The Australian share market closed lower on Monday amid the fallout from the collapse of startup-focused lender Silicon Valley Bank (SVB), the biggest US bank failure since the 2008 financial crisis.

Follow the day's financial news and insights from our specialist business reporters on our live blog.

Disclaimer: this blog is not intended as investment advice.

Live updates

Market close snapshot

By Rhiana Whitson

- ASX 200: -0.5pc to 7,108

- All Ords: -0.5pc to 7,311

- Aussie dollar: +1.3pc at 66.63 US cents

- On Wall Street: Dow -1pc, S&P 500 -1.4pc, Nasdaq -1.8pc (Friday)

- In Europe: Stoxx 454 -1.35pc, FTSE -1.67pc (Friday)

- Spot gold: +1pc to $US1,885.10 an ounce, at 4:30pm AEDT

- Brent crude: +0.4pc to $US83.15 a barrel

Signing off

By Rhiana Whitson

That's it for the markets blog today.

We'll be back tomorrow.

ASX down,

By Rhiana Whitson

The ASX 200 has closed half a per cent lower on Monday, 7,108.

The All Ords also lost half a per cent, ending the day at 7,311.

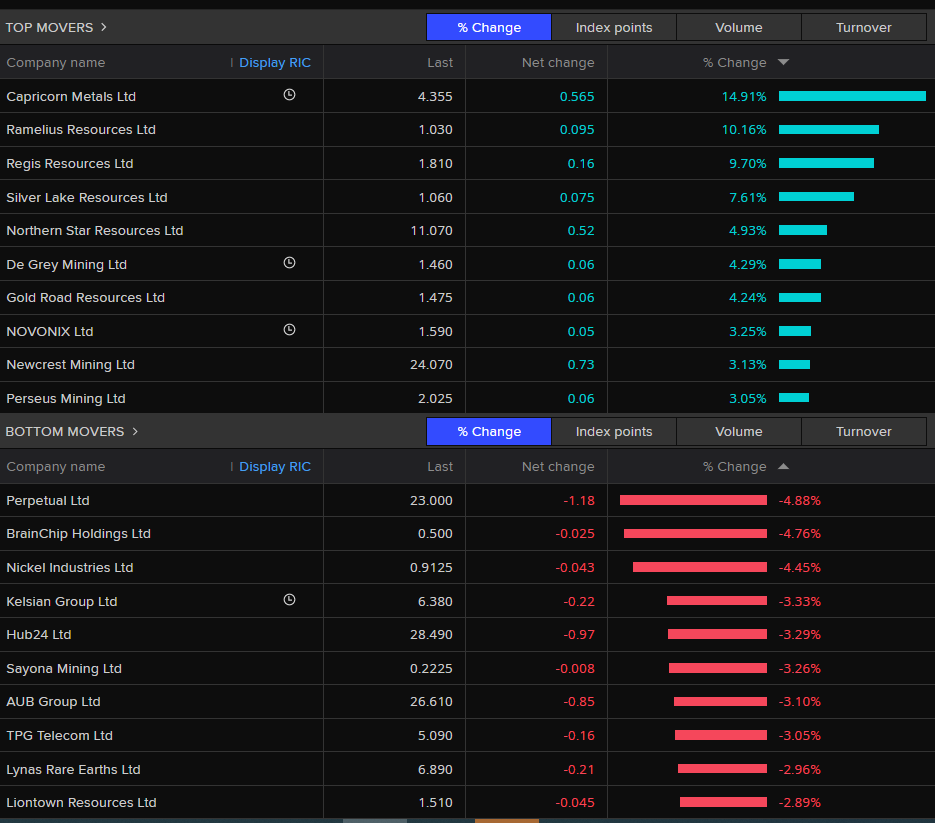

The collapse of Silicon Valley Bank in the US, saw investors here flock to gold stocks. Check out the biggest gains and declines on the top 200 companies index:

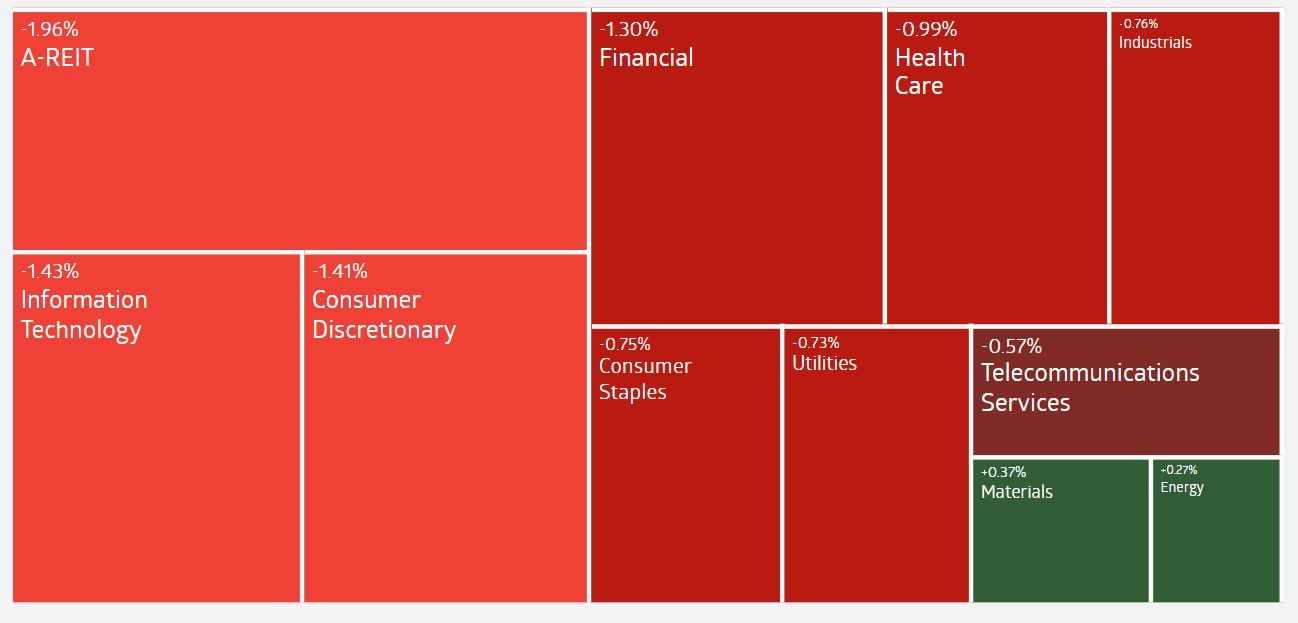

Banks, tech and real estate were the biggest drags on the ASX.

Lauren Cranston, daughter of ex-ATO deputy commissioner, found guilty over role in $105m tax fraud

By Rhiana Whitson

In breaking news, Lauren Cranston, the daughter of a former deputy commissioner of the ATO, has been found guilty over her role in a $105 million tax-fraud conspiracy.

Both Lauren, and her brother, Adam, faced a trial in the NSW Supreme Court which began last April.

Last week, the jury found Adam Cranston and co-accused Dev Menon and Jason Onley guilty of conspiring to dishonestly cause a loss to the Commonwealth and conspiring to deal with the proceeds of crime.

Ms Cranston was today found guilty of the same two charges.

The jury has not yet reached a verdict in relation to the fifth defendant, Patrick Wilmott.

The Cranstons are the children of former ATO deputy commissioner Michael Cranston.

There is no suggestion Michael Cranston was involved in wrongdoing.

Update

By Rhiana Whitson

There are a lot of analyst notes coming in about the collapse of Silicon Valley Bank in the US.

| Rabobank's global strategist Michael Every notes: "The failures of Signature Bank, Silvergate capital, Silicon Valley Bank (SVB) - the second largest in US history, then another in New York, due to their holdings of crypto rubbish *and* safe assets like 10-year Treasuries as ‘lower for longer’ is eviscerated, shows how vulnerable parts of the financial system are," Mr Every says. "SVB, now being carved up, found itself in the curious position of having been brought down by being given too much money. After the Fed cut interest rates to all-time lows in 2020, and consequently set off a renewed boom in growth company valuations, its deposit base more than doubled: the bank pumped the excess cash into “safe” US Treasuries and mortgage-backed securities. When the Fed began aggressively raising rates in 2022 the valuations on those securities went south in a big way, leaving SVB nursing mark-to-market losses in the vicinity of $23bn. "SVB tried to assure investors these mark to market losses weren’t a problem because the securities would simply be held to maturity. That strategy unravelled when the depositors started asking for their money back. The bank was forced to liquidate long duration assets at steep losses. This begs the question as to why the balance sheet wasn’t hedged? Holding that kind of interest rate risk in the banking book is a big no-no. "But if SVB has done it, might some other banks also be running unhedged mark to market losses on security holdings? And just how exposed to SVB are other banks? "Investors were obviously asking themselves these questions when they dumped US bank stocks late last week. This crisis thus threatens mass on-line bank runs with no need to queue up like in the movies anymore: indeed, why not put your money in T-bills at 5% rather than bank deposits offering zero? Mr Every says it underlines systemic issues for banks and shadow banks: "The former already facing an inverted curve, and now perhaps the need to increase deposit rates rapidly to hold on to funds. "There is also the direct issue of $170bn in SVB depositors funds (with everything over $250,000 nominally uninsured). The deposits were largely made by tech start-ups and rich Californians (and Democratic party donors), reportedly including Harry and Meghan, and Oprah. "There are reputations at risk here, as the SVB board were all heavy-hitters. Perhaps a warning sign, its Chief Administration Officer Joseph Gentile was formerly the CFO of Lehman Brothers! "Blaming the Gentile over a financial crisis is a new variant on an old theme we are about to hear more of, we sadly expect. Because “You get a bailout! And you get a bailout! And you! And you!” is now being heard by everyone involved." |

|---|

Market snapshot at 3:10pm AEDT

By Rhiana Whitson

We're into the final hour of trading for Monday, and the ASX 200 has pared some of its earlier losses. In the wake of Silicon Valley Bank's collapse in the US, gold stocks are shining as investors rush to the safe haven.

- ASX 200: -0.3pc to 7,125

- All Ords: -0.3pc to 7,325

- Aussie dollar: +1.3pc at 66.62 US cents

- On Wall Street: Dow -1pc, S&P 500 -1.4pc, Nasdaq -1.8pc (Friday)

- In Europe: Stoxx 454 -1.35pc, FTSE -1.67pc (Friday)

- Spot gold: +1pc to $US1,886.90 an ounce

- Brent crude: +0.3pc to $US83.00 a barrel

What the super tax debate means for government budget repair

By Rhiana Whitson

The federal government's plans to double the tax rate on earnings for super balances above $3 million has caused a media storm. Initially, the change would likely affect just 0.5 per cent of Australians with super accounts.

But as business editor Ian Verrender writes, the uncomfortable truth is that the super concessions — costing a monumental $48 billion a year — are social welfare payments the nation can no longer afford.

Gold glitters

By Rhiana Whitson

Australian gold stocks are up as much as 5.5 per cent to 6,250, set for best day since December 21, if gains on the sub-index hold.

All top 10 gainers in the ASX 200 benchmark index are gold miners; ASX benchmark down 0.2 per cent weighed by banks and healthcare stocks.

Gold prices rose to its highest in more than five weeks on a weak dollar, with concerns over the largest U.S. bank failure since 2008 driving investors to the safe-haven asset.

Newcrest Mining, the country's largest gold miner, advances as much as 4.2 per cent in its third session of gains

Sub-index heavyweight Northern Star Resources climbs as much as 6.8 per cent to mark its best day since Nov ember 11

Gold miner Capricorn Metals top gainer in the benchmark, soaring as much as 16.9 per cent and marking its best day since late July 2021.

– Reuters

Treasurer says SVB fallout for Australia unlikely to be significant

By Rhiana Whitson

Treasurer Jim Chalmers has released a statement on the collapse of Silicon Valley Bank in the US.

Mr Chalmers says the federal government is closely monitoring the situation.

"In seeking preliminary advice we are aware that some Australian firms have been impacted and we’re working closely with our regulators as well as the tech sector to better understand the implications for the industry as the situation evolves," Mr Chalmers said in a statement.

"The initial advice we have received from regulators is that any fallout for Australia’s broader financial system is unlikely to be significant.

"Australians should be reassured that our institutions are solid, our banking sector is well-capitalised, and we’re in a better position than most other nations to deal with the challenges we face in the global economy."

ASX at a glance

By Rhiana Whitson

It's 1:00pm AEDT, and the ASX 200 is down 0.6 per cent to 7,100.

Only two of 11 sectors (miners and energy) are in the green this afternoon. Real estate, tech, consumer discretionary and banks are leading the falls.

Here's a look at the biggest gains and declines on the benchmark index.

Market snapshot at 12:45pm AEDT

By Rhiana Whitson

- ASX 200: -0.7pc to 7,095

- All Ords: -0.6pc to 7,300

- Aussie dollar: +0.5pc at 66.10 US cents

- On Wall Street: Dow -1pc, S&P 500 -1.4pc, Nasdaq -1.8pc (Friday)

- In Europe: Stoxx 454 -1.35pc, FTSE -1.67pc (Friday)

- Spot gold: +0.7pc to $US1,880.50 an ounce

- Brent crude: -0.1pc to $US82.68 a barrel

Whispir expects to recover $262,000 SVB deposit

By Nassim Khadem

Anonymous social networking app Whispir said it has $US173,679 ($262,043) on deposit with Silicon Valley Bank which it expects to be recovered in full by the Federal Deposit Insurance Corporation in coming days.

"The company has a diverse portfolio of deposits across several leading global banks in order to reduce exposure," Whispir said in a statement to the ASX.

Meanwhile AV networking technology provider Audinate says it has no known exposure to SVB.

Pengana International Equities has 2pc of portfolio in SVB

By Nassim Khadem

Pengana International Equities has exposure to Silicon Valley Bank, holding around 2 per cent of the portfolio in the bank.

"Whilst we are disappointed with the outcome of this specific investment, we note that this is a limited exposure for PIA, which owns a highly diversified global portfolio of shares," the company said in a statement.

Pengana also noted that the only other investments that PIA has in the US banking sector was a 2 per cent position in First Republic Bank.

"The investment team continues to monitor First Republic Bank closely for any potential knock-on effects," it said.

Market snapshot 10.45am AEDT

By Nassim Khadem

ASX 200: -0.54pc to 7,106.20

Aussie dollar: 66 US cents

On Wall Street: Dow -1.1pc, S&P 500 -1.5pc, Nasdaq -1.8pc

In Europe: Stoxx 454 -1.35pc, FTSE -1.67pc

Spot gold: +0.81pc $US1,882 an ounce

Brent crude: +1.46pc at $US82.78 a barrel

Iron ore: +0.87pc to $US129.20

US regulators close Signature Bank

By Nassim Khadem

New York state’s Department of Financial Services said on Sunday it had taken possession of New York-based Signature Bank and appointed the US Federal Deposit Insurance Corp as receiver.

It is the second bank failure in a matter of days.

Signature Bank had deposits totalling about $US88.59 billion ($135 billion) as of December 31, the department said in a statement.

The US Treasury Department along with other bank regulators said in a joint statement on Sunday that all depositors of Signature Bank would be made whole, and that “no losses will be borne by the taxpayer”.

ASX opens lower

By Nassim Khadem

The S&P/ASX 200 opened 0.3 per cent, lower to 7126.7 as US regulators announced plans to limit the fallout from the collapse of Silicon Valley Bank, by protecting deposits up to $US250,000.

The index has lost 2.77 per cent for the last five days, but has gained 1.24 per cent over the past year to date.

Wall Street ended Friday lower with the S&P 500 index down 1.5 per cent to 3861 points while the Nasdaq index fell 1.8 per cent to 11,138 and the Dow Jones Industrial Average index was 1.1 per cent lower to 31,909 points.

Further sell-offs are expected this week following the collapse of SVB on Friday.

Airtasker says it has 'no material exposure' to SVB collapse

By Nassim Khadem

Online marketplace Airtasker says it has no material exposure to the SVB collapse.

In a statement to the stock exchange it said US$55,000 of Airtasker's global cash reserves were held on deposit at SVB.

"The balance of Airtasker's global cash reserves and working capital is held with other financial institutions, principally Tier 1 banking institutions in Australia," the company said.

"Airtasker expects to have an account at DINB for an amount of circa US$55,000 with funds expected to be made available this week.

"Airtasker is working to minimise any disruption to its operations caused by the SVB collapse and is engaging with its customers, users, partners and staff as required."

Nitro has $US12.18m of deposits at SVB

By Nassim Khadem

Australia's Nitro Software says about US$12.18 million ($18.4 million) of the company's global cash reserves are held on deposit at SVB.

Nitro said the SVB development does not impact private equity firm Potentia Capital's $532.3 million takeover offer for the software maker.

The US Federal Deposit Insurance Corporation (FDIC) has been appointed as receiver of SVB, and has said that deposits in FDIC-insured banks, such as SVB, are insured up to US$250,000 per depositor per insured bank.

To that end, Nitro said in a statement to the ASX that it will have an account at DINB for a minimum amount of US$250,000 up to US$500,000 for its US operating entity and Australian parent company.

In addition, the FDIC will pay all uninsured depositors an advance dividend.

"At present, it is unknown what proportion of uninsured deposits will be paid out," the company statement said.

"As an insured depositor, Nitro will be given a receivership certificate for the remainder of the funds.

"As the FDIC sells the assets of SVB, it may make further dividend payments against uninsured deposits.

"The timing and risks associated with any such payments remains uncertain."

"Nitro is engaging regularly with its customers and partners to minimise the impact of any disruptions caused by the SVB developments and, as a contingency measure, is in the process of evaluating short-term funding solutions to address any immediate operational requirements."

Australian big tech investors caught up

By Nassim Khadem

Australia’s big tech investors could be caught up in the collapse of Silicon Valley Bank, the second-biggest bank failure in US history.

Companies including Canva have money tied to the financier through the nation’s major venture capital funds.

A spokesman for Canva told ABC News: "We’re disheartened to see the news about Silicon Valley Bank and the impact it’s having on the tech ecosystem", but that the company was "in the fortunate position of having the majority of our cash outside of their banking system and have safety nets in place to ensure our operations aren't compromised".

"More broadly, we’re also very mindful that not everyone is as lucky as us and we’ll be on the lookout over the days and weeks to come to see if there are ways we can be supportive of the broader ecosystem."

Meanwhile US Treasury Secretary Janet Yellen said she was working with regulators to respond to the Silicon Valley Bank crisis.

Authorities are considering safeguarding all uninsured deposits at the bank, to prevent what they fear would be a panic in the US financial system.

The boards of the Federal Deposit Insurance Corporation (FDIC) and the Federal Reserve, in consultation with President Joe Biden, approved the FDIC's resolution of SVB.

The Federal Deposit Insurance Corporation (FDIC) protects deposits of up to $US250,000.

A joint statement from Ms Yellen, Fed chair Jerome Powell and FDIC chairman Martin Gruenberg said that the collapse would not lead to losses by American taxpayers and all deposits will be made whole.

According to a report from Reuters, SVB Financial President and CEO Gregory Becker sold almost $3.6 million of SIVB shares about two weeks before the company's Silicon Valley Bank failed when it was unable to raise capital to shore up its liquidity.