Shares of Lithium Americas Corp (NYSE:LAC) are trading lower Friday afternoon, caught in a sector-wide pullback after a significant recent rally. Here’s what investors need to know.

- LAC is encountering selling pressure. Get the latest updates here.

What To Know: The downturn in lithium and rare earth stocks was triggered by an announcement from China’s Commerce Ministry stating that foreign suppliers must now secure approval to export certain products containing rare-earth materials.

This move escalates geopolitical friction and introduces new uncertainty into the global supply chain for critical minerals. The pressure is compounded by the persistent threat of a prolonged U.S.-China trade war, which continues to weigh on investor sentiment.

The sector’s recent gains were fueled by the Trump administration's vocal push to bolster the domestic supply chain and reduce reliance on China. Friday's decline reflects a reassessment of these geopolitical risks, prompting profit-taking among investors in the face of Beijing’s latest strategic action.

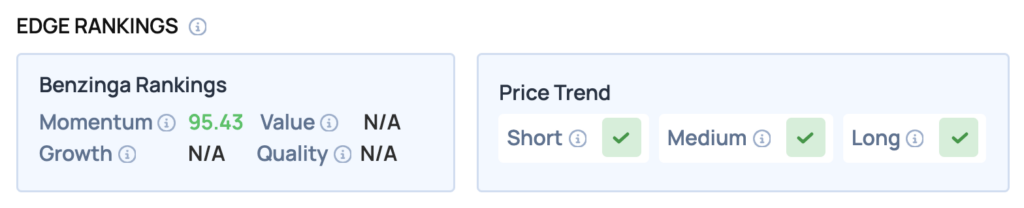

Benzinga Edge Rankings: According to Benzinga Edge stock ratings, Lithium Americas boasts a powerful Momentum score of 95.43.

LAC Price Action: Lithium shares were down 7.71% at $6.81 at the time of publication on Friday, according to data from Benzinga Pro. The stock is trading within its 52-week range of $2.31 to $10.52.

This recent decline follows a strong performance year-to-date, with the stock up 120.1%, indicating significant bullish momentum throughout the year despite the current pullback.

The stock’s current price is notably above both the 50-day moving average of $4.53 and the 200-day moving average of $3.29, suggesting a strong bullish trend over the longer term.

Read Also: Stocks Shrug Off Bank Fears, AMEX Jumps: What’s Moving Markets Friday?

How To Buy LAC Stock

By now you're likely curious about how to participate in the market for Lithium Americas – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock