The Reserve Bank of Australia has lifted the cash rate by 0.25 percentage points to an 11-year high of 3.6 per cent, and the local share market has rallied to close higher after suffering some falls earlier in the session.

Look back at how the market reacted to the RBA's decision and the rest of the day's financial news and insights from our specialist business reporters on our blog.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

That's it for the markets blog today

By Kate Ainsworth

Thanks for reading along throughout the day.

We'll be back with the latest market updates tomorrow — but until then you can stay up-to-date with other news on the ABC's website, by subscribing to our mobile alerts, and by watching News Channel or listening to local radio here.

Treasurer says he won't try to predict RBA's future decisions

By Kate Ainsworth

Treasurer Jim Chalmers spoke to ABC Radio Melbourne a little earlier this afternoon and said he won't try and predict what the central bank might do in the coming months, despite the RBA board flagging a potential shift in strategy.

Mr Chalmers told ABC Radio Melbourne while there's been a change in the language used by RBA governor Philip Lowe, it won't reduce the impact today's rate rise will have on households.

"The language has changed in the Reserve Bank's statement. People will pour over that for understandable reasons," he said.

"I'm not going to make a prediction but I do know that today's decision will have an impact.

"It will have an immediate impact on people with a mortgage and it will flow through to our economy as well."

How things compare

By Gareth Hutchens

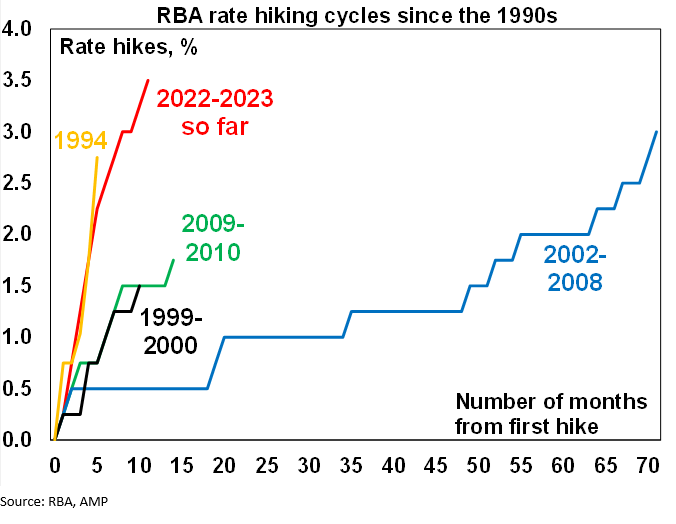

This graph from Shane Oliver, the chief economist at AMP Capital, shows how this rate hike cycle compares to others in the past.

He says the 3.5% (or 350 basis point) increase in the cash rate we've seen since May last year now "clearly surpasses" all of the rate hiking cycles seen since 1990.

He says it's the fastest tightening since the rise in the overnight cash rate from 10.6% to 18.2% that occurred between January 1988 and November 1989.

"Back then the RBA cash rate was not officially announced, which may have reduced its initial effectiveness, short-term rates were very volatile and mortgage rates were more regulated then and “only” rose from 13.5% to 17%," he says.

"Of course, household debt as a share of income was only 68% back then, whereas it's now 188%, so rates shouldn’t have to go up anywhere near as much as they did in the 1980s to slow spending and hence inflation."

Growth and the environment

By Gareth Hutchens

As someone born in 1940, and never buying stuff, I couldn't afford, even as a student, I am at a loss in understanding the "Gimme everything generation". What a truly wonderful lot of people economists are!!! How does consuming everything, help a). The Environment. b). Climate Change and other stuff? Too much greed is behind it all.

- Merrowyn Deacon

After the Keynesian Revolution in the 1930s and 1940s, the American economist Paul Samuelson wrote a textbook on the new economics.

It became the standard textbook for decades.

But its first edition, in 1948, didn't even mention pollution or ecology. Those post-war years were all about growth, growth, growth.

We have so much work to do.

How likely is the RBA to 'pause' its rate hikes?

By Kate Ainsworth

If you're a keen reader of the RBA's statements after its cash rate decisions, you'll have picked up on a subtle shift in the language used in today's release.

Last month we saw the RBA flag that there would be at least two more rate rises this year — but with some signs that the economy is beginning to slow down, some analysts suggest the central bank might be hitting the pause button on future rate rises sooner rather than later.

The ABC's senior business correspondent Peter Ryan has taken a closer look at what the immediate future of the cash rate might look like:

A "dual tenure" housing system?

By Gareth Hutchens

I just hope there is something that will prevent this generational classism becoming a cycle- it's likely the Post-Z generation will inherit from their Gen X/ boomer grandparents as the Millennials and Zs will be too old and established to need the leg up (and that's fine- we live longer now and its as it should be), but what do millennials give their grandchildren? And so every second generation has, and the others have not.

- C

If housing (shelter) was treated as a right for citizens in a healthy society, and not as a vehicle for wealth-generation, would we have to worry so much about inheritances?

In early 2020, the Australian Housing and Urban Research Institute released a report that said the Australian dream of home ownership was no longer "relevant" in the contemporary era.

They said we should expect new political fault-lines to emerge in coming decades:

"The 1940s to 1970s era generated the 'Australian dream', with home ownership levels reaching in excess of 70 per cent," it said.

"However, this era was a function of a particular window of opportunity that has now slammed shut and is unlikely to reopen.

"The housing market of this earlier era was much more affordable than today’s. It did not take a great degree of savings or a large household income to purchase — typically two to three times average household earnings, compared to today’s up to five to 10 times, depending on the city."

It said the declining rate of home ownership among millennials and younger age groups (everyone aged in their early 40s and below) would guarantee that Australia's historically-high rate of home ownership would drop away.

"The projected declines mean Australia will no longer be a near-universal ownership society, but must become a dual tenure society of ownership and rental (both private and social)," they warned.

"[But] a dual tenure housing system in which one segment (owners) acquires wealth and the other does not is a recipe for long-term social and economic problems.

"Addressing this will require new policy instruments to give renters the opportunity to create wealth and/or processes to redistribute some of the asset-generated wealth of owners."

Market snapshot at 4:25pm AEDT

By Stephanie Chalmers

- All Ordinaries: +0.5% to 7,5612 points

- ASX 200: +0.5% to 7,364 points

- Australian dollar: -0.3% to 67.1 US cents

- Nikkei 225: +0.4% to 28,341 points

- Shanghai Composite: +0.1% to 3,325 points

- Hang Seng: +1% to 20,805 points

- NZ50: +0.1% to 11,919 points

- Brent crude: +0.3% to $US86.41/barrel

- Spot gold: +0.1% to $US1,848.05/ounce

Share market closes higher after afternoon rally

By Stephanie Chalmers

After a lackluster first few hours left it little changed, the local share market took off after the RBA's decision and statement provided some hope of a rates reprieve in coming months.

The ASX 200 and the All Ordinaries each gained half a per cent by the close.

The Australian dollar lost a quarter of a per cent to around 67.1 US cents.

The major miners remained fairly weak through the session but came off their lows — BHP has ended down by 1 per cent and materials was the only sector to remain in the red.

The banks contributed to the afternoon rally, led by ANZ (+1.2%) and Westpac (+1.3%).

InvoCare rallied 35% after receiving a $1.8 billion takeover offer from TPG Global.

Overall, 125 of the top 200 stocks ended the session higher.

The focus for global markets tonight will turn to the US central bank, with Federal Reserve chair Jerome Powell due to give testimony before Congress.

Philip Lowe to speak tomorrow

By Gareth Hutchens

For anyone interested, RBA governor Philip Lowe will be giving a speech tomorrow.

The title of the speech is: "Inflation and recent economic data."

He's talking at the Financial Review's Business Summit in Sydney.

The speech will begin at 8.55am and you'll be able to listen live over the RBA's website.

Quick round up of some reaction to rates

By Stephanie Chalmers

There's no shortage of commentary on interest rates this afternoon.

Here's a quick round up of what some commentators and economists have made of it all:

"The decision is the 10th consecutive increase since May 2022 and comes after National Accounts and CPI data released last week revealed that both economic growth and inflation have slowed faster than expected, making the wisdom of this decision hard to understand." — Pradeep Philip, Head of Deloitte Access Economics

"The changes to the Statement raises the possibility that the RBA could contemplate pausing in April or May, dependent on the data, even while maintaining a tightening bias. Given inflation pressures, we still think the RBA will hike by 25bps in April and May, taking the cash rate to 4.10%. But today's Statement does raise the risk of the RBA pausing at 3.85%." — Tapas Strickland, Head of Market Economics, NAB

"My base case remains that the RBA will again raises interest rates again next month, but then pause for at least 3 to 6 months to assess the impact of its work given the inherent lags in which monetary policy impacts on the economy. I also then anticipate sufficient signs of slowing in both the Australian and global economy will emerge to allow the RBA to unveil its first interest rate cut on November 7, on Melbourne Cup day!" — David Bassanese, Chief Economist, Betashares

"The RBA looks to be prioritising the inflation data in its deliberations and seems circumspect about the weakening labour market data. In his speech tomorrow on Inflation and Recent Economic Data, we expect Governor Lowe will further downplay the recent softness in the data and highlight ongoing high inflation and the costs to the economy, as well as the likelihood of tightening in coming months." — Felicity Emmett, Senior Economist, ANZ

What is the definition of spendthrift?

By Gareth Hutchens

Dear Richard, I would gladly not be so "spendthrift"-y, however someone bought up all the houses 30-40 years ago when they were SUPER cheap and only about 3 times the yearly income, and now houses are about 6-7 times the yearly income, so had no choice but to spend lots of money to buy somewhere to live. Honestly that kind of insult towards people just trying to live in a place they own is extremely unhelpful.

- N

A final contribution to this part of the conversation

Some support for Richard

By Gareth Hutchens

I agree with Richard - everyone focusses on Dr Lowes miscalculation that rates would not rise until 2024 when in fact the RBA biggest mistake was leaving rates at 0.1 percent for far too long.

- Peter

Sure, but the cash rate target was already at 0.75 per cent before the pandemic hit Australia.

After fiscal policy fell out of fashion in the 1990s and policymakers lumped all of the responsibility for managing the economic cycle onto monetary policy, interest rates have been in long-term decline.

How do you stop rates hitting those lows again?

Communities looking for solutions to cost of living crunch

By Stephanie Chalmers

Here's a bit of a different take on dealing with the rising cost of living, including higher mortgage repayments after today's 10th-straight rate hike, from Central Victoria.

ABC reporter in Bendigo, Shannon Schubert, speaks to Lucy Young, who's reducing the amount she needs to spend on food by participating in a community agriculture project.

The region is being hit hard, with a local charity seeing people forced to sell their homes due to being unable to make their loan repayments and others sleeping in their cars.

Read more here:

Fears for the future

By Gareth Hutchens

As a young person who doesn't have a home at what point will we get to have a future? I don't have the bank of mum and dad, and social housing isn't going to happen. Rents keep going up and wages can't keep pace. I'd like to have a family but I don't see anyway it's affordable to have a decent life in Australia.

- John

There's an obvious generational divide in some of the comments coming through.

I'm with you, John.

I don't know if everyone has twigged to the political ramifications of the mess we've made of housing.

More than half of everyone living in Australia today was born after 1980. It means more than half of the population is comprised of Millennials, Gen Zers and younger.

These are the first generations born in Australia that can't expert to have a better material standard of living than their parents.

The lack of housing isn't a joke.

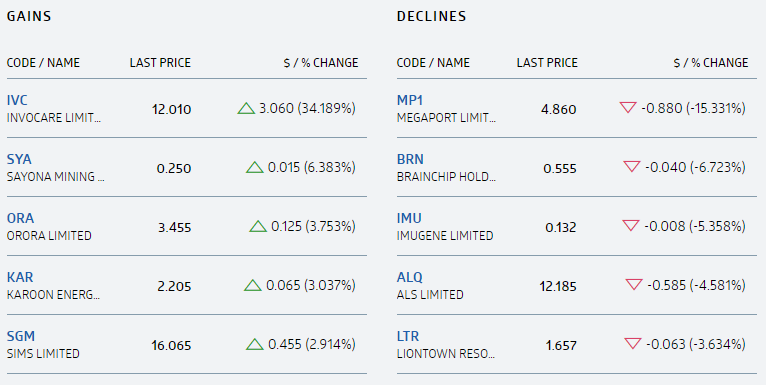

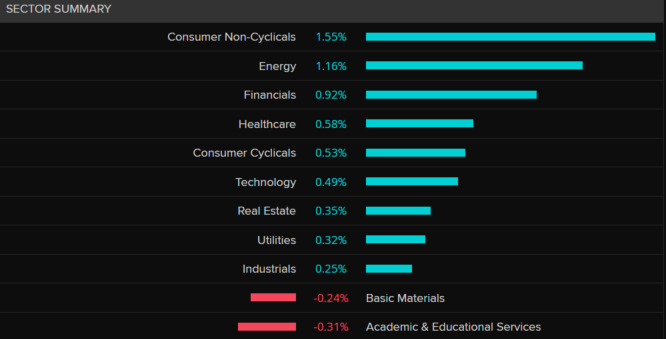

Best and worst performers heading into the close

By Stephanie Chalmers

Not long left before the closing bell, so let's check in on how the market is tracking.

The top and bottom movers on the ASX 200 are still being driven by company news — InvoCare has leapt on a takeover offer, while Megaport has slumped after its CEO quit.

And looking at the sectors, most are in positive territory after that RBA statement provided some sense that rates may peak sooner than expected.

What will Millennials say to their kids?

By Gareth Hutchens

I’m so sick of hearing about the 19% interest rates we had in the 90s. Things were different then. Every generation has its issues. I have friends that are not eating to feed their kids. Why isn’t the government stepping in to help with inflation?

- Millennial

It does get tiring hearing about 19 per cent interest rates - as though the relative pain of those rates were equivalent to what first homeowners are facing today.

I'd love it if property prices were still 3x annual income with much smaller required deposits, so it was much easier to get a property to begin with (rather than being locked into renting where you're paying someone else's mortgage for them).

In that situation, if rates hit 19% I'd think 'this is terrible, but at least I own this place.'

Calculate how today's rate hike will hit your home loan

By Stephanie Chalmers

As the RBA acknowledged today, there's a substantial lag between when the central bank raises its cash rate target and when that flows through to home loan repayments — it can take several months depending on your bank or repayment schedule.

If you have a home loan, plug your details into this calculator to see what impact today's hike could have on your monthly repayments — it may be painful reading, consider yourself warned.

Unemployment expected to rise

By Gareth Hutchens

These interest rate hikes are manufacturing a slow-down in economic activity, and that has implications for employment.

We know this already, but the RBA has repeated the point today.

"The labour market remains very tight, although conditions have eased a little. The unemployment rate remains at close to a 50-year low. Employment fell in January, but this partly reflects changing seasonal patterns in labour hiring. Many firms continue to experience difficulty hiring workers, although some report a recent easing in labour shortages. As economic growth slows, unemployment is expected to increase."

And just a reminder.

The unemployment rate hit a low of 3.4 per cent in October.

Then it rose to 3.5 per cent (in November and December).

Then it hit 3.7 per cent (in January).

In the RBA's February "Statement on Monetary Policy," it was forecasting unemployment to rise more slowly than that.

According to those forecasts, the unemployment rate was going to hit 3.6 per cent in the June quarter and 3.8 per cent at the end of this year.

So that will be one to watch - will it be caught off guard by the pace of the increase in unemployment, or will it end up being right?

One more and done? No reference to 'increases' in Lowe's latest statement

By Michael Janda

Those of us who watch the Reserve Bank's every word (at least it feels that way) pay very close attention to subtle tweaks in language.

Senior RBA officials acknowledge that its language is never accidental — at least not in formal documents, like Philip Lowe's post-meeting statement.

The last paragraph in that statement is always most closely scrutinised.

This month, the RBA governor said:

"The Board expects that further tightening of monetary policy will be needed to ensure that inflation returns to target and that this period of high inflation is only temporary."

Last month he said:

"The Board expects that further increases in interest rates will be needed over the months ahead to ensure that inflation returns to target and that this period of high inflation is only temporary."

So we have gone from rate increases, which means more than one, to tightening, which leaves open the possibility of just one more hike, potentially even a 15-basis-point one to take the cash rate to a nice even 3.75 per cent.

That's not to say that the RBA is planning just one more hike, but this language has left open that possibility.

The RBA also removed the timing reference, which could allow it to pause next month if it chose to and wait for more data, especially given that recent GDP, jobs and wages data has been weaker than expected.

I'll have more in the article below from the bank economists who are paid the big bucks to watch this space to see what they have to say.

We should never return to rates of 0.1 per cent

By Gareth Hutchens

What would a 3.6 per cent cash rate mean for me? More money and it is about time. About time that savers were REWARDED and spendthrifts PENALIZED instead of the upside down world of the last few years where the opposite was happening. Historically, a 3.6% cash rate is still quite low. When i had a mortgage, the interest rate I had to pay was NEVER less than 10% and up to 19% during 1990-91. Ridiculously low interest rates have largely caused the surge in real estate prices, locking a whole generation out of the housing market. It was stupid to cut the cash rate to 0.1% and that stupidity caused a lot of the current mess.

- Richard

Are people with mortgages spendthrifts?

The language in the first part of this message is moralistic. How very 18th century. It wouldn't be out of place if it was written on a scroll with ink and a quill.

But the second part of the message gets to the heart of the matter. Housing experts have increasingly been criticising the macro-economic policy settings of the last 30-years that have put Australian on the path of "landlordism."

The economist Dr Nicholas Gruen recently said the mess we've made of housing policy is pushing us back towards an Edwardian class structure, when it comes to landlords and renters.

By allowing interest rates to get so low, it's been great for asset owners and terrible for savers.

But you can't call people spendthrifts if they've had no choice but to borrow ridiculous amounts of money to buy a place to live in.