The local share market finished strongly higher, with energy and lithium stocks powering ahead.

Retail sales edged up in February but are weaker over the past few months, with economists weighing up what it could mean for the RBA's next interest rates decision.

Follow how the day unfolded on this blog from our specialist business reporters.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

Market Snapshot at 4:20pm AEDT

By Stephanie Chalmers

- All Ordinaries: +1.1% to 7,219 points

- ASX 200: +1% to 7,034 points

- Australian dollar: +0.6% to 66.9 US cents

- NZ 50: +1.4% to 11,771 points

- Nikkei 225: flat at 27,475 points

- Hang Seng: +0.8% to 19,716 points

- Shanghai Composite: +0.2% to 3,258 points

- Brent crude: -0.4% to $US77.84/barrel

- Spot gold: +0.1% to $US1,958/ounce

- Bitcoin: -0.4% to $US26,947

Australian share market gains 1 per cent

By Stephanie Chalmers

It's been a strong day for Australian stocks, although the local market has closed off its highs.

The All Ordinaries rose 1.1 per cent and the ASX 200 gained 1 per cent this session.

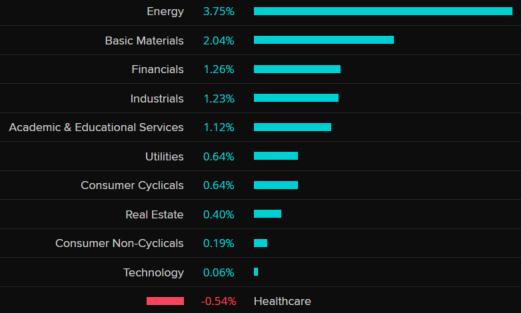

All sectors rose except healthcare. The biggest gains were for the energy (+4%), materials (+1.8%) and industrials (+1.5%) sectors.

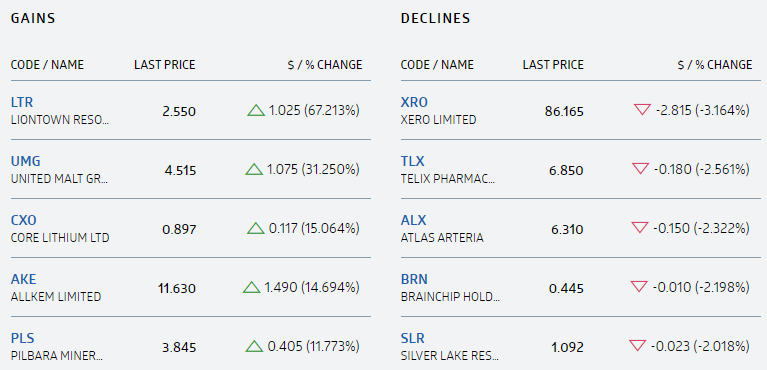

Here are the top and bottom percentage performers on the ASX 200:

Takeover moves saw shares in Liontown and United Malt Group skyrocket, while other lithium plays followed Liontown higher.

The Australian dollar rose around 0.6 per cent through the day.

Business reporter David Chau will be with you bright and early tomorrow morning with all the overnight market action ahead of the local session.

Lithium stocks power ahead after Liontown rejects bid

By Stephanie Chalmers

The big surge in Liontown Resources shares, after the company said 'no deal' to a takeover bid valuing it at $5.5 billion, has fed through to other stocks in the space.

Here are some of the other lithium plays surging ahead as we approach the close of trade:

- Pilbara Minerals: +12.2%

- Allkem: +14.6%

- Sayona Mining: +10.8%

- Core Lithium: +15.4%

- Argosy Minerals: +16.3%

- Anson Resources: +5.7%

- Latin Resources: +7.5%

- Mineral Resources: +6.3%

Shares in Liontown are up a whopping 64.6% in afternoon trade, after knocking back the proposal from Albemarle Corporation, saying it "substantially undervalues" the company.

Meanwhile, Albemarle says the Liontown board has not "meaningfully engaged" with it.

"Albemarle believes this is a compelling opportunity for Liontown shareholders and that Liontown's board should immediately engage with Albemarle to facilitate a binding offer to be put to its shareholders for their consideration," it said in a statement.

Market Snapshot at 3:00pm AEDT

By Stephanie Chalmers

- All Ordinaries: +1% to 7,218 points

- ASX 200: +1% to 7,033 points

- Australian dollar: +0.6% to 66.9 US cents

- NZ 50: +0.9% to 11,715 points

- Nikkei 225: -0.1% to 27,458 points

- Hang Seng: +0.6% to 19,676 points

- Shanghai Composite: +0.1% to 3,252 points

- Brent crude: -0.4% to $US77.81/barrel

- Spot gold: +0.2% to $US1,959/ounce

- Bitcoin: -0.2% to $US26,979

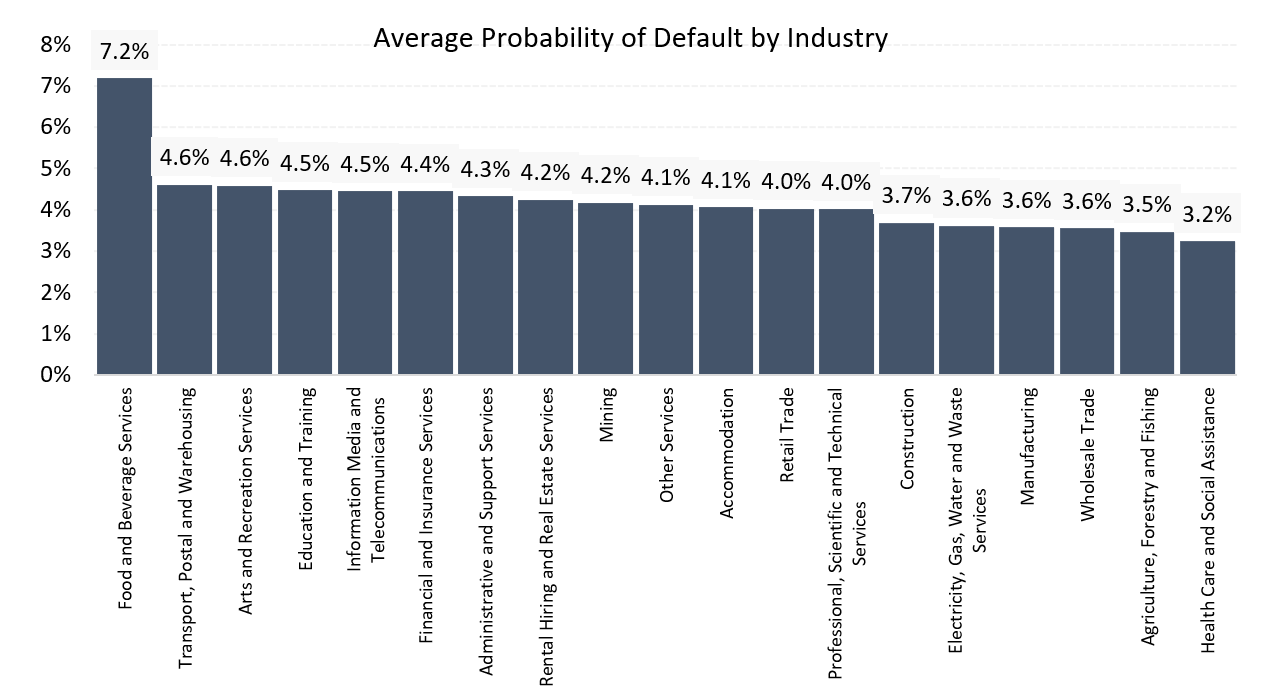

Industries reliant on discretionary spending most at risk of default: CreditorWatch

By Stephanie Chalmers

Cafe, restaurant and takeaway food spending held up in February but credit reporting agency CreditorWatch says businesses in that industry have the greatest risk of defaulting on their payments.

Retail turnover was up by half a per cent in the sector, and 0.2 per cent overall in February, which CreditorWatch chief economist Anneke Thompson describes as "very subdued":

"[It] will give the Reserve Bank of Australia board at the very least a discussion point in support of a pause to monetary policy tightening in April.

"The data reflects CreditorWatch risk metrics, which continues to place those industries which rely on discretionary spending at the top of the table in terms of probability of default.

"While we are yet to see a marked downturn in spending at cafes and restaurants, the upcoming winter could tell a different story as more Australian borrowers come off fixed rate loans and many household budgets will see a dramatic fall in excess money available for eating out."

CreditorWatch puts the average probability default in the food & beverage industry at 7.2%, higher than other industries.

Energy, miners, banks lead local gains

By Stephanie Chalmers

It's hard for it to be a bad day on the market when the biggest companies are rising strongly, and that's certainly the case today.

Here's a look at how the sectors are faring just over two hours from the close:

Some of the biggest boosts to the market include Woodside (+4.6%), BHP (+2%) and ANZ (+1.5%).

There's also some huge percentage gains from Liontown Resources (+63.6%) and United Malt Group (+31.5%) on the back of takeover offers.

It's also worth checking in on the Aussie dollar, which has been making a move higher since 11:30am AEDT, when retail sales data was released:

Don't panic — the message from Australia's banking regulator

By Stephanie Chalmers

It's little wonder the head of the banking regulator, APRA, is wanting to reassure Australians that the banks are secure and their money is safe.

For several weeks now, banks have been accompanied in the headlines with words like 'collapsed', 'failed', 'crisis' etc.

Today, APRA chair John Lonsdale was determined to disassociate our local banks from the global financial stability concerns that have rocked markets.

"[Australia's] banking system is among the strongest and most resilient in the world, with prudential safeguards above and beyond minimum international requirements," he told the AFR's banking summit.

It isn't all rosy though — although the level of people falling behind on mortgage repayments is far from being a major concern, delinquencies are ticking up.

And Westpac's boss says some borrowers will struggle depending on how long rates sit at their peak.

Read more here from my colleague Daniel Ziffer:

Market Snapshot at 12:35pm AEDT

By Stephanie Chalmers

- All Ordinaries: +1.1% to 7,225 points

- ASX 200: +1.1% to 7,041 points

- Australian dollar: +0.4% to 66.78 US cents

- Dow Jones: +0.6% to 32,432 points

- S&P 500: +0.2% to 3,977 points

- Nasdaq: -0.7% to 12,673 points

- FTSE: +0.9% to 7,471 points

- EuroStoxx 600: +1.1% to 444 points

- Brent crude: -0.1% to $US78.05/barrel

- Spot gold: +0.3% to $US1,963/ounce

- Iron ore: +0.5% to $US118.85/tonne

- Bitcoin: -0.1% to $US27,033

Sales volumes 'surely' down given price rises

By Stephanie Chalmers

Let's take a look at how some economists are reading the retail sales figures released a short time ago.

Retail turnover edged up by 0.2 per cent in February but it's followed a volatile few months, which leaves it below November levels:

These figures from the ABS are released at current prices, so not taking into account the steep rise in prices over the past year.

Therefore, Capital Economics says last month's "tepid rise" in sales "all but locks in a contraction in sales volumes" for the first three months of the year, as people are getting less for what they're paying.

"The bigger picture continues to be that the Australian consumer is worse for wear," Capital Economics economist Abhijit Surya said.

"We still expect continued growth in services spending to keep private consumption in the black this quarter.

"Nonetheless, the soft retail sales data indicate growing risks to our forecast that the RBA will hike rates by 25bp in April."

Indeed economist Callam Pickering puts the chances of a April rate hike at 50:50 considering the emerging weakness in consumer spending, alongside the global financial stability jitters that have emerged.

"Given rising consumer prices, the volume of goods sold in February surely went backwards…

"For policymakers, retail spending is an important and timely measure of household activity and confidence. The relatively weak retail growth that we've observed recently suggests that cost-of-living pressures and the RBA's response via higher interest rates is beginning to have an impact on household spending patterns," he writes.

"Most economic data suggests that another rate hike or series of rate hikes would be appropriate. That, of course, is complicated by the financial stability concerns that have emerged over the past month. The RBA will need to weigh these financial stability risks against the risks of a prolonged period of high inflation."

Meanwhile, on Twitter economist Stephen Koukoulas takes a pretty negative view on the data, when factoring in the adjustment for price changes over the period — even pulling out the 'R' word.

What are people spending on?

By Stephanie Chalmers

Despite the cost-of-living pressures many are facing as prices rise, rents increase and interest rates climb, retail sales have still increased modestly in February, although they're flat over the last few months.

So what are people spending on?

Food, for one — turnover at cafes, restaurants and takeaway food outlets rose half a per cent, while food retailing was up 0.2 per cent.

That'll be little surprise for those who've seen their grocery bills or the cost of their daily coffee rising.

"Non-food industry results were mixed as consumers continue to pull back on discretionary spending in response to high cost of living pressures," ABS head of retail statistics Ben Dorber said.

Department store and clothing and footwear sales rose, while spending on household goods, so furniture, electronics and hardware supplies, was unchanged.

There was a fall in the 'other retailing' category, including newspapers, toys and games, stationery, pharmaceuticals and cosmetics and some other miscellaneous things.

Overall, retail turnover was up 6.4 per cent compared to a year earlier.

CBA boss says Aussie banks are among the world's safest

By Michael Janda

The Commonwealth Bank's chief executive Matt Comyn tells the AFR's banking summit that Australia's major banks have become a lot safer and stronger since the global financial crisis (GFC) saw tougher regulation introduced.

"We're the most well-capitalised large bank in the world. I think the four Aussie majors would be four of the top five," he says.

"We're holding, relative to GFC, two-and-a-half times more capital."

Mr Comyn says the bank is much less reliant on raising cash short-term on global financial markets than it used to be, with about 7 per cent of its backing coming from short-term wholesale funding versus 25 per cent versus pre-GFC.

Mr Comyn says CBA has already raised $31 billion of the $35 billion it needs to raise on markets before June 30.

By way of contrast, he says the US banking system appears to have prioritised competition over stability.

"My guess is that a lot of the decisions that were made in US banking were actually about making it easier for smaller banks to compete by not imposing higher regulatory [obligations], and therefore costs of that.

"Which is fine almost all of the time, until it's absolutely not."

Retail sales edge higher in February

By Stephanie Chalmers

Retail turnover edged higher last month, up 0.2 per cent in February according the Australian Bureau of Statistics.

Expectations had been for an 0.1 per cent rise, after the 1.8 per cent increase in January.

ABS head of retail stats Ben Dorber says retail sales rose modestly in February and appear to have levelled out after a period of increased volatility over November, December and January.

“On average, retail spending has been flat through the end of 2022 and to begin the new year.”

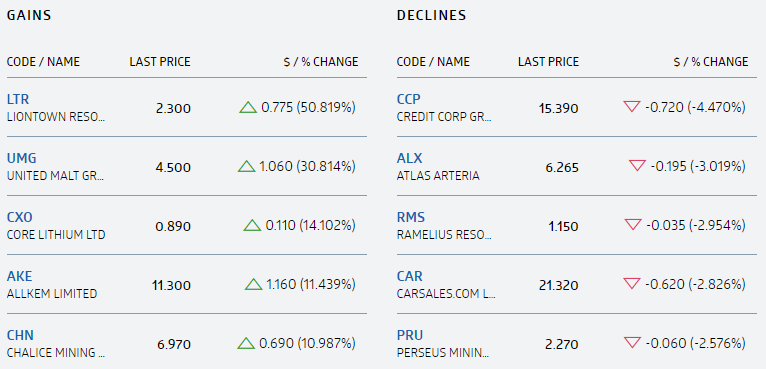

Takeover moves drive big gains for Liontown Resources, United Malt

By Stephanie Chalmers

A bit of merger & acquisition activity this morning and it's leading to some big stock moves.

Here are the best and worst performers on the ASX 200 so far:

As you can see, Liontown Resources has made the biggest gain with an absolutely massive 50% jump.

That follows news the lithium explorer has rejected a takeover offer which values it at $5.5 billion.

The takeover bid from the world's largest lithium producer Albemarle Corp is for $2.50 a share, a near-64% premium to its last closing price.

This morning, Liontown shares have rocketed up to $2.30 on the news.

Liontown's board says the proposal "substantially undervalues" the company and "therefore is not in the best interests of shareholders".

Liontown has two major lithium deposits in WA.

The next-best performing stock so far is United Malt Group, with shares leaping 30 per cent.

It received a takeover offer that valued it at $1.5 billion, from French rival Malteries Soufflet, which is owned by InVivo group.

United Malt is a maltster — a company that produces malt for use in brewing and distilling.

This is the latest in a series of approaches from Malteries Soufflet, this one for $5 cash per share.

The United Malt board has decided to provide access for due diligence so watch this space.

Bad loans still very low but mortgage delinquencies are rising: APRA chair

By Michael Janda

Asked about whether the regulator had made the wrong move in mid-2019 by removing a 7 per cent interest rate floor on mortgage serviceability tests, APRA chair John Lonsdale didn't give a clear response.

However, he did say the regulator was currently committed to maintaining its 3 per cent buffer on mortgage serviceability tests, and that there are no signs of severe stress in Australian home loans so far.

“Non-performing loans are very low, not historically low, but very low. Delinquencies are edging up a touch, we’re watching that very closely. And, importantly, credit is still flowing."

He also emphasised that Australia's banking system is "among the strongest and safest in the world".

If you want to find out more about what the mortgage serviceability buffers are, and the effect of APRA's 2019 changes, read my analysis from late last year.

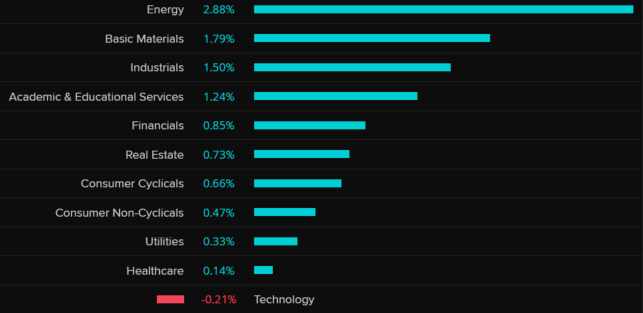

Energy, miners leading gains on ASX

By Stephanie Chalmers

Here's how things are stacking up so far in terms of sectors — only technology is in the red:

APRA boss says financial sector has 'more work to do' to address cyber threats

By Michael Janda

The Australian Prudential Regulation Authority's chair John Lonsdale says the threat posed by hackers is a "big risk".

However, he says many institutions reviewed by the regulator still needed to improve their systems and plans to deal with cyber threats.

"Boosting cyber resilience remains one of APRA's top priorities. Yet our analysis of the first tranche of results from the reviews show that entities have got more work to do and there is a need to continuously raise the bar on cyber preparedness and resilience across all industries.

"Notably, some of the areas for improvement are:

* A lack of rigour in the nature and frequency of security control testing;

* Insufficient board oversight;

* Incident response plans need improving as do safeguards for sensitive customer data."

Regulators need to be faster responding, says new APRA boss

By Michael Janda

In his first public keynote address, APRA chair John Lonsdale, who took over the bank, insurance and superannuation regulator on October 31 last year, said modern technology means crises can develop much faster than ever before.

"With the ubiquity of modern online banking, there's no need to queue and no need to be constrained by branch opening hours — entire balances can be instantly transferred elsewhere at the click of a button, 24 hours a day.

"Information and misinformation also spread further and faster than ever before, particularly through social media.

"As the speed of crisis has accelerated, regulators have less time to respond than they once did.

"We can no longer expect to have days or weeks to debate and plan considered responses — we need to act quickly, but we also need greater confidence than ever in the prudential safeguards we have in place."

Market Snapshot at 10:20am AEDT

By Stephanie Chalmers

- All Ordinaries: +0.8% to 7,200 points

- ASX 200: +0.8% to 7,017 points

- Australian dollar: +0.1% to 66.54 US cents

- Dow Jones: +0.6% to 32,432 points

- S&P 500: +0.2% to 3,977 points

- Nasdaq: -0.7% to 12,673 points

- FTSE: +0.9% to 7,471 points

- EuroStoxx 600: +1.1% to 444 points

- Brent crude: flat at $US78.12/barrel

- Spot gold: flat at $US1,957/ounce

- Iron ore: +0.5% to $US118.85/tonne

- Bitcoin: +0.4% to $US27,151

Positive start for local stocks

By Stephanie Chalmers

We're just a few minutes into trade for the local share market and it's a pretty good showing so far — the All Ords has gained around 0.7 per cent.

The major miners are doing some of the heavy lifting, with big gains for BHP, Rio Tinto and Fortescue, while the big banks are all up to the tune of 0.75-1 per cent, and energy stocks are riding high on the back of oil price gains, with Santos and Woodside charging ahead.

Westpac boss says 2023 will be hard, relying on rate cuts in 2024 to save struggling borrowers

By Michael Janda

A very interesting comment from Westpac's chief executive Peter King.

There's been a lot of focus on what the peak cash rate will be — where we are now, 3.6%, 3.85% or 4.1% being the most common forecasts among economists.

But King says Westpac is not focusing so much on what the peak is, but how long are rates going to stay at that peak.

"The duration is where we're thinking a lot about now," he says.

"Because customers will do everything they can, pull in their belt, do extra hours of work to keep the roof over their heads, whether they're renting or a mortgage holder. But the duration I think will have an implication for how many people need help.

"The economics team are saying a rate cut in the first quarter of 2024 and a couple more later on, so it feels like 2023 is the hard piece we need to help people through."

This seems to imply that Westpac knows it has a not insignificant group of customers who will seriously struggle to repay their mortgages in the longer term if interest rates don't come back down from their expected peaks.

It's counting on helping them through this year before the Reserve Bank starts cutting rates off their peak and perhaps back towards 3% and below.