Lithium Americas Corp (NYSE:LAC) shares are trading sharply higher Wednesday morning following reports that the Trump administration is seeking a stake in the company. Here’s what investors need to know.

What To Know: The Trump administration is pursuing a stake of up to 10% in Lithium Americas. The move is part of a national security strategy to bolster the U.S. domestic lithium supply chain and reduce dependence on China, according to Reuters.

The government is renegotiating a $2.26 billion loan, previously approved by the Biden administration, for the Thacker Pass lithium mine in Nevada. The Trump administration is seeking an equity stake and increased oversight, with potential concessions from General Motors, which has a 38% share in the project.

Per the company, Thacker Pass is poised to become the largest lithium operation in the Western Hemisphere, with production expected to begin in 2028. The mine is projected to produce 40,000 metric tons of lithium carbonate annually, enough to power as many as 800,000 electric vehicles.

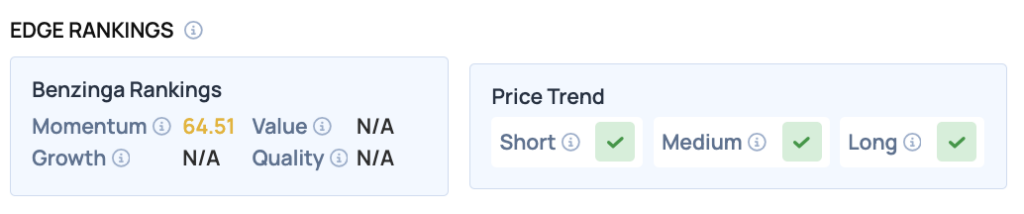

Benzinga Edge Rankings: Highlighting the stock’s recent surge, Benzinga Edge data shows a strong Momentum score of 64.51.

LAC Price Action: According to data from Benzinga Pro, Lithium Americas shares are trading higher by 88.6% to $5.77 Wednesday morning. The stock is hitting new 52-week highs on Wednesday, and has a 52-week low of $2.31.

Read Also: Stock Market Today: S&P 500, Nasdaq, Dow Futures Gain Despite Powell’s Cautious Take On Stocks

How To Buy LAC Stock

By now you're likely curious about how to participate in the market for Lithium Americas – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock