/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

Palantir (PLTR) announced a $200 million deal with Lumen Technologies (LUMN) this week. This is a strategic partnership that will help LUMN deploy its technologies faster and more securely. LUMN will be able to integrate Palantir’s Foundry and Artificial Intelligence Platform (AIP) with its own Lumen Connectivity Fabric, a digital networking tool. The two companies had already announced they were working together last month.

“We share the same disruptive DNA – reimagining the foundations of our industries to help others do the same,” Lumen CEO Kate Johnson said in a statement. “By bringing AI into real-world operations through a connected ecosystem, we’re empowering businesses to reinvent how they operate, compete, and grow.”

Lumen Connectivity Fabric moves large amounts of data with low latency and high security. It can connect multiple cloud facilities together, thus helping organizations scale faster. Palantir’s Foundry will help bring data from multiple systems together, while AIP will add the AI layer that enables automated decision-making and execution. This should significantly improve LUMN’s offering, making it an important player in the AI infrastructure arena.

Investors should not forget that LUMN has telecom roots and, like a typical telecom company, carries high debt. Despite debt restructuring in 2024, the company will continue to carry interest costs. As exciting as the technological partnership is, the valuation aspect needs to be considered.

About Lumen Stock

Lumen Technologies makes networking equipment targeting customers in the U.S. and across the globe. It operates in two segments: Business and Mass Markets. Many are familiar with the company due to its previous name, CenturyLink, which was changed to the current Lumen Technologies in September 2020. The firm is headquartered in Monroe, Los Angeles.

LUMN is up almost 55% on a year-to-date (YTD) basis, compared to the benchmark S&P 500 Index’s ($SPX) 16% price return. The stock has come a long way since touching the low of $3.01 back in April, currently trading 173% above that level. Limiting the analysis to the last 10 months might make LUMN appear expensive, but the stock is still trading at a 25% discount to its 3-year high of $10.33 in November 2024. Looking at the 5-year data gives us a 53% discount to a high of $16.60 in January 2021.

Studying LUMN’s valuation multiples gives the impression that the bullish momentum during 2025 seems justified, and there is room for further upside. The stock trades at a forward price-to-sales (P/S) multiple of 0.58x, which is 54% lower than the sector median. Comparison of forward price-to-cash flow (P/CF) ratios warrants a further discount, as the stock trades at a multiple of 1.34x compared to the sector median of 8.4x. Looking at a more operational metric, such as the forward EV/EBITDA, LUMN’s 7.06x multiple stands almost 16% lower than the sector median. These multiples reflect upon the stock’s undervaluation, offering potential for further gains.

Lumen Misses Earnings Consensus, but Transformation Continues

LUMN announced its second-quarter results on July 31, posting revenues of $3.1 billion during the quarter. This was $21.1 million below the consensus estimates and 5.5% lower than the same period in 2024. The company incurred larger losses during the quarter, posting GAAP earnings per share of -$0.92 compared to -$0.05 during the second quarter of 2024. The EPS figures missed the estimates by $0.65.

LUMN management shared updates on their 2025 earnings guidance. Adjusted EBITDA forecasts remain the same at around $3.2 - $3.4 billion. However, there is an upward revision in expected free cash flows by the end of the year. The management now estimates free cash flows between $1.2 and $1.4 billion for 2025.

On the earnings call, the company acknowledged that technology was shifting and its effects were visible in Nurture and Harvest product declines. However, the current partnership would bring a sign of relief to investors as the company is doing its best to ensure it not only remains a part of this technological shift but is also actually the one driving it.

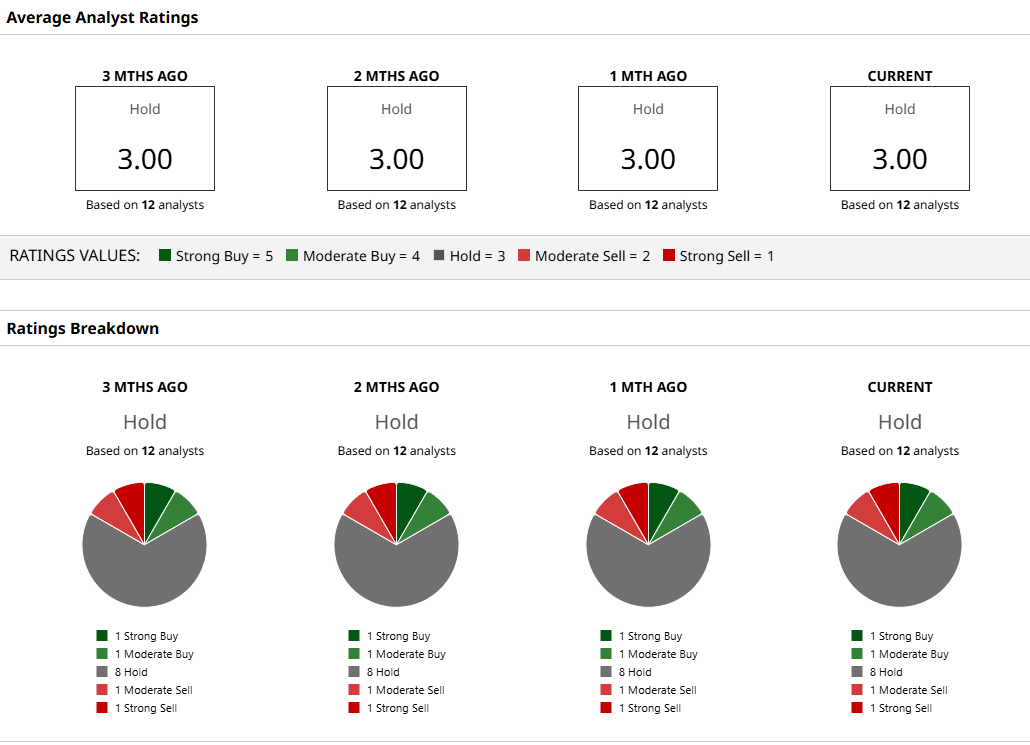

What Analysts Are Saying About LUMN Stock

LUMN is covered by 12 analysts on Wall Street, with a vast majority assigning a “Hold” rating. This suggests the market is uncertain about the company’s prospects. Moreover, the stock is already trading about 9% above the highest analyst target price. Things could change soon once the Palantir deal is scrutinized by analysts and they can quantify further upside based on this deal. Keep an eye on our LUMN analyst ratings page for any upgrades.