Australia's share market has suffered its fourth consecutive day of losses, as falling property prices weighed on the real estate sector.

Domain lost nearly 10 per cent in value, and it's now seen a 50 per cent drop in its share price over the past 12 months.

The Bank of Japan also surprised markets when it announced plans to start becoming a bit more flexible with its yield curve control.

It saw the Japanese Yen strengthen against Australia's dollar, but Japan's share market suffered early losses.

Key events

Live updates

Market snapshot

By Sue Lannin

The ASX200 has seen losses for four days in a row now.

It finished today 1.54 per cent lower.

Of the 200 largest stocks on the stock exchange on Tuesday, only 13 stocks made gains. 186 lost value. One remained unchanged.

This is where the market finished at the close of local trade shortly after 4:00pm AEDT:

- ASX 200: down 1.54 per cent to 7,024

- All Ords: down 1.66 per cent to 7,199

- Australian Dollar: 66.38 US cents

- It followed last night's moves on Wall Street: Dow Jones down 0.49 per cent, S&P500 down 0.9 per cent, Nasdaq flat

- And Europe: FTSE 100 up 0.4 per cent

- Brent Crude: Up 0.1 per cent to $US79.85 a barrel

- Bitcoin: Up 1.14 per cent to $US16,780

Market snapshot

By Gareth Hutchens

Thanks for having me today. We'll see you back here tomorrow.

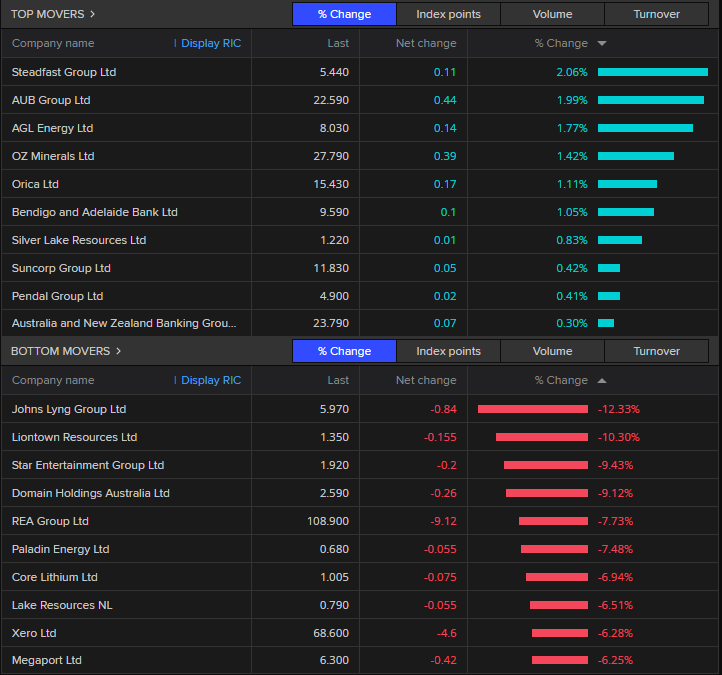

Top performers, worst performers

By Gareth Hutchens

As the market closes for the day and trades are settled, we've got the final numbers for the day.

Here are the top 10 and worst 10 performers.

Steadfast Group and AUB Group (both insurance brokers and underwriters) finished around 2 per cent higher.

AGL Energy, Oz Minerals, and Orica Ltd all gained between one and two per cent.

But the major activity occurred on the selling side.

Johns Lyng Group ended 12.3 per cent lower, followed by Liontown Resources (a battery metals exploration and development company), down 10.3 per cent, and Star Entertainment, down 9.4 per cent.

The real estate sector also suffered. Domain lost 9.1 per cent in value, and REA Group shed 7.7 per cent.

Former NSW Labor minister Ian Macdonald has been found guilty

By Gareth Hutchens

Former NSW Labor minister Ian Macdonald has been found guilty of wilful misconduct after granting a mining licence to a company run by ex-union boss John Maitland.

The former NSW resources minister was found guilty of two charges, while Mr Maitland was found not guilty of being an accessory to the offences.

You can read more here.

Johns Lyng Group down again

By Gareth Hutchens

The share price for Johns Lyng Group keeps declining.

It's now down 14.4 per cent, to $5.83 a share.

It follows news that the group's chief operating officer, Lindsay Barber, sold 4 million of his shares, worth around $27.2 million according to yesterday's closing share price.

It comes after CEO Scott Didier sold four million of his own shares in the company in October, worth around $25 million, when the share price was $6.25. He said it was to finance his move to the US.

The company's share price is now 33 per cent down year to date.

Japan's stock market drops, yen strengthens

By Gareth Hutchens

After gaining ground earlier in the day, Japan's Nikkei index has lost ground following the Bank of Japan's surprise announcement.

The Nikkei has slipped to 26,600 points, down 2.34 per cent.

But the Yen has jumped 3.3 per cent against the Australian dollar, to be worth A$1.12 (see below)

Japan central bank surprise move

By Gareth Hutchens

You'll notice how the ASX200 (Australia's public stock exchange) fell noticeably this afternoon.

That coincided with surprise news from the Bank of Japan.

The BoJ's policy board said it had decided to review the operation of its yield curve control band.

It said it will keep most of its policy settings unchanged, but it will start to widen the allowable band for its 10-year government bond yields to 50 basis points, up from 25 basis points.

The BoJ said the move was intended to “improve market functioning and encourage a smoother formation of the entire yield curve, while maintaining accommodative financial conditions."

It took economists by surprise.

Australian dollar sitting at US66.8 cents

By Gareth Hutchens

Australia's dollar is sitting at US66.8 cents, which is US10 cents below its long-term average.

But to put things in perspective, you can see how it's tracked over the last 10 years.

It's been worth less than US$1 since 2013.

Asian markets

By Gareth Hutchens

How are major stock exchanges in the region performing?

- Hong Kong's Hang Seng index: 19,129 points, down 1.16 per cent

- CSI 300 index: 3,843 points, down 1.28 per cent

- Japan's Nikkei 225 index: 27,315.54 points, up 0.29 per cent

Real estate doldrums

By Gareth Hutchens

It's a little after lunch and it hasn't been a great day for the real estate sector.

- Johns Lyng Group: -11.89 per cent

- Domain: - 6.49 per cent

- REA Group: -6.02 per cent

Domain shares started the day by shedding 10 per cent of their value after the group said conditions in the property market are still deteriorating.

We all know Domain as one of the main real estate websites. It's majority-owned by Nine.

But REA Group is another player in the sector. It advertises property and property-related services on websites and mobile apps across Australia and India.

It's sharing in the sector's woes today.

Reserve Bank board minutes

By Gareth Hutchens

The minutes of last week's Reserve Bank board meeting are out today. Here's what they discussed.

International events:

- Inflation seems to have peaked in a number of countries as oil prices have declined, supply-chain pressures have eased and growth has slowed.

- China's economy faces real challenges due to its ongoing COVID-19 containment measures.

- The clearest signs of the effect of rising interest rates are in the housing sector, where house prices are declining across a range of countries

Domestic events:

- Australia's labour market is still relatively tight and demand for workers is still strong.

- However, average monthly employment growth in the three months to October has slowed down.

- The Wage Price Index had increased by 1 per cent in the September quarter, to be 3.1 per cent higher over the year, slightly above the Bank’s forecast in November.

- The monthly Consumer Price Index (CPI) for October confirmed that inflation remained high at the start of the December quarter but, at 6.9 per cent over the year, it's a little below market expectations.

- Some signs are emerging of easing supply-chain pressure flowing through into reduced inflation.

Interest rates:

- The RBA board considered several options for interest rates.

- It considered lifting the cash rate target by another 50 basis points in December, or by 25 basis points, or to leave the target unchanged.

- It opted for 25 basis points.

At the start of May the cash rate target was 0.1 per cent. After this month's increase, it's now 3.1 per cent.

Why do share prices fall?

By Gareth Hutchens

Share prices can fall for all sorts of reasons.

But today's movement in the share price for Johns Lyng Group is interesting.

Johns Lyng Group is an Australia-based integrated building services company that delivers building and restoration services across Australia and the United states.

It specialises in rebuilding and restoring properties after damage caused by insured events, including fires, storms, water, impact, and burglary and malicious damage.

But its chief operating officer sold off 31 per cent of his stake in the company this morning.

If you owned shares in the company, it could be the kind of event that would make you wonder, "what does he know about the company that I don't?"

How many people are trading on that concern? Who knows.

But the market was only told about his share sales a few minutes before it officially opened this morning, and you can see the immediate drop in the share price once trading began.

How the sectors are performing

By Gareth Hutchens

The only sectors that have gained value this morning are energy, financials, and consumer non-cyclicals.

Best performing stocks

By Gareth Hutchens

The 10 best performing stocks at 11.30am.

Oz Minerals is the top performer so far.

It told the share market this morning that it's extended its exclusivity period with BHP Group by one more week.

On November 18, BHP confirmed it had entered into a confidential and exclusivity deed with Oz Minerals in relation to its proposal to acquire 100 per cent of OZ, by way of a scheme arrangement for a cash price of A$28.25 per Oz share.

The one-week extension allows for finalisation and agreement of the binding scheme implementation deed.

There's still no certainty that the deed will be agreed. We'll have to wait for approval by the Oz Minerals board.

Worst performing stocks

By Gareth Hutchens

Where do things stand on Australia's stock market after the first hour of trading?

Domain stocks have lost over 10 per cent of their value this morning.

They've now lost more than 50 per cent over their value over the last 12 months, to be worth $2.55 a share. They were worth over $5 in December last year.

Domain updated the market this morning with news that conditions in the real estate market have deteriorated since its annual general meeting.

With the Reserve Bank hiking interest rates aggressively and with property prices falling, there are fewer and fewer listings.

"The 4 per cent new listings growth delivered in FY23 Q1 has been followed by a decline of 16 per cent in October and 22 per cent in November.

"Inner city Sydney and Melbourne continue to experience particular weakness, with November listings down 38 per cent and 32 per cent respectively.

"December is experiencing an earlier than usual seasonal decline as agents and vendors defer listings into the 2023 calendar year. This trend contrasts with December 2021 when listings activity was unusually long, extending into late December.

"As a result, December month to date listings are down around 51 per cent in Sydney and 37 per cent in Melbourne.

You can see how the property market downturn is affecting other real estate stocks.

REA Group has lost 5.2 per cent this morning, while Johns Lyng Group has shed nearly 9 per cent after its chief operating officer, Lindsay Barber, sold 31 per cent of his stake in the property services group, worth 4 million shares.

Mr Barber said he'd sold some of his shares "to diversify ... [his] personal asset portfolio."

A significant policy change

By Gareth Hutchens

Isabella Weber, economics professor at the University of Massachusetts Amherst, worked on the gas price-cap plan in Germany.

She's weathered a lot of abuse from some economists for daring to argue that price caps should be a policy option sometimes.

EU countries adopt gas price cap to combat energy crisis

By Gareth Hutchens

News is coming through that European Union energy ministers have agreed to a gas price cap, which can be triggered from February 15.

According to the Reuters news agency, it ends weeks of talks on the emergency measure as leaders try to find a remedy for the continent's energy crisis.

As per Reuters:

The cap is the 27-country EU's latest attempt to lower gas prices that have pushed energy bills higher and driven record-high inflation this year after Russia cut off most of its gas deliveries to Europe.

Ministers agreed to trigger a cap if prices exceed 180 euros ($191.11) per megawatt hour for three days on the Dutch Title Transfer Facility (TTF) gas hub's front-month contract, which serves as the European benchmark.

The TTF price must also be 35 eur/MWh higher than a reference price based on existing liquefied natural gas (LNG) price assessments for three days.

"We have succeeded in finding an important agreement that will shield citizens from skyrocketing energy prices," said Jozef Sikela, industry minister for the Czech Republic, which holds the rotating EU presidency.

The cap can be triggered starting from Feb. 15, 2023. The deal will be formally approved by countries in writing, after which it can enter into force.

Once triggered, trades would not be permitted on the front-month, three-month and front-year TTF contracts at a price more than 35 euros/MWh above the reference LNG price.

This effectively caps the price at which gas can be traded, while allowing the capped level to fluctuate alongside global LNG prices - a system designed to ensure EU countries can still bid at competitive prices for gas in from global markets.

Germany voted to support the deal, despite having raised concerns about the policy's impact on Europe's ability to attract gas supplies in price-competitive global markets, three EU officials said.

It shows the Albanese government is not alone.

Last week, it passed legislation that will impose a temporary 12-month price cap of $12 a gigajoule on uncontracted gas on the east coast, as part of a suite of measures to prevent energy prices rising even further in the short term.

Twitter users vote in favour of Elon Musk stepping down

By Gareth Hutchens

If you use Twitter, you'll know that since Elon Musk took control of the company he's been the platform's main character.

After firing thousands of employees, he's been issuing new diktats for Twitter's users, and has suspended some journalists from the platform, before reversing some policies after they've backfired or has doubled down harder.

It's been chaotic.

Meanwhile, Tesla's share price has been tanking so badly that investors have been pressuring Musk to stop spending so much time on Twitter.

Tesla shares have lost 51.4 per cent in value since September.

They were worth US$308.73 in September, but now they're worth US$149.87.

Yesterday, Musk ran a poll asking Twitter's uses if he should step aside from the leadership of the company, and they voted overwhelmingly: YES.

You can continue reading the story here:

Here's where things stand at 9am

By Gareth Hutchens

ASX futures down 14 points to 7113 points, a loss of 0.2%

The Australian dollar (AUD) is down slightly, to 67.15 US cents. The long-term average for the Australian dollar is roughly 76 US cents, so it's quite low at the moment.

Major US stock exchanges:

- S&P 500: -0.9 %

- Dow Jones: -0.5%

- Nasdaq: -1.4%

Hong Kong:

- Hang Seng: -0.5%

Major commodities:

- Brent crude is trading at $US80.36 a barrel

- Iron ore is worth $US109.2 a tonne

Yesterday, Australia's stock exchange had extremely thin trading volumes. A little over 485 million shares were traded by the closing bell, compared to a 30-day average of 800 million.

It was the lowest trading volume since mid-January, so it looked like traders were sitting on their hands.

ASX expected to fall ASX on opening bell

By Gareth Hutchens

Good morning,

It's Gareth Hutchens here. I'm running the markets blog today, bringing you news about economic and political events that are influencing stock prices.

What's the point of a stock exchange?

It's a meeting place for people who want to buy and sell shares in specific companies.

When the price of a stock moves up or down, it's supposed to indicate how traders are feeling about the fortunes of a particular company.

I'll start this morning's blog by listing some of the foundational information traders are looking at this morning, and through the day I'll talk about the reasons why certain news events are important for some stocks.

The stocks being traded on the Australian stock exchange (ASX) have lost value for the last three days.

We'll see what today has in store.

The ASX begins trading at 10am.