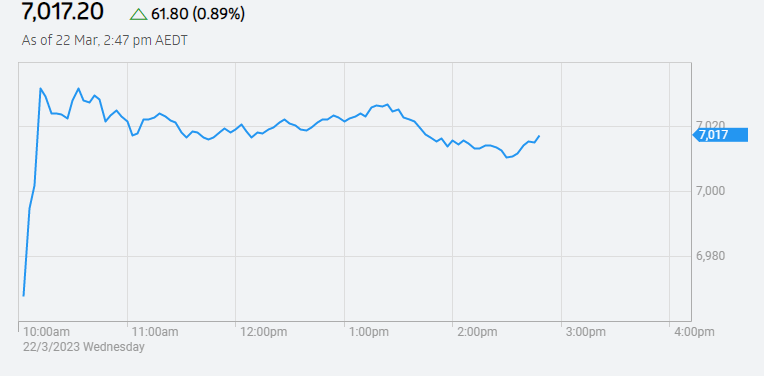

The market at 12.30 AEDT

By Daniel Ziffer

The ASX 200 is at 7,020.800 at 12.30 AEDT, up 0.9% in morning trade.

The Australian dollar is buying 65.400 of a US dollar.

The GFC and now? Different, says the former Finance Minister

By Daniel Ziffer

Nick Sherry was finance minister when the Australian economy shuddered through the global financial crisis (GFC).

Now the chair of TWUSUPER, a a not-for-profit industry super fund for the transport and logistics industry, he joined host Kathryn Robinson on 'The Business' to explain what happened then... and why the issues now are different.

Energy has energy

By Daniel Ziffer

The energy sub-index of the Australian stock market is up 3.6% today, and set for biggest intraday percentage gain since October 2020 if it holds through the day.

Globally, oil prices rose more than 2% overnight with the rescue of Swiss banking giant Credit Suisse somewhat allaying concerns of a banking crisis that would hurt economic growth and cut fuel demand.

- Woodside Energy Group has been up as much as 5.1% today. It's currently $32.54 (+4.35%).

- Oil and gas producer Santos is up 3.1% to $36.9

Overall the energy index is down 10.3% this year as yesterday's close, against a 1.2% fall on the benchmark ASX200 index.

The strength of the energy market - largely powered by fossil fuels - is in contrast to yesterday's news about the need for a rapid shift to renewable energy if the world's climate is to be kept at a level that prevents catastrophic impact.

- with Reuters

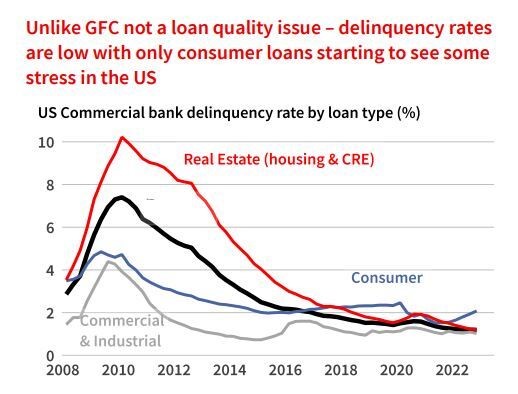

The GFC again? Not yet, as banks shuddering for different reasons

By Daniel Ziffer

A common questions is: will this 'moment' be the GFC II?

The global financial crisis (GFC) in 2008/09 occurred for a lot of reasons, but a key one was the sub-prime mortgage market.

Watch or read 'The Big Short' for a better understanding of what went wrong.

Masses of higher-risk, lower-value home loans were wrapped together and regraded as a higher quality asset. But when there were problems - and growing numbers of people unable to pay the mortgage - the reality was quickly made clear and banks with a big exposure to the 'assets' got crunched.

It became a global contagion as confidence slumped. (The Australian share market took more than a decade to recover to where it had been before).

People are understandably concerned about a repeat, but what we have now are different problems. This graph from NAB shows problem loans in the US right now.

There are certainly issues in the global financial environment right now. But they're 2023 ones, not 2008 ones.

Latitude uncovers 'further evidence of large scale' data theft

By Emilia Terzon

The non-banker lender hinted at this on Monday.

It's now confirmed its ongoing review of the cybersecurity incident on its systems this month is worse than originally thought.

It had already confirmed the data of around 330,000 customers was stolen in the hack, largely drivers licences but also Medicare and credit card numbers.

Here's the update:

While to the best of our knowledge no compromised data has left Latitude’s systems since Thursday 16 March 2023, regrettably our review has uncovered further evidence of large-scale information theft affecting customers (past and present) and applicants across Australia and New Zealand.

Our people are working urgently to identify the total number of customers and applicants affected and the type of personal information that has been stolen.

We appreciate how frustrating this latest development will be for our customers and we unreservedly apologise.

We will provide a further update once we have determined the full extent of the theft and we will contact all additional customers and applicants affected as soon as we can.

It has said its call centre is back online.

Reserve Bank to 'reconsider' pausing interest rate hikes

By Daniel Ziffer

The released minutes from the meeting of the Reserve Bank board suggests there might be relief for borrowers who've seen the steepest ever climb in interest rates. This video explains more, it's short enough to watch on a coffee break.

If you're not into that, maybe you'd like a Kohler.

ASX markets open, up

By Daniel Ziffer

The ASX 200 has rocketed at opening trade, up 1%.

The index, which tracks the fortunes of our biggest listed companies was set to rise after overseas indicies lifted, but it's really off to a start... this is yesterday's trading, with the hike on the right showing you trade since 10:00am AEDT today.

Why SVB is VBP (very big problem) for the world's banking system

By Daniel Ziffer

Great article from my colleague Nassim Khadem that unwinds the issues flowing from the collapse of Silicon Valley Bank (SVB) the 16th biggest bank in the US.

It all happened... fast.

"It's scary when you realise how fragile things are. A bunch of group chats — people texting each other — can cripple one of the USA's top 20 largest financial institutions overnight; it's alarming."

SVB was the biggest bank failure since the global financial crisis of 2008. The loss of confidence it created has roiled markets since, as First Republic and Credit Suisse - with similar issues - have hit the rocks.

Big news coming

By Daniel Ziffer

Lots on for today, but some big news you'll have by this time tomorrow too...

- UK consumer price index data is out tonight our time. What will we learn about inflation? The last reading of the cost of living was that it was rising at 10.1% annually (year to January) having hit a high of 11.1% on the previous read (October 2022).

- The most powerful central banker in the world, Jerome Powell, chair of the US Federal Reserve will meet early tomorrow (Australian time) to nut out what to do with interest rates. It has consistently flagged they'll keep hiking them to tame inflation - but have the ripples of falling confidence in the global economy tempered that view? We'll know then.

Here's where we're sitting at 9.00am AEDT

By Daniel Ziffer

-

Aussie dollar: 0.6671 US cents

- Wall St: Dow Jones +1%, NASDAQ +1.6%, S&P 500 +1.3%

- In Europe: FTSE100 +1.8%, EuroStoxx +1.5%

- Asia: Hang Seng (Hong Kong) +1.4%, BSE Sentex (India) +0.7%, Nikkei (Japan) -1.4%

- Spot gold: US$1965.95 an ounce

- Brent crude oil futures: +1.7% to US$75.07 a barrel

- Bitcoin: US$42,099.13 +1.6%